Saving up to 40% onboarding time, costs: How award-winning solution speeds up work for advisory firms

By integrating multiple business functions into one, shared services solution Propel with Singlife eases administrative burdens for firms, allowing them to better serve their customers and scale their businesses

THE growth of the financial advisory (FA) channel in recent years has coincided with more tied agency leaders exploring opportunities to start their own firms. As customers become savvier, they are seeking more personalised financial advice and greater choice in financial solutions.

Yet, starting and growing an FA firm comes with obstacles.

Many advisers, who want to break away from their tied agencies to offer a broader range of solutions across providers, have cited the lack of robust middle-to-back-office support and efficient processing systems as major roadblocks in their transition1.

For newly licensed FA firms, the high costs of hiring an in-house team for back-end operations alone can be prohibitive.

More established firms face a different set of challenges, including juggling paperwork, data reconciliation and the need to manage multiple systems. These take up time needed for meaningful client engagement, the very foundation of trust.

Propel with Singlife – a shared services hub – was created to bridge this gap.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“Propel started as an idea because we saw the challenges agents face in starting their own firms to give customers the freedom of choice, as opposed to being restricted to specific brands or products,” says Propel’s chief executive officer, Steven Ong.

“Our goal at Propel is to help FA firms do the heavy lifting in the middle and at the backend, so they can focus on their clients and grow their businesses.”

With a team of around 100 seasoned professionals, Propel offers a suite of support services to meet the unique needs of FA firms at every stage of their journey. These services include policy lodgements, adviser onboarding, commission management and finance services.

New FA firms especially benefit from Propel’s product management services, which streamline due diligence and comparisons to help advisers recommend the right products to customers.

Propel’s all-in-one proposition has already delivered tangible benefits: Firms using its full suite of services have cut administrative work by up to 75 per cent and sped up client onboarding by up to 40 per cent. They have also slashed operational costs by up to 40 per cent.

Propel’s market-disrupting potential has not gone unnoticed. In July, six months after its official launch in January, Propel was named Insurtech Initiative of the Year – Singapore at the Insurance Asia Awards 2025.

The company also received the Operational Excellence Pioneer and Technology Integration Excellence accolades at the InsurInnovator Connect Asia Awards last month.

Boosting efficiency and choices

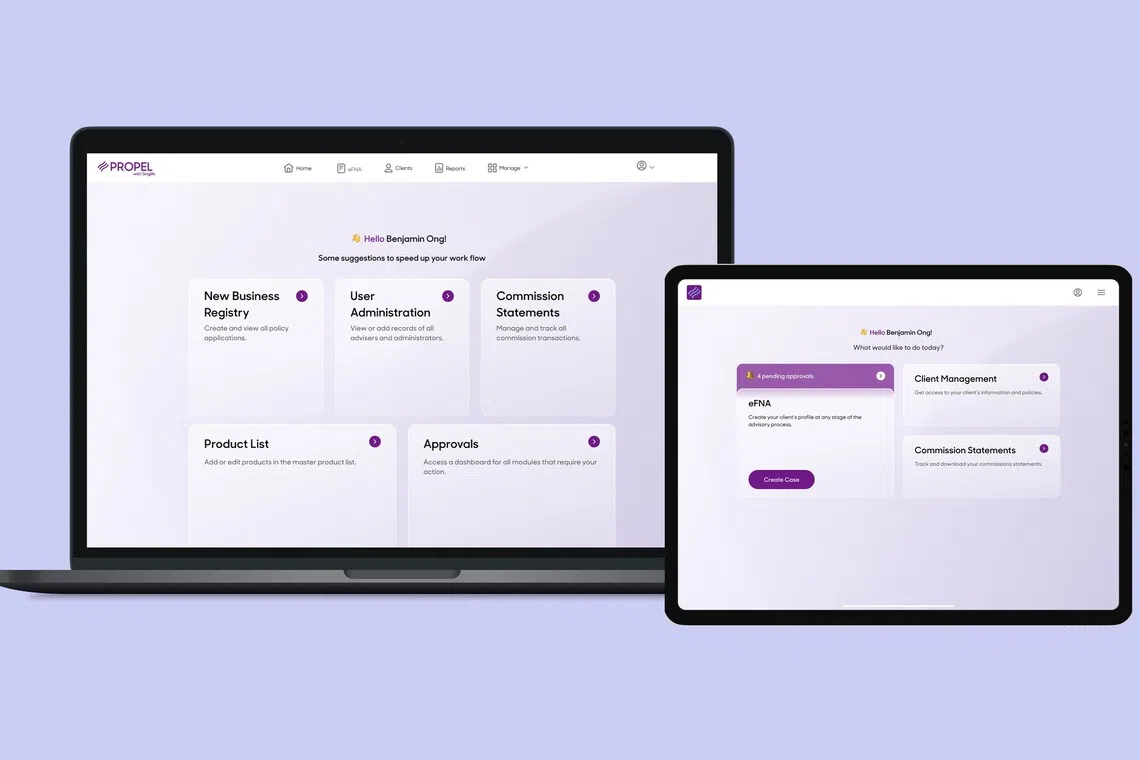

Another core service of Propel is its platform. It unifies key functions – electronic Financial Needs Analysis (e-FNA), New Business Register and Commission Management – into one system. With this integration, firms no longer need to invest in multiple platforms in a piecemeal manner.

Like many new systems, Propel faced teething problems when its platform launched, such as laggy responses and unexpected logouts. However, the team has worked closely with clients to address these challenges, listening to feedback and using it to guide improvement efforts.

Says Ong: “We take our clients’ feedback seriously, and our tech teams have also worked on improving our platform’s reliability significantly in ensuring we offer the best experience possible for our clients.”

Propel’s latest optimisation cycle in August has significantly improved the platform’s transaction success rates, and cut errors and timeouts by over 95 per cent. Users also reported zero cases of slowdowns or timeouts in September.

Says Shaun Lin, chief executive officer of Gen Financial Advisory (Gen), a Singapore-based untied FA firm and an early adopter of Propel: “For Gen, having a trusted partner like Propel is important. We appreciate their commitment to listening to feedback and continuously enhancing their platform for clients.

“Whether it’s their client engagement or tech teams, Propel has been steadfast in their support, no matter the time of day. Over my years as a financial planner, I’ve seen first-hand what works and what doesn’t in this industry. We are excited to continue this partnership, and we look forward to achieving greater success together.”

In just months since launching the platform, Propel upgraded the e-FNA module, which helps advisers get a holistic assessment of their customers’ needs. e-FNA 2.0 allows firms more flexibility and control to adjust settings tailored to their compliance and business requirements.

Upcoming upgrades include more customer relationship management tools that will enable firms to better engage clients. Under Propel’s multi-tenanted approach to the platform, its clients benefit from every system upgrade at no extra cost.

Above all, as a product-neutral solution, Propel lets client firms retain full autonomy of their businesses, never placing any sales burdens or obligations for its own benefit.

Explains Jean Yeo, Propel’s head of platform and client engagement: “Firms should be able to sell the products they truly believe will benefit the customer, and thus be able to offer unbiased recommendations and a broader range of products to their clients.

“This builds trust and transparency with customers.”

Says Ong: “By empowering advisers with the tools and support they need to succeed, Propel is helping to transform the financial advisory industry into a more dynamic, transparent and customer-focused ecosystem.”

1Singlife survey conducted among 102 tied agents from May to June 2024.

Learn more about Propel with Singlife here.

Share with us your feedback on BT's products and services