How we learnt to stop fearing inflation – and start investing

More than ever before, persistent inflation fears may be driving emotional decisions about investing. Here’s how to keep that in check

THE failure of Silicon Valley Bank and the takeover of Credit Suisse spooked the global financial industry. But for the most part, Singapore and the wider Asian region have been largely shielded from the spillover effects of the banking turmoil in the United States and Europe.

Nevertheless, against what feels like a continued deluge of bad news and prolonged market uncertainty, investors in Singapore are ostensibly cautious – almost nervous – about their next steps for the year ahead. As the latest Endowus Wealth Insights Report 2023 reveals, this anxiety can often lead us to make emotionally charged decisions about our money.

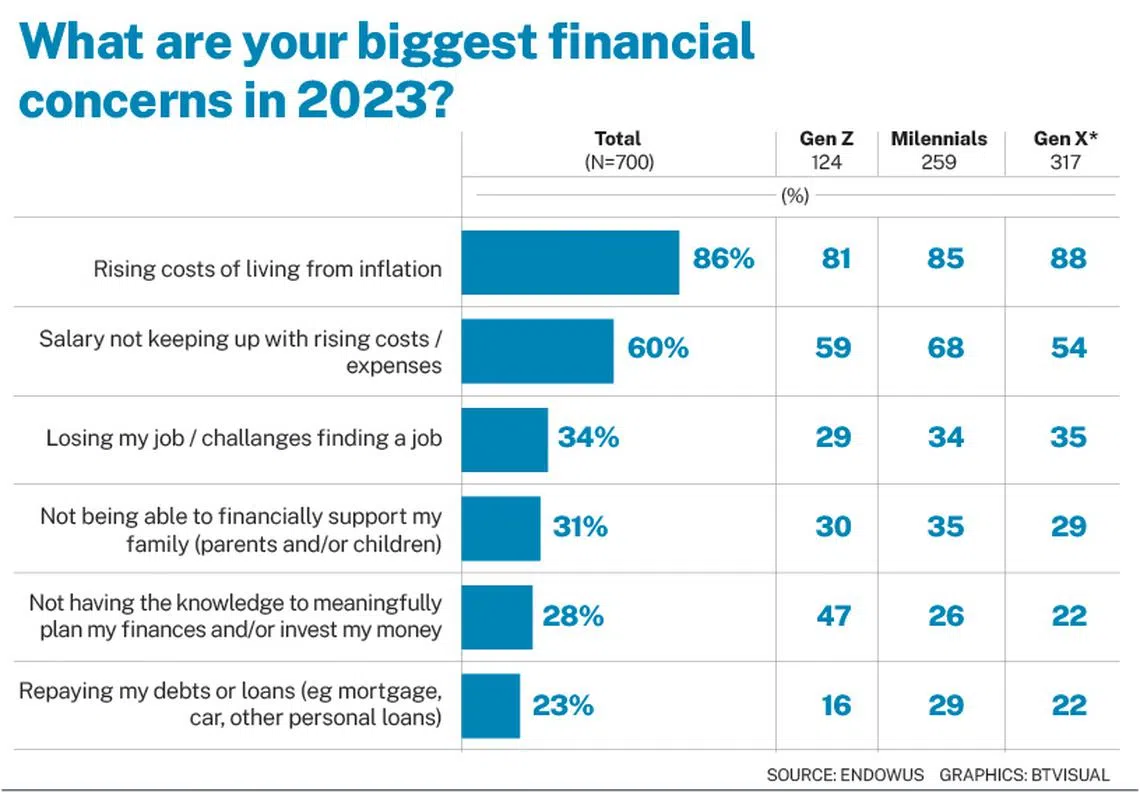

Importantly, the study found that inflation and rising prices of goods and services remain the biggest financial concern in 2023 for most respondents in Singapore (86 per cent) across all age categories. This was also seen in Hong Kong (66 per cent).

