👲🏻 Want to invest in China tech stocks? Here are some things to know

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for thrive at bt.sg/thrive

🌾 Seeking new pastures?

The sea of red seen in the US stock market has not sparked joy for many.

Newly-elected US President Donald Trump’s steep tariffs on imports from many countries, such as Canada and Mexico, have escalated trade tensions, sparking fears of a recession and shaking investor confidence.

The result? US$4 trillion wiped out from S&P 500’s peak last month, with continued volatility in the market. For many young investors who dabble in popular US tech stocks or ETFs, this is alarming.

On the other hand, Chinese tech stocks traded in Hong Kong have rallied in the past months. Alibaba, in particular, saw its shares rise 15 per cent after the e-commerce company reported in late February sales that beat estimates.

Meanwhile, other tech companies such as Lenovo and video-sharing platform Bilibili also climbed on better-than-expected results.

But why such a comeback – and why now? We take a look at a couple of factors:

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

- The entrance of DeepSeek, an artificial intelligence (AI) model by Hangzhou-based startup, on Jan 20 catalysed a rally. It proved to be a fierce competitor to OpenAI’s ChatGPT – especially since it could reportedly operate at a fraction of the cost.

- China’s President Xi Jinping held a rare, “highly choreographed” meeting on Feb 17 with the country’s tech leaders such as Alibaba founder Jack Ma, who was previously sidelined. Sources noted that DeepSeek’s founder Liang Wenfeng attended, too. To some, this appeared as a signal that China’s crackdown on the tech space was over.

- China’s latest growth target of approximately 5 per cent for the third consecutive year set last week reflects the country’s confidence in its economy. The index was up 4 per cent on Mar 5, even after China imposed harsh retaliatory tariffs against the US’ recent moves of 10 per cent to 15 per cent on various US agricultural products.

- The electric vehicle (EV) space in China has witnessed a 76 per cent growth, causing global EV sales to surge in Feb. US automaker Tesla’s shipments plunged 49 per cent that month from a year earlier, while Chinese EV manufacturer BYD has a market share that’s heading towards 15 per cent, signalling the latter’s increased competitiveness.

Some analysts are optimistic. Recently, Citigroup downgraded its view on US equities while upgrading China to an “overweight” rating.

🤔 Not a sure win

While industry players have noted that Chinese tech stocks have “room to run”, investors still need to be patient, selective and careful with their investments.

Using a golf analogy, veteran China investor and founder of the hedge fund APS Asset Management Wong Kok Hoi explains Chinese tech in this way:

“I would say that US tech companies might already be on the 18th tee box – in a round of golf there are 18 holes… whereas Chinese tech companies might only be on the second box.”

This means, in Wong’s view, that China is still at an early stage of tech innovation with more breakthroughs to come. After all, AI’s large language models are still difficult to monetise at this stage, so company earnings may not be driven up as significantly as hoped for.

Coupled with the newest US tariffs and China’s growth slowdown as risk factors, the prospects for China tech stocks may not be as clear-cut. But one thing to take note of is that regulatory risk remains, as the Chinese government could change its stance on the sector at any time.

👊 Still want to give China investments a shot?

We hear you – it’s normal to want to diversify your investing options. And to be fair, the cheap(er) valuations of Chinese stocks this rally still have significant appeal. (Several major Chinese stocks are trading at just 11 to 15 times earnings, compared with 26 times earnings for the S&P 500.)

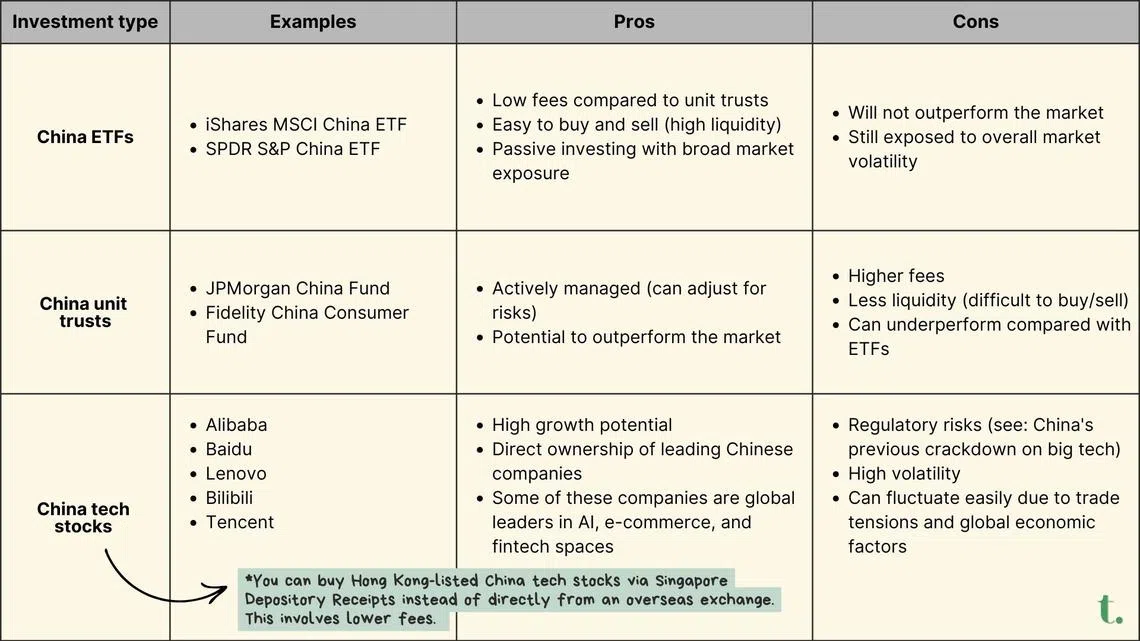

Besides China tech stocks, you can consider China ETFs or unit trusts, too. Here are some things to consider:

Looking at my current portfolio of US stocks and ETFs in the red, the need for diversification has become even more apparent. But if China stocks are the next step, more thought will have to be given to which investment type to pursue exactly.

TL;DR

- Many Chinese tech stocks traded in Hong Kong are generally on an upward trend recently, with Alibaba up by over 60 per cent 📈 year-to-date

- This is because of headway made by Chinese companies in the AI and EV spaces, and the country’s optimistic GDP target signalling a strong economy this 2025 💪

- However, the newest US tariffs and China’s growth slowdown are still risk factors for these tech stocks ⚠️

- If you’re still keen to diversify your portfolio with Chinese holdings, you can consider China ETFs and unit trusts, too

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.