How to conquer the fear of missing out

Many investors do not invest enough or fully, after taking profits too early and not being able to get back in and missing the boat

THE major financial markets have been on a tear since the US presidential election. All risky assets – from equity markets especially in the US; high-flying tech stocks; to crypto such as Bitcoin – have been on a continuous upward trend. Despite the fact that markets were up double digits this year after a double-digit return last year, there seems to be no letting up.

Fomo (fear of missing out) is in full bloom. From a behavioural perspective, this combines the two worst emotions when it comes to investing – greed and fear.

We hear that many investors are struggling even as markets break out to new historic highs. Only a small fraction of investors were fully invested in equities at the beginning of the year, and even fewer remained invested throughout. Many have tried to take profits or attempted to time the market by jumping back in.

Investment returns vs investor returns

Jack Bogle, the founder of Vanguard, once wrote that the average equity fund investment gained 173 per cent from 1997 to 2011, but the average equity fund investor earned only 110 per cent.

Investment returns are the returns that an investment generates. In contrast, investor returns are the returns actually experienced by investors. The difference between these two is often attributed to individuals’ poor decision making and behaviour, which are influenced by emotions.

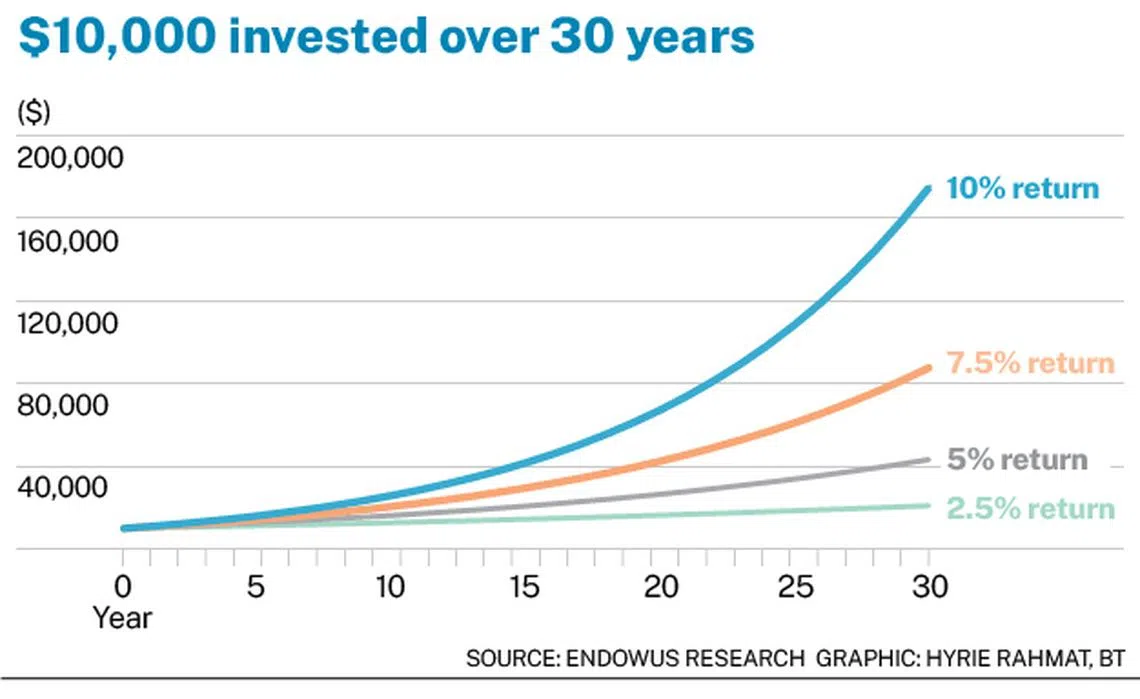

Despite many performing asset classes, the average actively managed portfolio return of investors was a meagre 2.5 per cent annualised over many decades, a study by JP Morgan Private Bank showed. If all the money had been left in a low-cost, passive index fund, annualised returns would have quadrupled to 10 per cent. That may not seem like much, but the number grows exponentially over time.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Over a 30-year period, $10,000 invested would have grown to $174,494 at 10 per cent annually versus just $20,976 at 2.5 per cent. This is the difference between investment returns and investor returns that Carl Richards talks about in his book, The Behaviour Gap.