This creeping sense of fear can derail individuals’ investing resolve, prompting them to make emotionally led financial decisions that may not be meaningful for their wealth goals.

Despite being the most concerned about inflation, when asked for their main financial goal for 2023, a majority of respondents in Hong Kong (62 per cent) and Singapore (68 per cent) said they want to save more money. Yet, with the average interest rate at less than 1 per cent for most savings accounts, individuals are effectively losing money when the inflation rate exceeds the interest rates on their savings account.

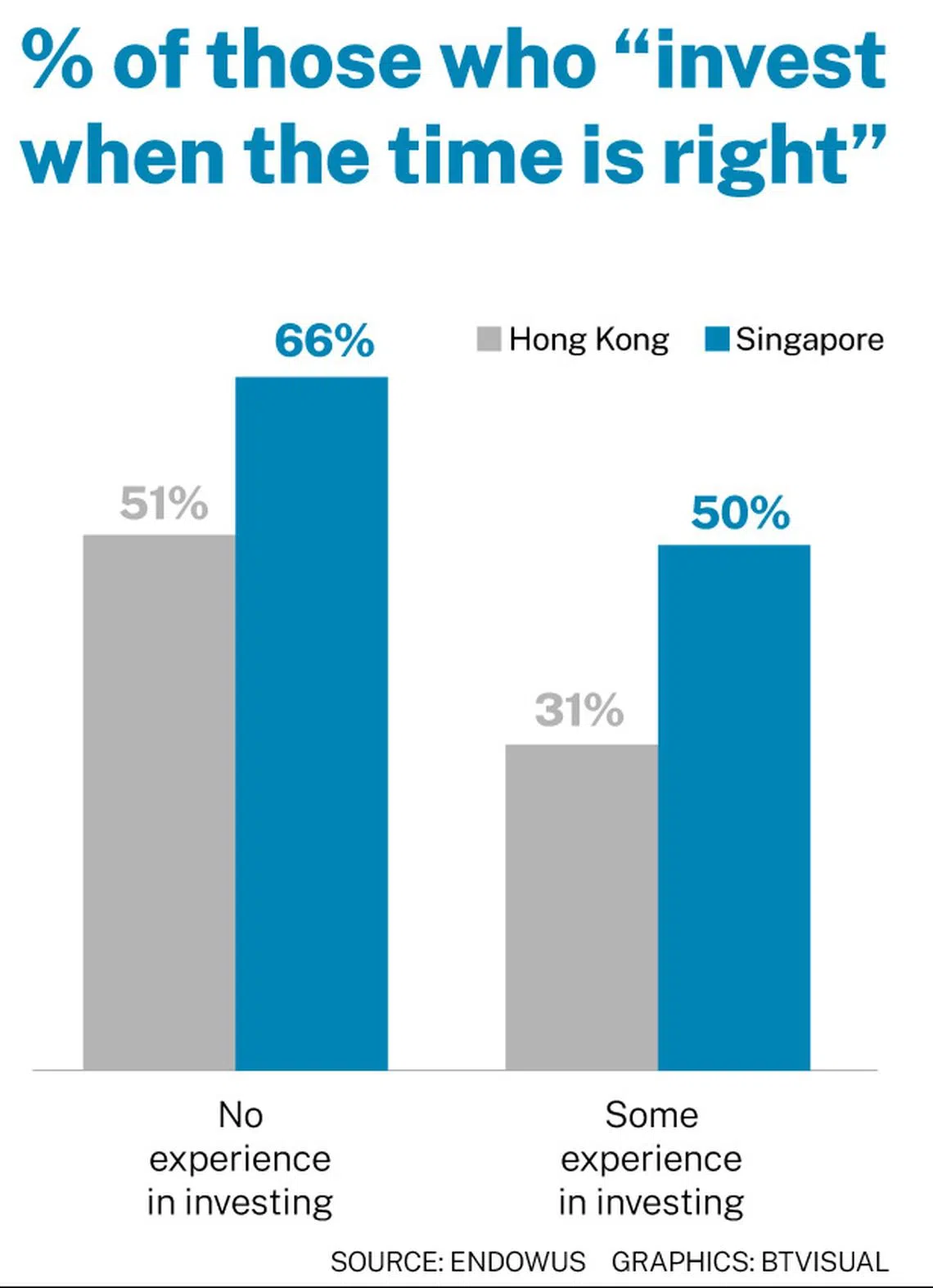

Many may feel that they do not have the necessary experience or knowledge to do invest well. New or inexperienced investors are most vulnerable – the study noted that respondents who have no investing experience are also those more likely to “invest when the time is right”.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Attempts to time the market are inevitably coloured by emotion. To effectively get ahead of inflation, there are precautionary measures to help investors manage the stress of uncertain times, lest they fall prey to the noise of misinformation or speculative behaviour.

Don’t confuse speculation with investment

Even experienced investors may think they are investing when what they are doing is, in fact, disguised as speculation. In fact, one in three respondents who indicated they have some or a lot of experience investing reported that they only invest when they feel the time is right.

It is human to want to time the market or panic-sell investments in periods of high volatility, but short-term speculative action ultimately leads to random outcomes for the risk taken. Resisting the temptation to react to the ups and downs of the stock market in a disciplined way makes for a better investment practice.

Evidence-based investing is designed to give you the highest chance of a return that is commensurate to – and compensates you for – the risk that you take.

More than half of respondents in Singapore (55 per cent) would choose to preserve capital while taking minimal risk. But with the right investing approach and a trusted wealth manager, you can grow your capital ahead of inflation rates, by taking some risks that you are willing to accept.

More importantly, investors should first clearly define their future needs and investment horizon, before figuring out the actions to take. An investment plan to reach your financial goals is often a long-term pursuit. A get-rich-quick strategy is almost guaranteed to fail.

Perhaps the biggest risk of all is not being able to reach our long-term goals of being able to retire when we want, or live the life we envision post-retirement.

