DBS and OCBC hit record highs; will the rally continue in 2026?

Both banks are set to close the year on a strong note, while UOB may need more time to overcome volatility

SINGAPORE’S major banks are set to end the year on a strong note, with the share prices of DBS and OCBC having climbed to record highs. As at Dec 19, 2025, DBS shares were trading around S$55, while OCBC hovered above S$19, translating into year-to-date gains of more than 25 per cent and 15 per cent, respectively.

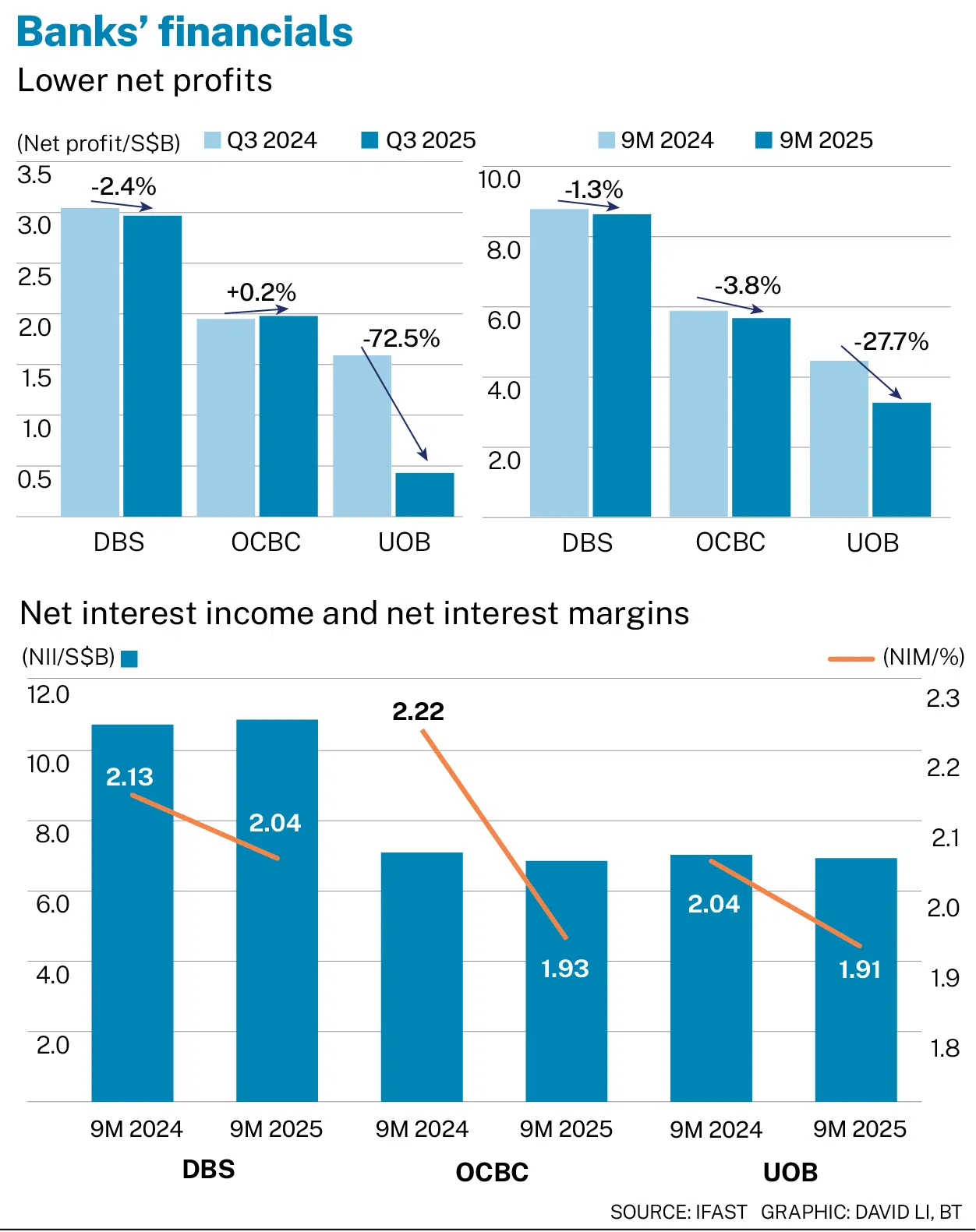

The rally has been underpinned by steady third-quarter earnings. DBS reported a modest 2.4 per cent year-on-year decline in net profit, while OCBC posted a marginal 0.2 per cent increase.

Although headline growth remained subdued, investor sentiment was supported by stable core earnings, bolstered by stronger-than-expected growth in non-interest income.

In contrast, UOB has underperformed its peers, with its share price trending lower. The bank’s net profit plunged 72.5 per cent year on year in the third quarter, following an almost fourfold increase in provisions, which significantly weighed on overall profitability.

