Don’t just wait for the lucky dragon

A NEW year is always a time to reflect on the previous year and what we might learn from it, and then apply these lessons. What better time for reflection than now, as we usher in the Year of the Dragon? Considered one of the most auspicious creatures in the Chinese zodiac, the mythical dragon symbolises power, wisdom, strength and good fortune.

From an investment perspective, however, there is more you can do than wait to tap into the dragon’s luck. Last year, I wrote that in investing, it is just as important to follow some key principles, such as diversifying and keeping your emotions in check, as it is trying to predict what the future holds.

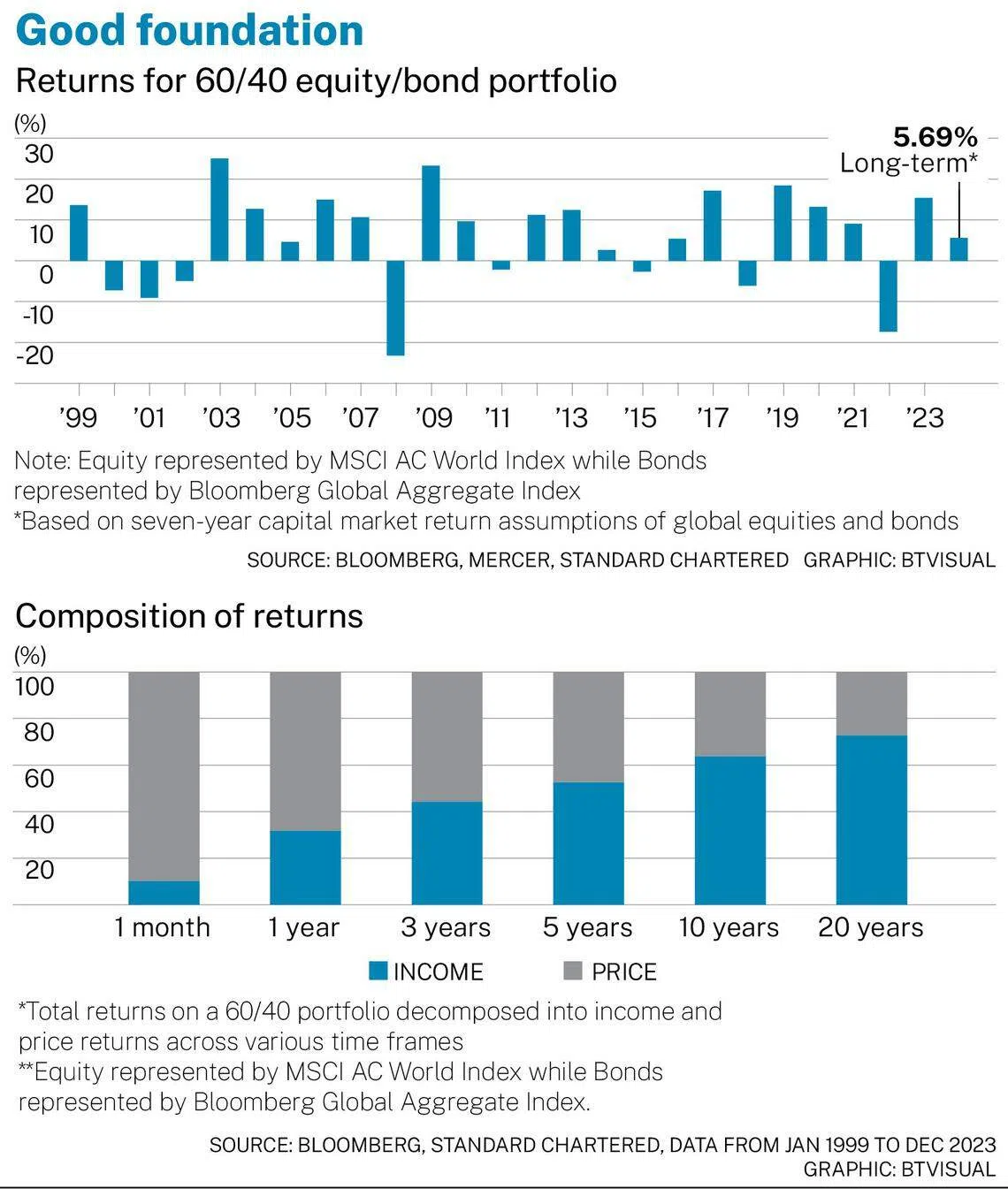

In addition, investors will benefit from allocating a sizeable portion of their wealth into a foundation portfolio consisting of diversified stocks, bonds and other alternative assets invested for the long run, and opportunistic trades, which are more short-term in nature.

The sizeable allocation goes into a foundation portfolio because staying invested in such a portfolio and rebalancing periodically to bring it back to a target allocation (thus automatically “selling high and buying low”) has historically helped seasoned investors beat cash returns and inflation over the long run. Following this core principle helps an investor stay disciplined, rather than relying too much on trying to time the market.

Last year provided a powerful illustration of the benefits of this approach. At the beginning of 2023, almost everybody was on alert for a recession in the US and worried about what that would mean for the performance of equity markets around the world. This led to a rush for the safety of cash deposits, as investors waited for interest rates and bond yields to peak and for the recession to pass.

One year on, we are still waiting for a recession; and bond yields peaked much later than expected. Once they did, they dropped dramatically in the fourth quarter.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Those guided exclusively by trying to time the market or putting too much of their wealth into higher-yielding deposits did much worse than those who maintained a diversified foundation portfolio.

For instance, our CIO Signature investment strategies which adopt a diversified approach delivered healthy returns in 2023. Our Growth strategy, with a higher weight to equities than bonds, rose over 13 per cent; our Balanced strategy was up by over 11 per cent. Our Income Generating strategy was higher by almost 9 per cent. Those are better than the average annual returns generated over the past century.

Of course, the path was not a straight line. The more volatile Growth strategy fell more than 9 per cent peak-to-trough during the year. However, experienced investors targeting to grow their wealth over the long run would know that any significant decline in a diversified foundation allocation is a buying opportunity.

Cash deposits still look attractive today, given close to 5 per cent yields on offer in US dollar short-term Treasury notes. However, many investors often ignore the reinvestment risk, or what would happen to those deposits when they mature in a year’s time. Interest rates a year from now may well be much lower than where they are today. Investors would have to then park their matured deposits at lower interest rates.

If an investor is really worried about the investment outlook because of a recession over the next six to 12 months, a more fruitful way to park savings would likely be in a foundation portfolio with a relatively conservative asset allocation strategy. Such a strategy would have a larger allocation into a mix of government and corporate bonds than stocks.

This strategy is not only likely to provide income close to the current cash deposit rates, but it would offer the potential for additional returns as yields on government bonds decline (and therefore bond prices rise) in the event of a recession. Another key benefit is an opportunity to profit from any upside in equities should the recession be delayed by yet another year.

As we head into the Year of the Dragon, this is the lesson I think 2023 taught us: Start with a foundation allocation that suits your risk appetite and financial needs, and then add to this on a regular basis, accelerating the investments should the performance deteriorate. Follow up with opportunistic investments if you want to, but only after a foundation portfolio is in place.

If you follow this time-tested principle, you will thank yourself – and not just the lucky dragon – for your good fortune.

The writer is global head of wealth management, deposits and mortgages, Standard Chartered Bank

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.