Love later, save now? Why so many Gen Zs aren’t rushing to get married

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

[SINGAPORE] When I was a kid, I thought I’d be married by 25 and start a family at 27. Today, that seems like an absurd timeline.

Turns out, I’m not alone. Just the other day, a friend said: “I have confidence I can live a comfortable life, but I don’t see a man in that vision.”

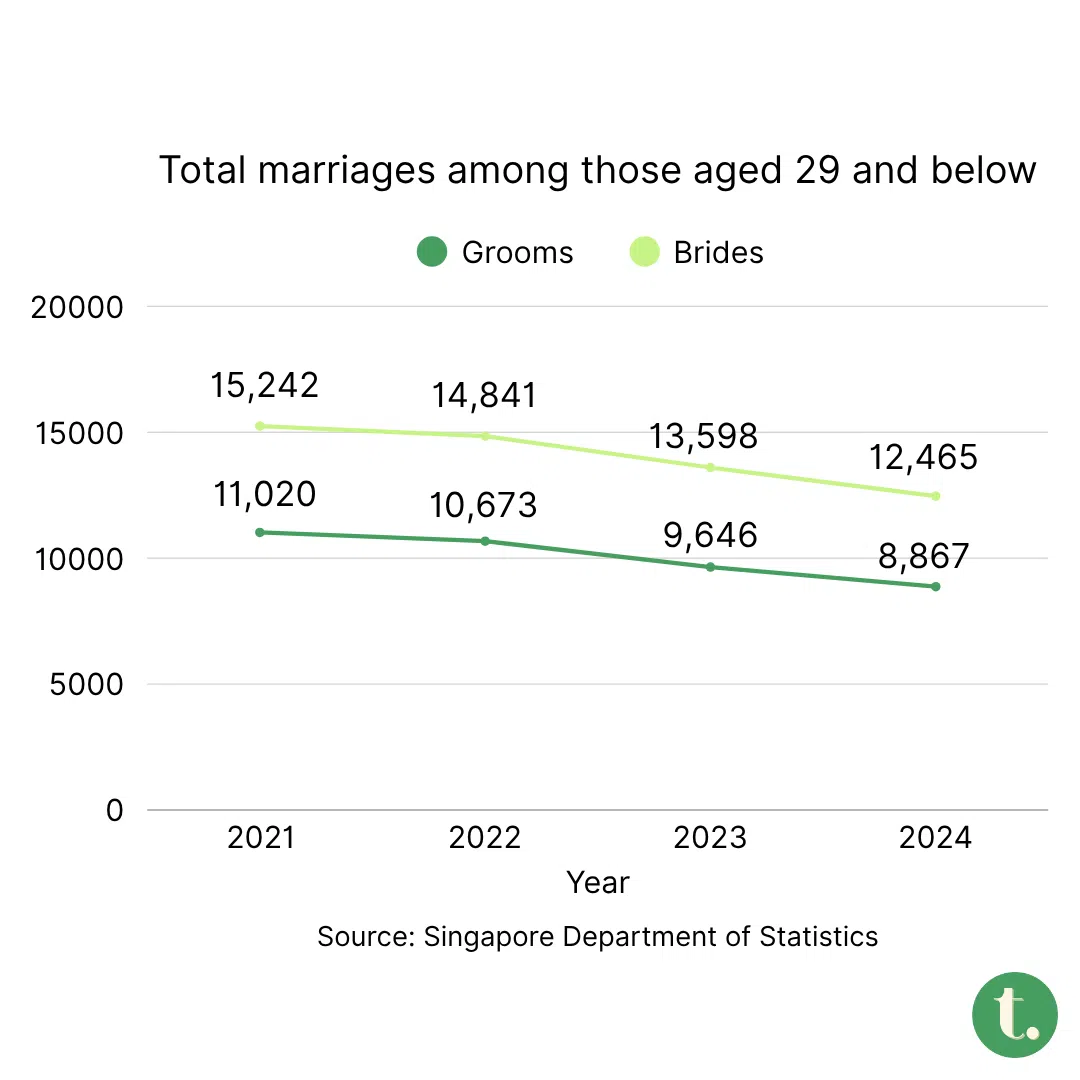

Indeed, more of us are embracing singlehood or simply not in a rush to get hitched. Statistics show that marriages among Singaporeans aged 29 and below have declined steadily over the years.

The median age for first marriages in Singapore has also crept up to 31.1 for grooms and 29.6 for brides in 2024, up from 30.2 and 28.2 a decade ago.

Where our parents might have married first and then built financial stability together, today many of us are doing the reverse.

A 2024 study by the Institute of Policy Studies found that young Singaporeans now rank career and financial security above marriage or home ownership, a sign of how priorities have flipped from our parents’ generation.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Now, this doesn’t mean our generation isn’t falling in love. I think we are simply more cautious about tying the knot – and in my opinion, rightfully so.

The Business Times’ Lee Su Shyan recently questioned if marriage is another high-risk investment, pointing out that the rising “together costs” – the shared expenses of living together – are making marriage less attractive these days.

Between a higher cost of living and a shaky job market, most of us 20-somethings aren’t eager to add another big financial commitment to our life portfolio.

And while a surge in those “marry a man in finance” and “if you don’t have a trust fund, find one” TikToks can feel regressive, they also reflect a genuine anxiety about money and stability.

Getting hitched does come with financial perks. Married couples can enjoy greater tax savings and government incentives. For instance, there are the Parenthood Tax Rebate and NSman Wife Relief. And, most of all, access to housing is easier.

But even then, the upfront costs can be daunting. Some of my friends question the point of qualifying for a flat when they can barely afford the wedding.

❤️ Love isn’t logical However, we shouldn’t see marriage as a one-off transaction, says Rainy Rainmaker, founder and principal coach of Rainmakers Coaching International.

