Digital Darwinism: How the theory of evolution is helping businesses stay relevant

In order to survive and thrive, companies must embrace disruption and keep up with tech acceleration, societal shifts and other megatrends, says Allianz Global Investors

Singapore was ranked 4th in Asia and 15th globally in a recently published digital quality of life index1. Posted by Surfshark, it measured: Internet affordability, access, e-infrastructure, e-security, and e-government as its matrix.

While digital connectivity has become synonymous with innovation and modernisation, it's not just people who find it hard to keep up with the breakneck pace of the digital revolution. The business sector is also scrambling to stay abreast with the rapid changes brought about by the Fourth Industrial Revolution.

To be, or not to be

According to futurist Tom Goodwin, who popularised the term Digital Darwinism in his book Digital Darwinism: Survival of the Fittest in the Age of Business Disruption, businesses have little choice but to embrace disruption. Not only those of the technical nature but also shifting consumer behaviour and sustainable values.

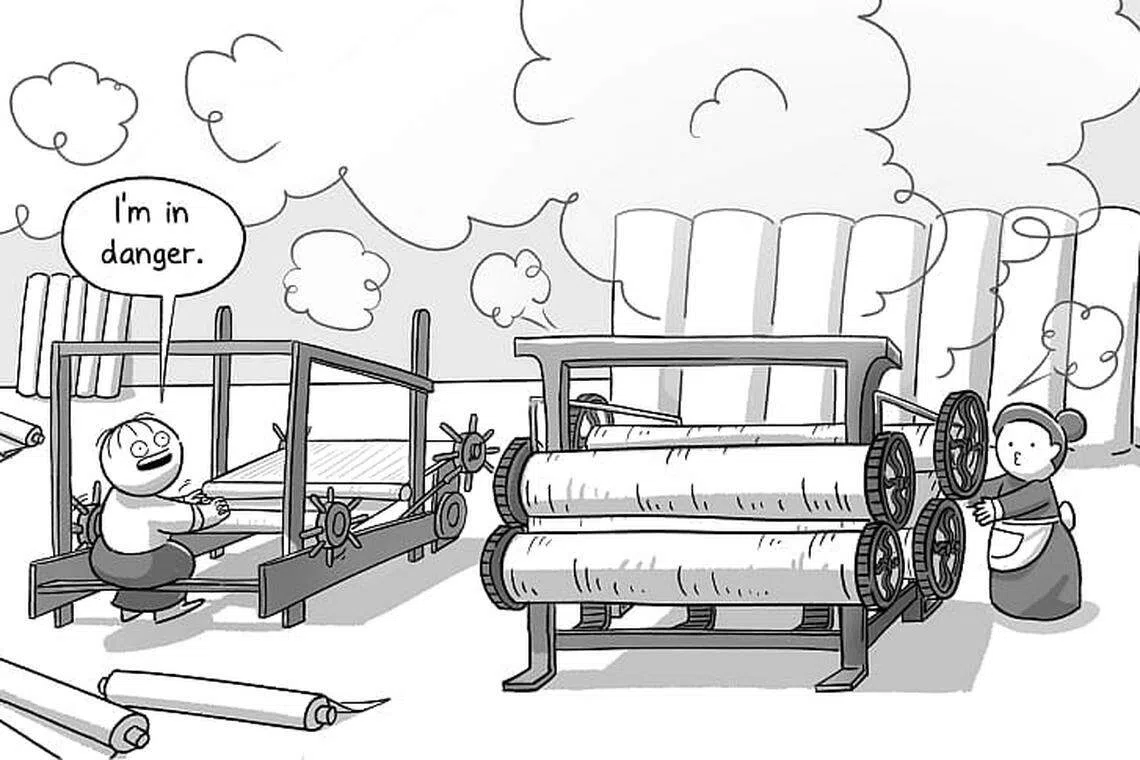

Digital Darwinism is an updated take on Charles Darwin's theory of evolution: "It is not the strongest species that survives, nor the most intelligent. It is the one that is most adaptable to change".

Digital Darwinism may be a new term, but history is replete with countless examples of renowned companies and brands who have had their "Kodak moment":

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Embracing disruption

While Digital Darwinism can be unsettling, it does have its silver linings.

Technology giant Apple is a classic example of a transformational business model that broke the mould by thinking differently. Its most valuable product, the iPhone, has single-handedly decimated over 20 business models and industries, including pocket cameras, GPS navigation devices, flashlights, watches and more.

And there's Amazon, Disney+, and even Lego - dubbed the greatest digital turnaround story.

The good news for investors is that many businesses are investing in change and, as a result, changing the way we live for the better.

Disruption's sweet spots

By identifying the sweet spots in the various megatrends, investors can capitalise on opportunities emerging from the waves of disruption. Allianz Global Investors, a global investment management firm, has identified three megatrends that investors can benefit from and, at the same time, contribute to real-world outcomes:

1. Climate and technology

2. Data and connectivity

3. Man and machines

Key takeaways for investors

The future is being shaped right before your eyes. With high inflation and rising geopolitical tension, it pays to rethink your portfolio strategy and diversify your investments. Allianz Global Investors believe that the next game-changers will come from companies, with many likely to be start-ups focusing on healthy living, intelligent cities, cyber security, and next-generation energy. Through thematic funds, investors can have a window into future opportunities and a new prism alongside traditional investing methods.

Find out how you can embrace disruption.

Footnotes:

1 Surfshark, 2022 2 Business Insider, November 2011 3 GK Today, September 2011 4 PwC, State of Climate Tech, 2021 5 United Nations ITU, November 2021

Disclaimer:

Any company names mentioned (above) are for illustrative purposes only. It should not be considered as an investment advice or a recommendation to buy or sell any particular security or strategy. Past performance, or any prediction, projection, or forecast, is not indicative of future performance. Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this publication but should seek independent professional advice. There is no guarantee that these investment strategies and processes will be effective under all market conditions and investors should evaluate their ability to invest for the long term based on their individual risk profile especially during periods of downturn in the market. Past performance, or any prediction, projection or forecast, is not indicative of future performance. The duplication, publication, extraction, or transmission of the contents, irrespective of the form is not permitted. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS), and is published for information only. The issuer of this advertisement is Allianz Global Investors Singapore Limited (79 Robinson Road, #09-03, Singapore 068897, Company Registration No. 199907169Z).

Copyright SPH Media. All rights reserved.