CareShield Life to be enhanced; S$570 million in government premium support over five years

Changes to this and other long-term care financing schemes will be implemented progressively in 2026

[SINGAPORE] Policyholders of CareShield Life, the national long-term care insurance, will enjoy a doubling of the annual growth rate of payouts in an effort to help defray the rising cost of care.

Premiums will also rise, but this will be cushioned by government support to the tune of more than S$570 million – on top of existing premium subsidies.

The support comprises three elements:

- A broad-based “transitional” support of S$440 million to evenly phase in the one-step premium increase in 2026.

- Means-tested premium support for low to middle-income policyholders of more than S$130 million. Premiums will be offset by premium subsidies of up to 30 per cent for eligible policyholders.

- Additional premium support for those who are unable to afford CareShield Life premiums after premium subsidies, and have limited family support.

These were the main recommendations of the CareShield Life Council in its 2025 review of the scheme, which were accepted by the government. Changes to CareShield Life and other long-term care financing schemes will be implemented progressively in 2026.

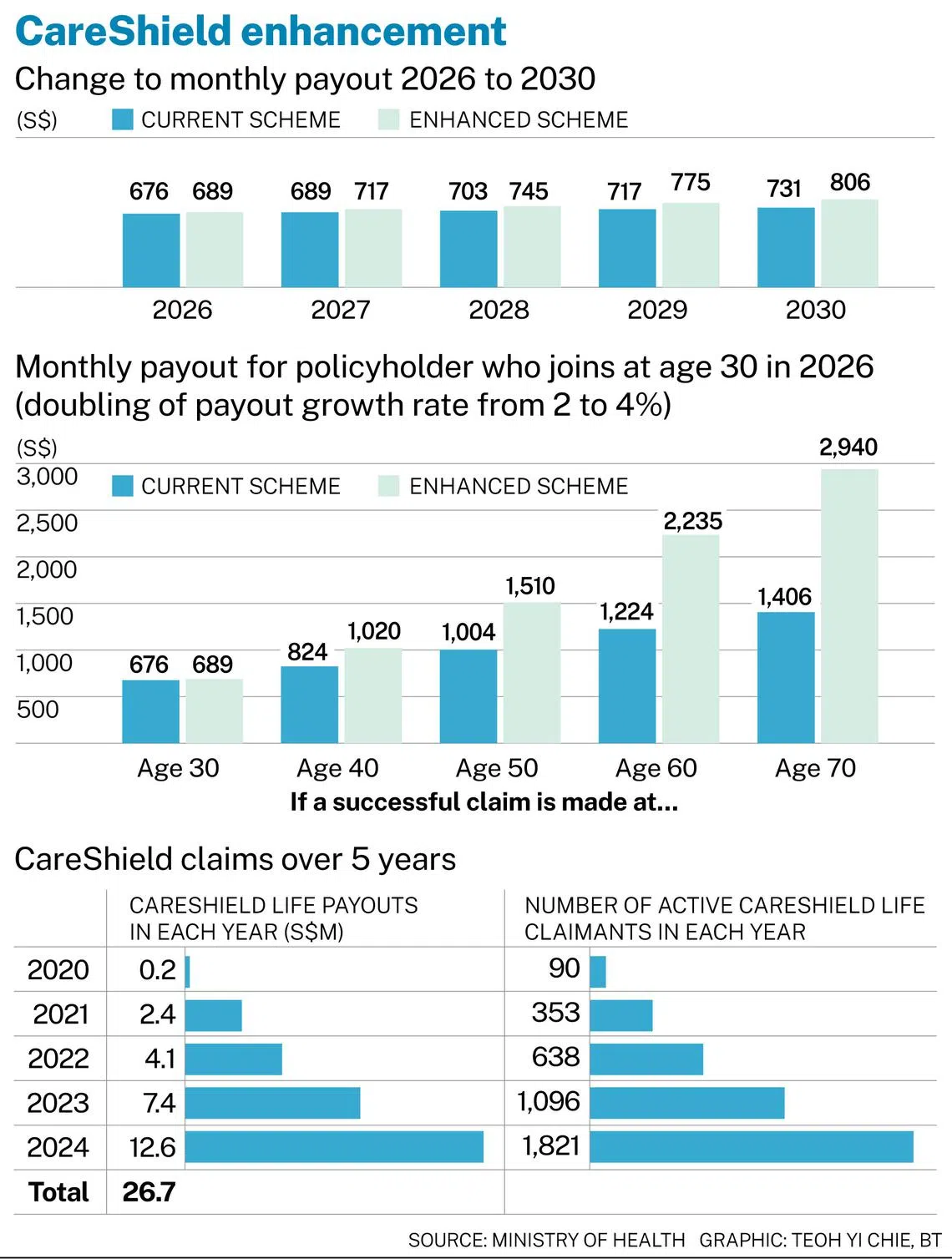

Without the support measures, annual premiums would have increased by S$126 on average in 2026, and rise by 4 per cent thereafter. With the support measures, annual premium increases from 2026 to 2030 will be moderated to about S$38 on average, and no more than S$75.