Interest margins squeeze

All three local banks reported declines in net earnings for the first nine months of the year, largely weighed down by elevated provisions and sustained pressure on net interest margins (NIMs). The faster repricing of loans relative to funding costs compressed margins and weighed on net interest incomes (NIIs).

The impact has been uneven across the sector. OCBC experienced the sharpest impact, with NIM contracting by 29 basis points year on year over the first nine months, alongside a 6.1 per cent decline in NII.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In contrast, DBS proved the most resilient, recording a more modest nine-basis-point compression in NIM while delivering a 1.9 per cent increase in NII.

This outperformance was supported by effective balance sheet hedging, strong deposit inflows and a growing base of low-cost deposits.

A key bright spot for Singapore’s banks this year has been the strength of non-interest income, particularly for DBS and OCBC, which recorded year-on-year increases of 9.3 per cent and 10.3 per cent, respectively, over the first nine months of the year.

This was largely driven by a surge in wealth management income of more than 30 per cent, reflecting sustained client activity and strong investment product flows.

Both lenders also benefited from broad-based growth across other fee-based businesses, including loan-related fees, transaction services, investment banking and trading activities.

UOB, meanwhile, reported a solid 19.3 per cent increase in wealth management income, but overall non-interest income growth was weighed down by elevated card reward expenses, which offset part of the gains from fee income expansion.

Banks’ earnings likely to remain modest

Singapore Overnight Rate Average, or Sora, is expected to ease further in 2026, supported by ample domestic liquidity, a tight Singapore dollar, a softening labour market and relatively stable US inflation, which also points to downside risks for US interest rates.

However, having already outpaced Secured Overnight Financing Rate (SOFR) with a substantial year-to-date compression of about 184 basis points to near 1.2 per cent, further declines in Sora are likely limited, and any Fed easing may see Sora fall less than SOFR.

With limited room for further Sora declines and faster pass-through of lower deposit costs since September 2025, NIM compression for Singapore banks is expected to moderate.

DBS appears best positioned, benefiting from sizeable fixed-rate assets and proactive funding cost pass-through, with its six-month fixed deposit rate at 0.8 per cent. OCBC and UOB, with larger floating-rate loan books, are likely to face relatively higher NIM pressure.

Non-interest income will remain the key earnings driver, with wealth management firmly at the centre of that story.

Singapore’s safe-haven status, Monetary Authority of Singapore’s enhanced frameworks for family offices and private wealth structures, and the ongoing Equity Market Development Programme and “value unlock” initiatives are attracting fresh inflows, prompting clients to reallocate from deposits to investment products. This is likely to boost assets under management and provide a structural tailwind to sector valuations.

Singapore banks’ solid credit

All three banks’ non-performing loan (NPL) ratios remained stable in the third quarter. For DBS and OCBC, new problem loan formation was largely offset by repayments and write-offs, keeping specific credit costs broadly stable over the past year.

Both banks maintain strong balance sheet buffers, with non-performing asset (NPA) coverage ratios of 139 per cent and 160 per cent, respectively. Given their track record in loan recoveries, current allowances appear adequate to absorb potential asset quality deterioration under weaker macro conditions.

UOB also reported a stable headline NPL ratio but booked a sharply higher credit cost of 134 basis points for the quarter, up from 36 basis points a year earlier.

While much of the increase was driven by pre-emptive general allowances, described by management as “buying insurance”, specific credit costs rose to 55 basis points, reflecting newly identified problem loans linked to commercial real estate (CRE) exposures. NPL ratios for the bank’s Greater China and US portfolios climbed 110 and 160 basis points year on year, respectively.

With UOB’s US and Greater China CRE exposures representing only 1.5 per cent of total loans, and supported by higher total allowances and a 50 per cent loan-to-value ratio, capital risks appear limited.

Nonetheless, its NPA coverage ratio of 100 per cent remains below peers, and specific credit costs are expected to stay structurally higher, indicating that near-term earnings pressure is likely to persist.

Anchoring Singapore market

After a strong 2025, Singapore’s banking sector is poised to maintain a steady course into 2026. Resilient fundamentals, underpinned by robust non-interest income and sustained demand for local assets, help offset NIM compression and elevated provisions.

Looking ahead, UOB’s earnings are expected to rebound as provisioning normalises, while DBS and OCBC are likely to deliver steady, moderate growth.

Dividend-focused investors may still find the sector attractive. DBS stands out with a projected forward yield of 6 per cent over the next two years, backed by a fixed and transparent dividend framework. OCBC and UOB’s earnings-linked payouts are more volatile, particularly for UOB during periods of higher provisions or earnings pressure.

Overall, the three banks remain well positioned for 2026, offering investors continued opportunities ahead.

The writer is a research analyst with the research and portfolio management team of FSMOne.com, the B2C division of iFast Financial, the Singapore subsidiary of iFast Corp.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.