“When a relationship is emotionally healthy, it nurtures stability, focus and confidence – qualities that naturally lead to better financial and career choices,” she says.

Even the simplest things – like how supportive your partner is – can affect how well you perform at work. Quiet resentment over differing views and lifestyles may also spill over into your work life and contribute to burn-out.

“True love isn’t a blind leap; it’s an intentional investment,” Rainmaker says. When we approach marriage with awareness and commitment, it can be one of life’s highest-return ventures – emotionally, spiritually and financially, she adds.

Beyond financial concerns, it’s also important to be emotionally ready for marriage.

Cindy Leong, founder of The Enneagram Academy and Relationship Studio calls this doing your “due diligence of the heart”.

Before thinking about marriage, she advises paying attention to how your partner handles stress, communicates boundaries and takes responsibilities. These are all signs of whether you can grow together, she says.

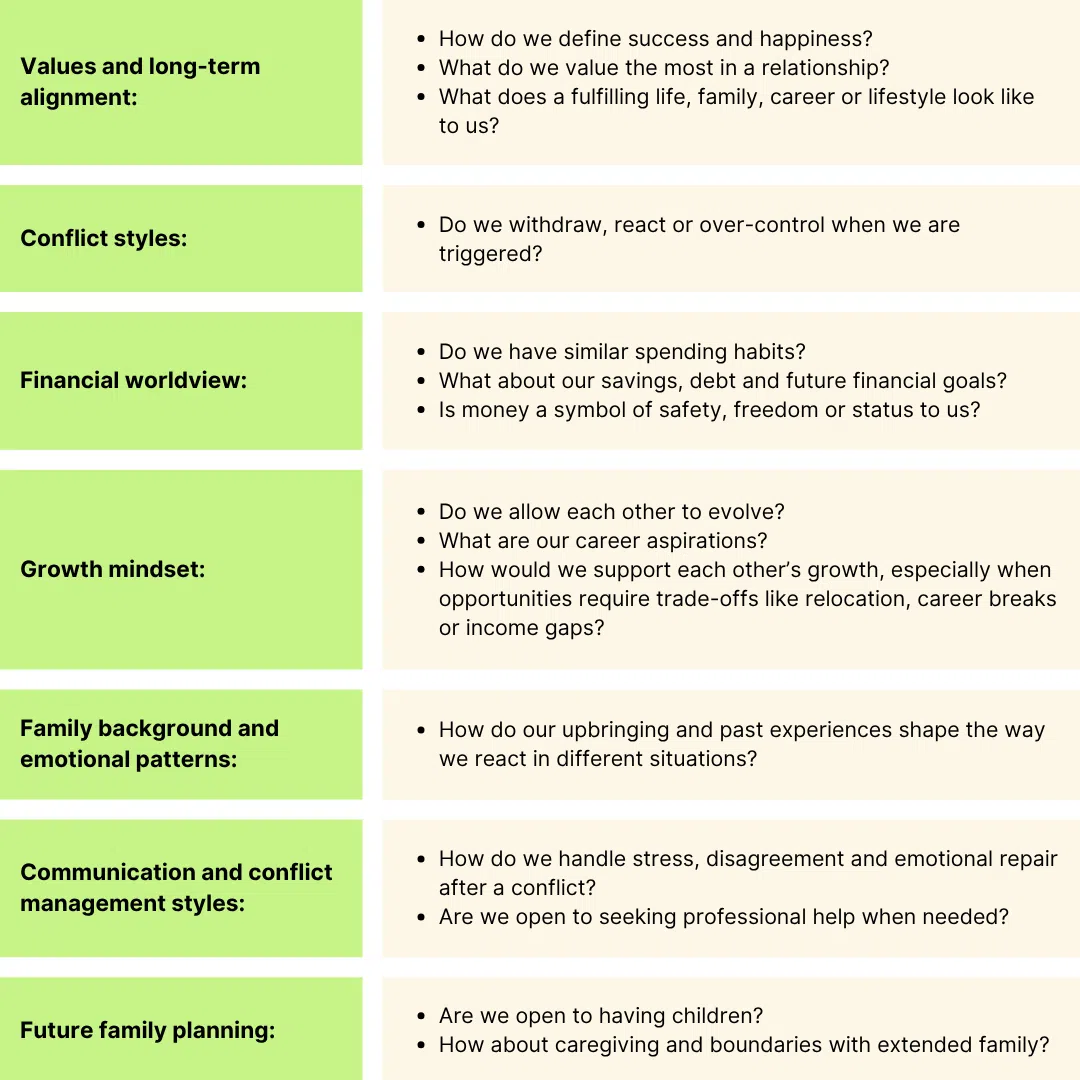

According to the life coaches I spoke to, here’s a checklist of tough questions you should have with your partner early on:

🖖 Before you put a ring on it The common consensus among my social circles is: there is no rush. Young adults prefer to be financially stable before saying “I do”, and that’s where we differ from older generations.

We’re building financial stability first so that we can choose marriage – and not rely on it to get us there.

Sure, it is a little disheartening that people my age are making decisions around marriage based on financial milestones rather than love. Proposals these days sound less like “want to build a life together?” and more like “want to get a BTO (Build-To-Order flat)?”

Perhaps that’s what growing up in an uncertain economy does to you.

Still, it takes time for us to feel ready, both financially and emotionally. And for many of us, that comes in our late-20s or early-30s.

So until then, marriage can wait. Not because it matters less, but because we want to enter it on our own terms.

TL;DR

- Fewer young adults are rushing to get married

- Higher costs and job uncertainty have flipped the script: stability now, marriage later

- Before marriage, emotional stability matters just as much as financial stability

- Ultimately, young adults want to enter marriage on their own terms

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.