Over the past two decades, investment returns from benchmark indices such as the S&P 500 and global stock markets averaged between 8 and 13 per cent annually. The S&P 500 index led the way, with an average annual return of 13 per cent over the past 15 years, while the Nasdaq yielded returns above 16 per cent in the same period.

However, most investors fail to achieve that number for a variety of reasons. Some chase markets, others put more money to work at the top because of Fomo. Many do not invest enough or fully, after taking profits too early and not being able to get back in and missing the boat.

If we look at the average performance of all US mutual funds, more than 90 per cent of the funds have underperformed the benchmark in the past 15 years, according to S&P Indices versus Active (Spiva) scorecards.

The bigger issue is that top-performing managers change each year. It seems to be impossible for any manager to consistently outperform for five consecutive years. Even Warren Buffett’s Berkshire Hathaway, known for its remarkable long-term performance, has underperformed the S&P 500 index over the past 20 years. Consequently, investors have not kept pace with the investment returns of major markets, especially in the US.

And, if you are wondering about the future of US market dominance, it may last longer than anticipated.

Why US market dominance may continue

The new Trump administration raises the prospect of more explicitly US-centric policies, such as deregulation and smaller government, lower taxes and higher tariffs.

Perhaps unintentionally, this has sparked concerns over higher inflation for longer, leading bond vigilantes to price down (and yields rose) US Treasury bonds and maintaining a stronger dollar as a consequence.

On the geopolitical front, there is heightened uncertainty over the administration’s mixed signals about China, Ukraine, Russia, North Korea, and the relationship between and among the Middle Eastern nations. These spur investors to seek refuge in US dollar assets.

