Healthcare of the future: A shift towards affordable drugs and services

A new fund by HSBC Asset Management focuses on sustainability, with therapies and innovations delivering better value

The current healthcare system is not sustainable.

The model of developing better therapies and charging more for them, which has driven profits higher for decades, is all but played out. As pressure grows on healthcare systems from ageing populations, expenses are at an all-time high and governments need to rein in the cost increases.

"The old model of high innovation and the highest possible price tag is broken," says Dr Nathalie Flury, co-head of Sustainable Healthcare Equity at HSBC Asset Management.

"You have to find solutions with payers to come up with the optimal possible price; you have to price therapies in a way that makes sense at a healthy economic level," adds Dr Flury, who holds a Doctor of Philosophy (PhD) degree in biochemistry and oncology and has more than 20 years of experience in fund management.

The healthcare sector was, even pre-pandemic, set to see unprecedented demand due to Asia's growing middle class and increasing life expectancy around the world. Covid-19 was a trigger for players across the entire value chain to take a collective step in creating a more affordable and future-proof sector.

Drastic changes are needed to transform the current model of the healthcare industry into a sustainable one.

Defining sustainable healthcare

HSBC Asset Management defines sustainability in healthcare as a system that improves, maintains or restores health while minimising the negative impact on our environment, society and governance (ESG). This means ensuring the broadest possible access to healthcare across a given society within tight financial constraints, thus benefiting the society and population as a whole.

Affordability and accessibility, rather than these conventional benchmarks of sustainability, have become the key metrics of future performance, says Dr Michael Schröter, HSBC's co-head of Sustainable Healthcare Equity.

For investors in healthcare, relying purely on conventional ESG benchmarks will result in their missing some of the important dynamics that drive the sector.

Dr Schröter, a PhD in biochemistry and immunology, has more than 20 years of pharmaceutical and biotech industry experience, having held various executive roles in areas ranging from research and development (R&D) to commercial. He has worked in the United States, Europe and Asia and was once head of research for a large multinational pharmaceutical company in Singapore.

The blind spot in healthcare investing

"We believe that agility, broad sector knowledge and a focus on the right kinds of innovation are key to building a healthcare fund for the long term," says Dr Flury.

On the one hand, investing in healthcare is complex. An investor may need to get into the weeds of the molecular R&D environment, understand a range of differing competitive and regulatory terrains and just how hard it is to develop software and hardware in medical devices and digital therapies.

