8 reasons why trading platform Tiger Brokers is generating buzz

What makes it different from other trading platforms in terms of speed, fees and ease of use?

Regardless of whether you are a novice or a seasoned trader, the top qualities of a reputable trading platform are typically the fees charged, the ease of use and the ability to offer the right analytical tools and market information at your fingertips.

Nasdaq-listed Tiger Brokers ticks all these boxes.

It is a recent addition to the trading landscape in Singapore, one of Asia's most prominent financial and private-wealth hubs where there is no lack of options. Backed by US-based brokerage Interactive Brokers, Chinese tech giant Xiaomi and Wall Street investment guru Jim Rogers, Tiger Brokers was founded in 2014 and listed on the Nasdaq five years later. In the second quarter of 2020, it had 833,900 customer accounts worldwide with a trading volume of US$46.8 billion.

Tiger Brokers' platform is accessible via its Tiger Trade mobile and online trading app, which offers a next-generation fintech platform with complimentary real-time stock quotes and multilingual customer service support. Here are eight other reasons why it has found a following in the financial world.

1. Faster and easier account set up

Tiger Trade has a streamlined technology-enabled Know-Your-Client (KYC) process, which combines automation and artificial intelligence (AI) to improve processing time and make account approval faster significantly. It is integrated with the government's MyInfo portal, which allows users to fill out forms quickly. It also leverages critical tools such as the use of AI to verify IDs, documents and handwritten signatures, as well as face recognition technology which speeds up identity verification and prevents fraud.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Because people are always on the go, the app allows users to accomplish the KYC process through their mobile devices, including scanning QR codes to upload documents from their phone.

2. Real-time market data and 24/7 updates

Financial markets are often volatile, which is why it is essential to be equipped with comprehensive and the most up-to-date information. Any lag in the availability of such information could have negative outcomes. Tiger Brokers' platform allows users to gain access to market data in real-time, delivering 24/7 updates on financial, industry-related and corporate news. Its instantaneous newsfeed enable investors to make informed trading decisions, no matter which part of the world they are in.

3. A wide range of free tools to manage your investments

A crucial aspect of ensuring successful trading is access to optimal tools for data and trend analysis. Tiger Brokers provides a wide range of complementary tools to guide traders in their investment journey, including:

4. One account, multiple markets

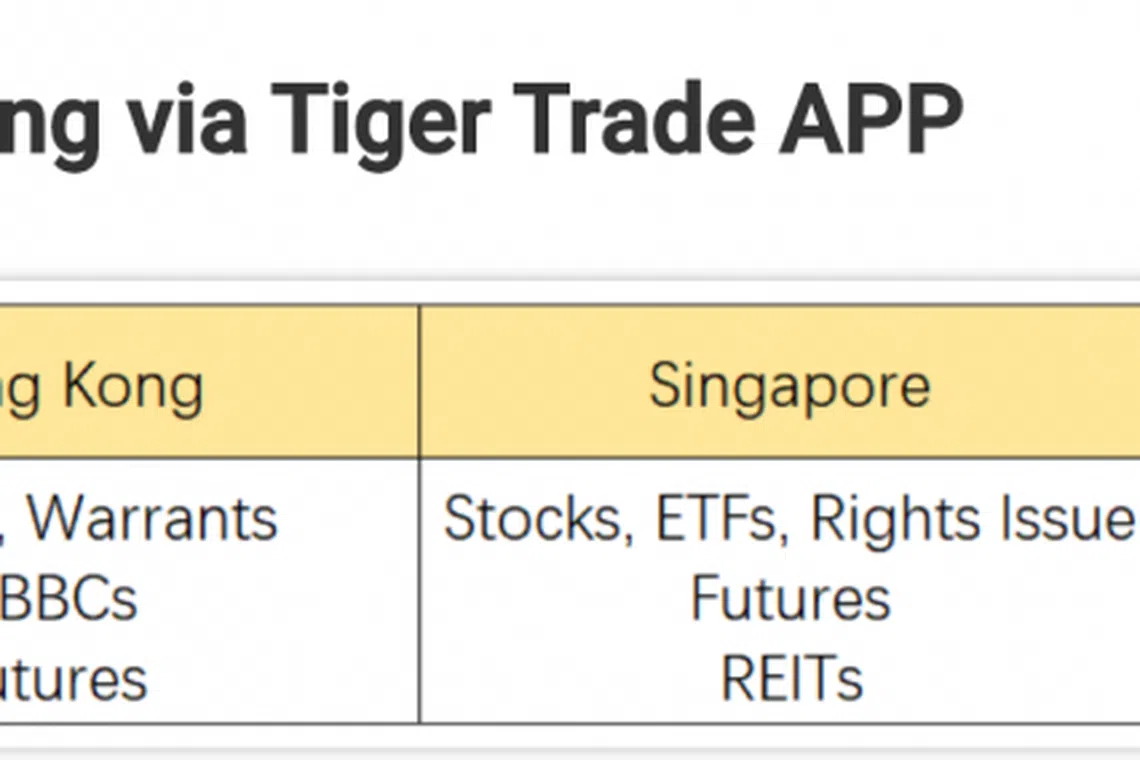

With a single account, investors can trade multiple markets with a multi-currency facility. Tiger Brokers provides access to global opportunities in equities, Exchange-Traded Funds (ETFs), futures, stock options, warrants and Callable Bull/Bear Contract (CBBC) in markets including Singapore, US, Australia, China and Hong Kong markets.

For more information on products available, click here.

5. Risk and reward analysis

In any type of investment, a certain level of risk is involved. However, with proper risk management and diversification, losses can be minimised.

Tiger Brokers' multiple trading functions help investors analyse and manage risk and rewards. For instance, one-click trading allows for the quick placement of orders based on trade size and buy or sell price, profit and loss analysis, stock options trading, screeners and in-depth analytics.

6. Customisable dashboard

Each trader has unique needs when it comes to investing and trading. And so, Tiger Brokers' trading dashboard is fully customisable, and investors can tailor functions and data according to their portfolio and investment goals.

Relevant and insightful account data is made available at a glance, without the need to switch in and out of apps or pages. Additionally, the dashboard is integrated with real-time market data and news updates, so all relevant information is accessible in one location.

7. Investors enjoy among the lowest commission rates

There has been an ongoing price war among online brokerage firms when it comes to commissions, and Tiger Brokers' commission rates are among the lowest across different global markets. For Singapore equities, Tiger Brokers charges a commission of 0.08 per cent per trade, and maintains transparency for other fees and additional charges so there are no hidden costs.

8. Licensed and Regulated

Tiger Brokers operates with a Capital Markets Services Licence from the Monetary Authority of Singapore and an Australian Financial Services (AFS) licence granted by the Australian Securities & Investments Commission (License No: 505213).

It is also registered on the Financial Service Providers Register in New Zealand (NO.FSP473106). It is registered as a brokerage firm at SEC(CRD: 120583;SEC: 8-65324) and NFA (0328552), and a member of FINRA/SIPC. It is also regulated by the US Securities and Exchange Commission. And as a licensed and regulated broker, Tiger Brokers' trading activities are performed per policies and industry standards.

Tiger Brokers is excited to announce the launch of Australian Equities!

Take it one step further when diversifying your international portfolio with commission-free trades of ASX equities with Tiger Trade's all-in-one account and tools. Tiger Brokers charges 0.1 per cent with a minimum of A$8 per trade, inclusive of a 0.05 per cent commission fee and 0.05 per cent platform fee.

Wait no further and start trading ASX via Tiger Brokers today! Click here to find out more.

For more information about Tiger Brokers, click here.

Footnote: 1. Tiger Chaos Timing Index (TCTI) is a timing strategy based on the Chaos theory. This model focuses on daily trend following. Average holding period is between 16 to 60 trading days.

Disclaimer: This article has not been reviewed by the Monetary Authority of Singapore.

Any views shared with Prospective Clients ("Prospects") are suggestive in nature and on a sample basis only. This may also be predicated on assumptions that are made by Tiger Brokers (Singapore) Pte Ltd about the Prospects' investment objectives and risk profile. Our suggestive and sample views extended to Prospects are not to be considered as recommendations made by the Company. Suggestions provided are also based on information that may be shared by the Prospects, the accuracy and comprehensiveness of which Tiger Brokers is not in a position to verify.

Tiger Brokers (Singapore) Pte Ltd (herein "Tiger Brokers") may, to the extent permitted by law, participate or invest in other transactions with the issuer of the products referred to herein, perform services or solicit business from such issuers, and/or have a position or effect transactions in the securities or options thereof. The information herein is for recipient's information only and not an offer to sell or a solicitation to buy. Any date or price information is indicative only and may be changed without prior notice. All opinions expressed and facts referred to herein are subject to change without notice. The information herein was obtained and derived from sources that we believe are reliable, but while reasonable care has been taken to ensure that stated facts are accurate and opinions are fair and reasonable, Tiger Brokers does not represent that it is accurate or complete and it should not be relied upon as such. The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services