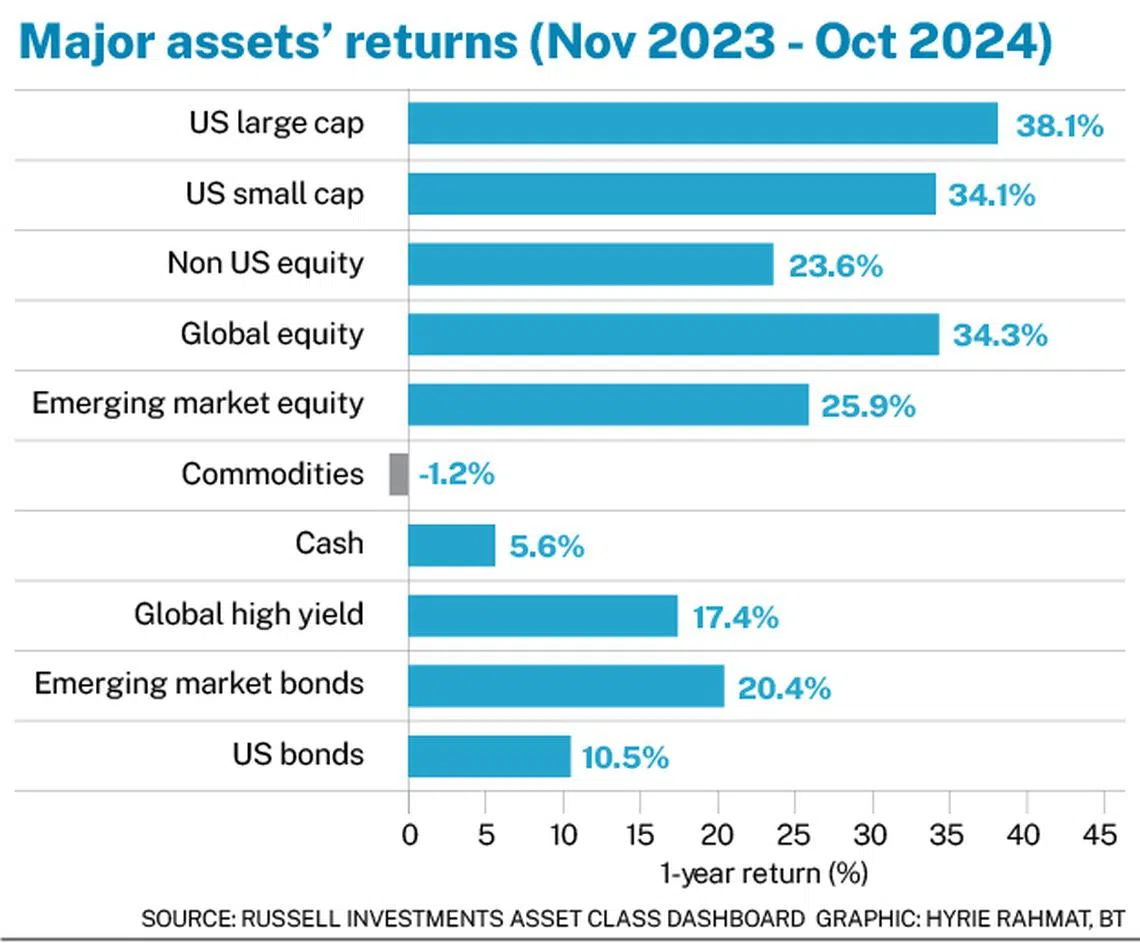

What may surprise many is that, apart from US equities, one of the best-performing asset classes in 2024 is emerging market bonds, with a return of more than 15 per cent.

The performance divergence between EM bonds and equities is notable, as dollar-denominated EM bonds with wide spreads allow investors to generate positive returns. These returns are based on expectations that EM countries will maintain their creditworthiness, while rate cuts and efforts by the US Federal Reserve to tame inflation drive credit spreads to narrow.

In stark contrast, EM equities have languished over the past few years. Despite a brief rally fuelled by optimism around a Chinese economic recovery and around the AI-driven tech rally in Taiwan and Korea, EM equities have once again floundered due to their vulnerability to tariff hikes by Trump administration and the impact of a stronger dollar.

The futility of predictions

When I wrote the first Science of Wealth column of 2024 on Jan 9, I noted how many people had been locking in a Fed rate cut and overweight on bonds, on which I sounded caution. Investing based on predictions is a strategy fraught with danger.

The bond market again disappointed as the bond yield, which initially fell, rebounded to higher levels. The sturdy US economy, sticky inflation, and the Trump election put paid to expectations of a rapid decline in both Fed and market interest rates.

Again, as we approach the end of a year of poorer-than-expected bond returns and better-than-expected equity returns, we are braced for a flurry of 2025 outlooks and market strategists forecasting that this or that will happen to the economy and the markets.

The one thing we know for certain is that nothing is known. In reality, we are terrible at predicting the future.

Proven investment principles

Rather than basing your investments on a whim, Fomo or an unknown future, you should anchor yourself on the proven principles of investing.

- Implement a rules-based process of investing, so you take the emotions out of the equation.

- Start with a core allocation to equities and bonds; the longer you invest, returns will revert to the average.

- Adopt the discipline of a regular savings plan to neutralise volatility and uneven returns.

- Investing regularly means you get to invest at lower levels when markets are down. Even if you are in your 50s like me, you still have an investment horizon of 30 to 40 years.

- Keep turnover low and costs as low as possible as they directly and negatively impact returns.

- Keep it as simple as you can and keep it personal (crystallise the goals you are investing for).

- Being honest with yourself is the most important trait to help you remove your personal biases and reduce the negative effects of being driven by your emotions.

Li Lu, an investor dubbed the “Chinese Warren Buffett” by Charlie Munger, is quoted as saying: “If investing is trying to predict the future, and the future is inherently unpredictable, then the only way we can do better is to assess all the facts and truly know what you know and know what you do not know. That’s your probability edge.”

Being honest with yourself is essential to achieve your goals. This includes understanding what is drives Fomo for you. Only then you can crystallise the other six principles above to have a personal investing plan that aligns with your needs. A trusted financial adviser can help you in your journey.

Even though there are no guarantees, we can do what we can to raise the probability of success. Remember, too, that success looks different for different people.

As the year ends with markets at historic highs and a new year dawns with uncertainties and opportunities, let’s not focus on our Fomo emotions, but take the time to reassess and plan ahead, so that we can maximise the probability of investing successfully in 2025.

The writer is chief investment officer, Endowus, the leading independent digital wealth platform with over S$9 billion in client assets across public, private markets and pension funds (CPF and SRS)

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services