Keeping faith despite the market downdraft

AS of May 20, 2022, the S&P 500 has fallen 18.36 per cent since the beginning of the year. The MSCI ACWI (All Country World Index) which includes the emerging markets is down 17.61 per cent. Even bonds were not spared. The Bloomberg Global Aggregate Bond Index came down 6.66 per cent year to date.

Why are both stocks and bonds falling? The main culprit is inflation. Governments all over the world have been injecting cash into the global economy by “printing money” or making asset purchases from financial institutions which raises money supply. This caused interest rates to fall. Banks, flush with cash, aggressively extended credit to corporates and consumers. Demand for goods and services then increased, and pushed up inflation.

To make matters worse, supply chain disruptions caused by Covid-related lockdown of cities such those in China caused a bottleneck in the supply of goods, and further raised inflation. Then, with the Russia-Ukraine conflict, food and energy prices skyrocketed. Russia was the world’s second biggest oil exporter and the largest exporter of natural gas, while Ukraine exported large amounts of soft commodities such as corn. To combat inflation, central banks have raised interest rates at lightning speed, with the hope of now doing the opposite – slowing down demand.

There is now an expectation that companies’ earnings will drop and hence, equity markets fell. As for bonds, higher interest rates and inflation expectations pushed up the return or yield demanded by bondholders, and bond prices fell in tandem with equities.

While many things can happen in the short term, one thing is certain. Governments will continue to raise interest rates if inflation remains high. The US Fed funds rate is expected to rise from roughly 1 per cent currently, to 2.5 to 2.75 by end of the year. This may tip the global economy into recession. This fear has raised volatility in financial markets.

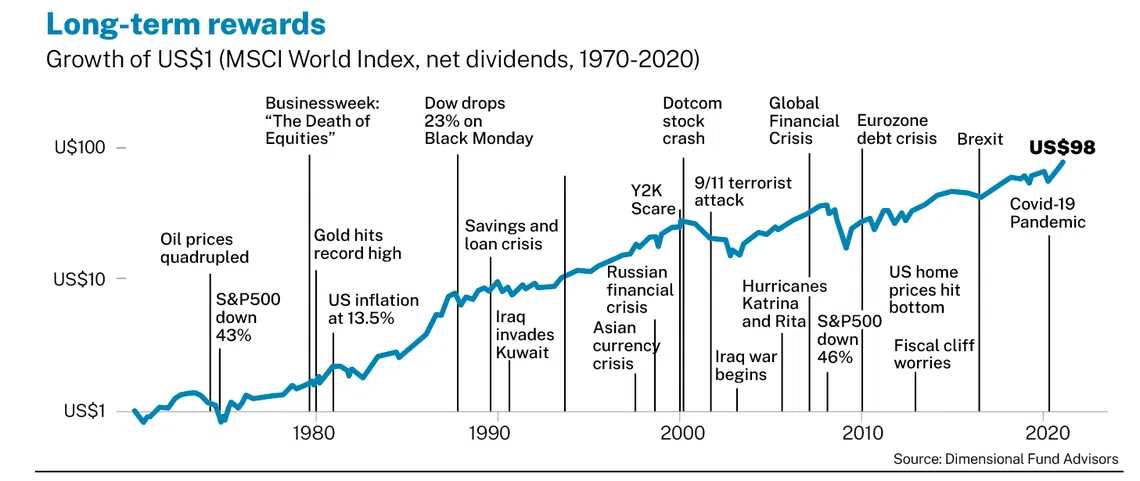

But the world has experienced similar crises before (See chart). Over the past 50 years, we have seen stock market crashes, high inflation, financial crises, natural disasters, terror attacks and wars. While circumstances may differ, there is one sure thread – the markets remained resilient and grew. This time will be the same. Governments cannot increase interest rates forever. The pandemic will end. Lockdowns will cease and supply chains will resume. Prices will stabilise; companies will continue to trade and make profits and markets will rise again.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The greater fear now is the escalation of the Russia-Ukraine war. Russia has started moving nuclear-capable missiles towards its border with Finland after both Finland and Sweden announced their plan to join NATO. What is going to happen if a nuclear war breaks out? Honestly, no one can be really sure. During WW2, when the US dropped 2 atomic bombs on Japan, the world survived because the devastation was isolated and even then, Japan recovered economically.

But if the current conflict results in a nuclear war of a much larger scale involving more countries, then the financial system may not hold together and this suggests that all financial assets may become worthless. In this scenario, your strategy to mitigate the risk of a large-scale nuclear war should then be to focus on survival as the top priority, instead of protecting financial assets.

One course of action is to buy a farmland in a country with strong military power and good medical system; countries like the US or Canada come to mind. You can’t easily buy land in China, unfortunately. You then need to build your house (perhaps far enough from strategic installations but not too far from medical facilities), and perhaps even bunkers deep underground and store enough food to last you through the war. The nice thing about farmland is that it is a cash-yielding asset and also has appreciation potential as prices may go up over time when everything is over.

But until this catastrophic event happens, you may need to engage farmland management companies to manage the place for you. The minimum investment for this could be at least US$1 million. But before we let our minds wander too far, let’s be rational and ask ourselves: Should we spend so much resources for an event with a low probability? In any case, it may be too late now to embark on this if you have not already done so.

How should you respond?

1. If you are still saving for your financial goals, knowing that markets are resilient and will rise over the long term, stay invested. Keep investing in tranches and do not panic and sell. However, this only works if you are invested into broadly diversified portfolios of securities with a track record of rising over the long term. Cryptocurrencies, concentrated and thematic portfolios of stocks or bonds and actively managed funds may not fit the bill.

2. In order that you can weather the storm, you must be financially healthy in the meantime. This is the time for financial prudence as recession looms. Make sure you have enough emergency funds to meet your family expenses for between 6 and 12 months in case you lose your income. It is not a good idea to over-leverage yourself to buy big-ticket items that you do not need. Also, make sure you are comprehensively insured to mitigate life risks.

3. For those who need money in the next 1 to 3 years, do a review with your trusted adviser. If your investment portfolios have already met your return objectives, you may want to consider cashing out. Otherwise, find alternative funding or delay your goals or re-budget to spend less during this period.

Since the beginning of the year, we have been spending extended time communicating with our clients. Instead of busily trying to make changes to investment portfolios, our focus has been to ensure that our clients have the financial and psychological ability to weather the turbulence. We can do that because every client has a “flight plan” based on their needs, ability and willingness to take risk. Furthermore, in the past years when it was easy to jump onto the bandwagon of high-risk assets such as growth stocks, high-yield bonds and cryptocurrencies, we stayed on course with boring, low-cost, globally diversified portfolios of equities and investment grade bonds. When we do that, we can then “maintain unwavering faith that we can and will prevail in the end, regardless of the difficulties, and at the same time, have the discipline to confront the most brutal facts of our current reality, whatever they might be” . (Jim Collins, Good to Great)

Christopher Tan is CEO, Providend Ltd, Singapore’s first and probably sole fee-only comprehensive wealth advisory firm. He is also author of the book “Money Wisdom: Simple Truths for Financial Wellness”. He can be contacted at chris_tan@providend.com

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.