Low and middle-income Singaporeans will see even lower premium increases as they continue to receive means-tested premium subsidies.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In terms of the enhanced payout, the annual growth rate of payouts will rise from 2 per cent to 4 per cent from 2026. For example, a policyholder making a claim in 2030 would receive S$806 a month, compared with S$731 under the current rate.

Affordability concern

The council has kept the threshold for claims unchanged, despite views from some members of the public that the criteria should be relaxed – from inability to perform three out of six activities of daily living (ADLs) to two ADLs. The ADLs comprise feeding, dressing, toileting, washing, mobility and transferring.

But it is estimated that changing the criteria to two ADLs would result in a doubling of premiums.

Jeanette Wong, chairperson of the CareShield Life Council, said the issue was discussed in focus groups, and participants “veered towards the idea that it was just too expensive”. She was speaking on Tuesday (Aug 26) in a briefing hosted by the Ministry of Health (MOH).

The council consulted close to 300 stakeholders, including caregivers and healthcare professionals, in coming up with its recommendations. There were 14 focus group discussions.

Associate Professor Gan Wee Hoe, a council member, said: “I think there was a sentiment, a strong one, that CareShield Life is a basic national (scheme)... There was a lot of feedback that it was important to make sure it’s affordable. Really, between affordability and features, there is a trade-off.

“There was also the view that… for those who want more coverage at a lower threshold, there are private supplements in the market. Those who are willing to pay for it can access those top-up products.”

Supplements to CareShield Life are offered by three insurers – Great Eastern, Singlife and Income. Their claims thresholds can be as low as one ADL, which may merit a partial monthly payout, or two or three ADLs.

Rising long-term care costs

MOH said national expenditure on long-term care has almost doubled over the last five years, from S$1.7 billion to about S$3 billion currently. An ageing population is among the drivers as more seniors require long-term care.

“Costs are also increasing, due to the evolving care needs of the population and inflation, driven by manpower and technology costs. Some of these trends are structural in nature, and likely to persist in the future,” said MOH.

“Over a longer time horizon, as the policyholder pool ages, we expect significantly more claimants over time.”

In 2024, there were 1,821 active claimants, with more than S$26 million of claims paid out under CareShield Life. The ages of claimants range from 30 to 93, with the median age at 52. This means about half of them are in their 30s and 40s.

As at December 2024, S$2.8 billion of CareShield Life premiums have been collected, including around S$800 million of government premium support.

Among Singapore citizens and permanent residents aged 30 and above as at June 2025, 1.93 million are covered under CareShield Life, with about 535,000 under ElderShield. The proportion covered under either plan is roughly eight in 10.

CareShield Life was rolled out in 2020, offering significantly enhanced benefits over ElderShield. CareShield’s monthly payouts started at S$600 in 2020; they were paid for life and rose annually. In contrast, ElderShield’s payout was fixed at S$300 or S$400 for up to six years.

CareShield Life is compulsory for those born in 1980 or later, regardless of pre-existing conditions. For those born in 1979 or earlier, it is optional. Premiums are payable annually up to age 67 or for over 10 years – whichever is later.

Among those born in 1979 or earlier, those with mild or moderate disabilities were able to join. After an extended grace period of more than four years since 2021, and with sign-up rates dwindling, the council recommended the reinstatement of underwriting criteria.

This is to moderate the extent of premium increases for older policyholders, and is intended to keep the scheme fair and sustainable.

MOH said more than S$100 million of ElderShield and CareShield Life claims have been paid out since 2020.

“The low payout ratio is expected, as most of the premiums collected are intended to help the scheme meet its future payout obligations when more of its policyholders are older and likelier to claim. This is in line with the design of CareShield Life as a pre-funded scheme,” the ministry said.

“The fund also needs to maintain sufficient capital to meet its commitments to policyholders and absorb the impact of adverse events without requiring sudden increases in premiums.”

It added: “Holding sufficient liabilities and capital is consistent with the insurance industry’s best practices and the requirements set by the Monetary Authority of Singapore for private insurers.”

Council chairperson Wong said: “Through this review, the council seeks to ensure that CareShield Life payouts continue to provide meaningful support against long-term care costs, while ensuring that premiums are affordable.”

The council’s recommendations were guided by three key considerations, she noted. “First, amid rising long-term care costs, CareShield Life should continue to provide protection against the cost of basic long-term care alongside other support such as government subsidies.

“Second, as a national scheme, CareShield Life should be appropriately scoped so that premiums remain affordable, particularly for the vulnerable, lower-income group. Third, the claims process should continue to be enhanced to be more accessible.”

The government will be streamlining the process and assessment of related long-term care grant schemes. Residents who undergo severe disability assessment for a long-term care scheme such as CareShield Life will soon be assessed against the eligibility criteria for other related schemes, such as the Home Caregiving Grant.

If the eligibility criteria for other schemes are met, care recipients will receive support without needing to make additional applications.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.