Dollar-cost averaging: A small action to reap big returns

In Endowus’ report, those looking to invest less in 2023 point to market volatility and uncertainties as their biggest deterrents; these worries are most felt among Gen X respondents (71 per cent).

Inflation does not just hurt someone who is retiring or has retired. For Gen Zs who are saving for a down payment on their first home, or millennials for their children’s university funds, their resultant purchasing power will be further eroded in the longer term if they leave these funds in their savings accounts.

Instead of simply earmarking money for saving, consider the less daunting approach of dollar-cost averaging (DCA) – which lets you start with smaller amounts and earlier on in your journey. It also prevents emotionally charged investment decisions, which we can be especially susceptible to when volatility is high.

For example, you can choose to invest a fixed sum of $1,000 on the first day every month. This means that regardless of the state of and your opinions on the stock market, you stay committed to investing that $1,000 monthly. This routine forces you to adopt a passive investment strategy. In the long run, the cumulative value of the investment will grow, boosted by the power of compounding.

Diversify your information sources

The worrying habit of timing the market usually stems from a root problem of insufficient or inadequate financial literacy.

In addition to financial concerns, just above half of Singaporean respondents (57 per cent) are confident about their own financial health in 2023 versus 70 per cent of respondents in Hong Kong. This relatively lower sense of confidence is perhaps aggravated by a lack of the right knowledge for meaningful financial planning or investment strategy, especially felt among Gen Z respondents.

One in three would turn to friends and family as a source of financial knowledge. This is more prevalent among those without investing experience (55 per cent) than those with experience (38 per cent).

When it comes to building up your financial knowledge, take heart that there is a repository of expertise shared online that is easily and freely accessible; webinars and articles published by trusted advisors, and curated for not only experienced investors but also for new investors.

All investors, regardless of experience, should always do their due diligence and ensure the credibility of the source before making any investment decisions.

The writer is head of financial planning and editorial at Endowus, an independent wealth platform advising over S$5 billion in individual and family client assets across public and private markets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services