Fixed income is attractive, but be wary of ‘fake’ yield

The shift from yield scarcity to abundance is exciting, but it needs to be approached carefully as higher rates make the operating environment more difficult

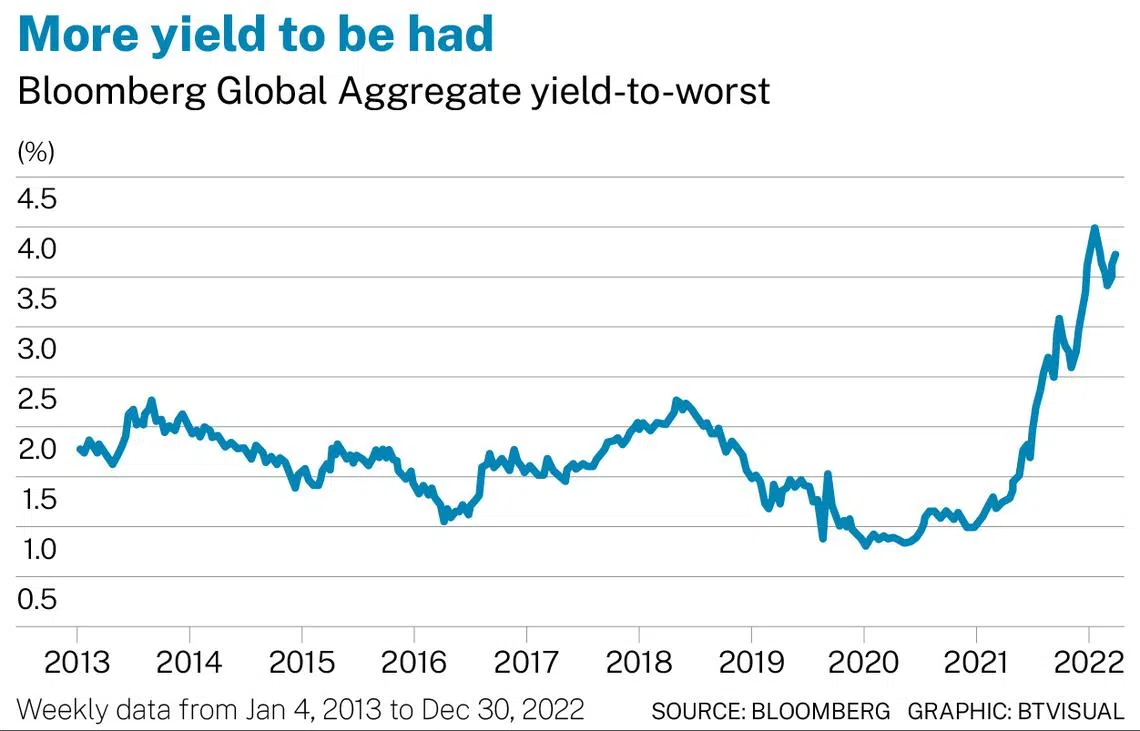

YEARS of weak economic growth and quantitative easing caused interest rates to compress, creating a scarcity of yield throughout the 2010s. However, all that was reversed last year, as central banks belatedly took action to contain stunningly high levels of global inflation.

Soaring policy rates resulted in cash becoming a competitive asset again, which in turn prompted an overdue de-rating of risk assets. At the same time, higher sovereign bond yields combined with wider credit spreads, creating an abundance of yield.

Shift in focus

Whether inflationary pressures decelerate more slowly or quicker than expected, central banks are moving closer to peak overnight rates. From our perspective, the combination of relatively high yields and normalised credit spreads has made fixed income quite attractive, so much so that the multi-sector income portfolios that I manage are overweight fixed income and underweight equities.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services