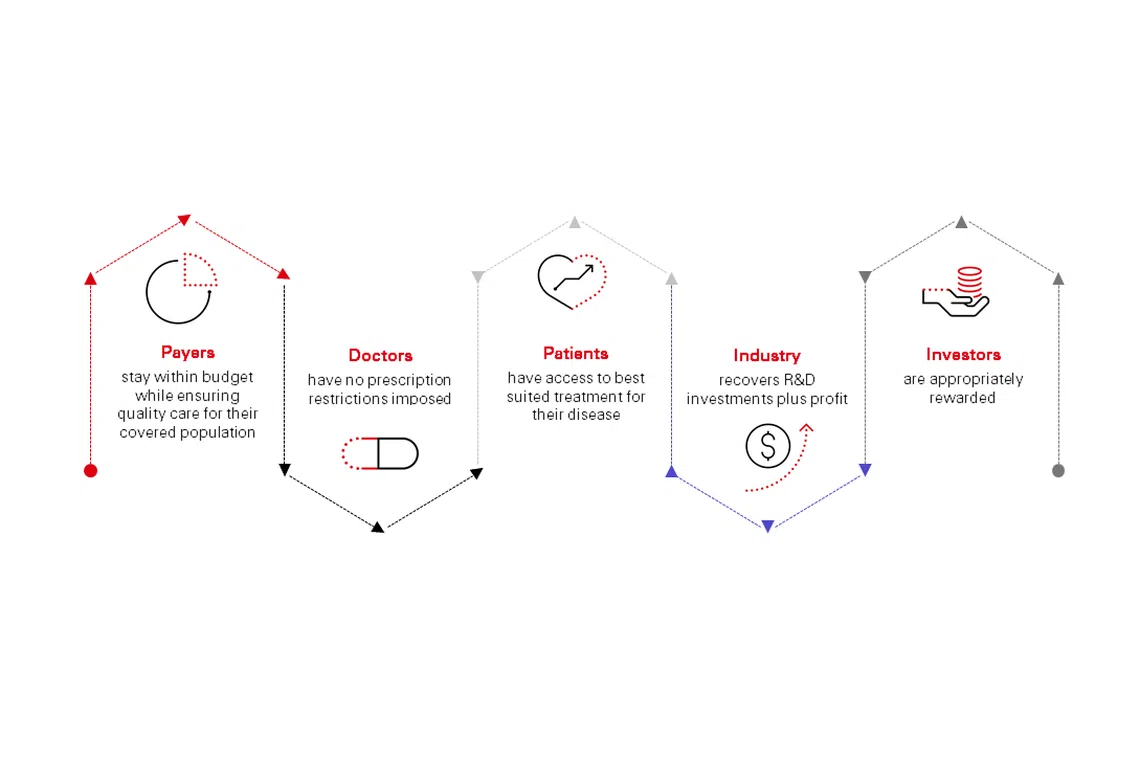

But on another level, it is simple: pharma, makers of medical devices, diagnostics developers and digital health developers must offer value to all stakeholders - to patients, healthcare providers and payers.

In many cases, however, companies routinely increase prices for their products twice a year in the most important healthcare market - the US - without adding any new value. Such an approach will meet with increasing resistance.

This is a blind spot for a number of healthcare investment funds with a sustainability label but do not give value and affordability its due weighting, she adds.

Innovating on affordability

With healthcare budgets strained as never before, owing to even greater pressure arising from the pandemic, continued drug price escalation is no longer viable. Focusing on clinical innovation and the theoretical market size for the resulting drugs is not enough. Companies seeking to simply maximise price and profit will not prosper in this new era if they do not address value.

"We realised that just bringing therapies to market at maximum prices won't work, yet you have to recover your investment. This is an opportunity for investors to think ahead of where the industry is going," says Dr Schröter.

To pursue this opportunity, Dr Schröter teamed up with Dr Flury to pursue this theme and co-founded a new boutique investment company.

The duo worked to develop proprietary tools and insights to help identify sustainable innovation from across a broad swathe of the healthcare business, which taps these new drivers in healthcare. They then joined HSBC to head its newly launched Global Equity Sustainable Healthcare fund.

Focus on value

The focus on value is central to the HSBC Global Equity Sustainable Healthcare Fund's approach.

"Delivering care and reducing cost can also be achieved with medical devices and digital applications, and through service and diagnostics," says Dr Schröter. "We are investing in all these sub-sectors. We also see more interplay between these sub-sectors."

Another important feature of the fund's approach is its mid-cap bias (companies with a market capitalisation between US$500 million and US$20 billion) across all sub-sectors as such firms tend to have a higher R&D productivity compared with large caps and are thus the sector's growth engine.

Dr Schröter says the fund is interested in drugs that offer clinical efficacy and competitive pricing to health systems, either by simply coming in cheaper than rivals or by offering to save payers other costs. Such products could obviate the need for adjacent therapies, prevent the progression of a disease to a more complex and expensive stage, or prevent rehospitalisation.

The fund also pursues investments beyond the molecule in areas including medical devices, services, diagnostics and digital, which integrate technology into care pathways to drive better outcomes and save costs.

One example is diagnostic services paired with medical devices, such as insulin pump/continuous glucose monitor combinations that can dramatically improve diabetes care management and patients' lifestyles.

Wearables that help patients work with clinicians to manage their conditions better, and digital therapeutics - apps that help patients to change behaviours and manage their mental health - are further exciting areas of promise, he adds.

The path forward

HSBC Asset Management believes the HSBC Global Equity Sustainable Healthcare Fund's focused but flexible investment approach offers a clear way of identifying opportunities that innovate beyond the conflicting trends of rising drug prices and constrained healthcare budgets.

Along with the more sustainable health systems that such products will help to create, a sustainable stream of profits for investors will be established over the long term.

As the ancient Roman poet Virgil says: "The greatest wealth is (truly) health."

Important Information

The HSBC Global Equity Sustainable Healthcare sub-fund is registered as a Recognised Scheme in Singapore.

This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

HSBC Asset Management (Singapore) Limited 10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983 Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324 Website: www.assetmanagement.hsbc.com/sg Company Registration No. 198602036R

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.