Investing lessons from the banking turmoil

A bank run looks terrifying, but investors can find peace of mind from diversification and due diligence

WHEN banks collapse, investors panic. People think the safest place to put their money is in a bank in the form of a deposit. The thought that you may not be able to take that money out is scary.

The failure of Silicon Valley Bank (SVB) rattled markets in March. As the bank of choice for Silicon Valley’s elites – the venture capitalists (VCs) and their tech startups – its collapse has large ramifications for not only the financial sector, but also the VC and technology sector.

SVB’s failure brought on the collapse of Signature Bank, as well as a run on First Republic and other smaller regional banks in the US, culminating in investor fears of another global financial crisis. The shaky confidence in Credit Suisse, Switzerland’s second-largest bank, sparked huge deposit outflows. The 167-year-old bank was acquired by UBS in a Swiss government-sponsored marriage. Concerns then spread to other European banks.

Jittery markets

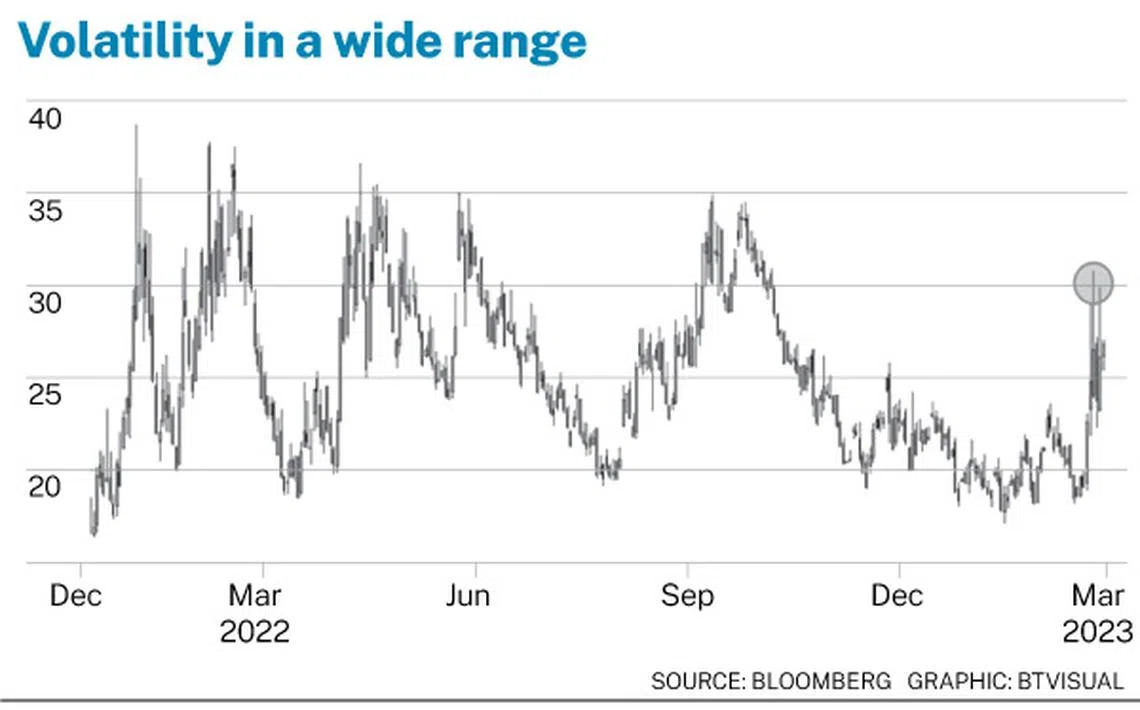

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) shot up significantly in mid-March after SVB’s collapse, but has stabilised at lower levels.

Stock and bond markets were actually resilient in the first quarter of 2023. In US dollar terms, global equity markets ended the quarter with a positive return of about 7 per cent, while the global fixed-income markets generated a 3 per cent return. Headline inflation is slowing in Europe and the US, and investors hope that rate hikes will end sooner than expected.

Lesson 1: Think about risk

The collapses of SVB and Credit Suisse drive home the importance of risk management and proper due diligence – areas where both failed. What, then, can individual investors do?

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It may be tempting to invest in a high-profile stock that has trebled in six months, such as a lot of meme stocks. But remember that return is proportionate to risk. As enticing as huge returns may be, it’s important to ask yourself: “Would I be able to tolerate losing that money?” Your portfolio should suit your risk appetite, as well as your investment timeline and financial goals.

Conducting due diligence on your investments simply means making sure that you understand what you are buying. For example, before deciding to invest in a stock, you should understand the company’s business model, financial statements and outlook.

Whether you invest through a brokerage, fund platform or robo-advisor, due diligence is key. Check whether the platform is licensed, and that the investment professionals are qualified; also look into its track record, and ensure you understand all the fees involved.

Lesson 2: Diversification matters

The biggest lesson from all this is that diversification is critical to investment success. Putting your deposits into just one bank was the downfall of many tech companies at SVB. Buying only cheap contingent convertible bonds (CoCos) issued by Credit Suisse meant you lost your shirt.

And, owning just the stock of either of these companies meant you lost most of your capital. Don’t put all your eggs in one basket.

It is impossible to forecast when markets will rise or fall. To ride out this volatility, we advocate investing in portfolios that are diversified in terms of the number of companies you own, and in terms of the industries, countries, and size of companies.

When you are building wealth over the longer term, it is important to invest on a regular basis into a core, diversified portfolio with an evidence-based approach, without taking unnecessary concentration risk.

In a passive and globally diversified portfolio of 10,000 stocks, the collapse of one or two stocks has no real meaningful impact – you can afford to have peace of mind.

Lesson 3: Stay invested

Global equities were up about 7 per cent in January this year, before declining by more than 2.5 per cent in February and rebounding 3 per cent in March. If an investor had followed the euphoria after a solid January rebound and chased the market up, only to panic from the banking sector troubles and sell off after the week of Mar 18, they would have missed out on the January rally and an overall positive return in March.

In the Internet age, flashy headlines quickly draw our attention. Yet, knee-jerk reactions to news can mean losing money when markets are up. Data shows that investors who are disciplined and stay invested at a risk level suitable for their goals stand a much better chance of success over time.

Lesson 4: The cost factor

At the start of this year, very few people would have predicted that SVB would fail in 48 hours, and that Credit Suisse would require a rescue due to a crisis of confidence. What we can say with confidence is that cost savings improve your returns without having you take more risk.

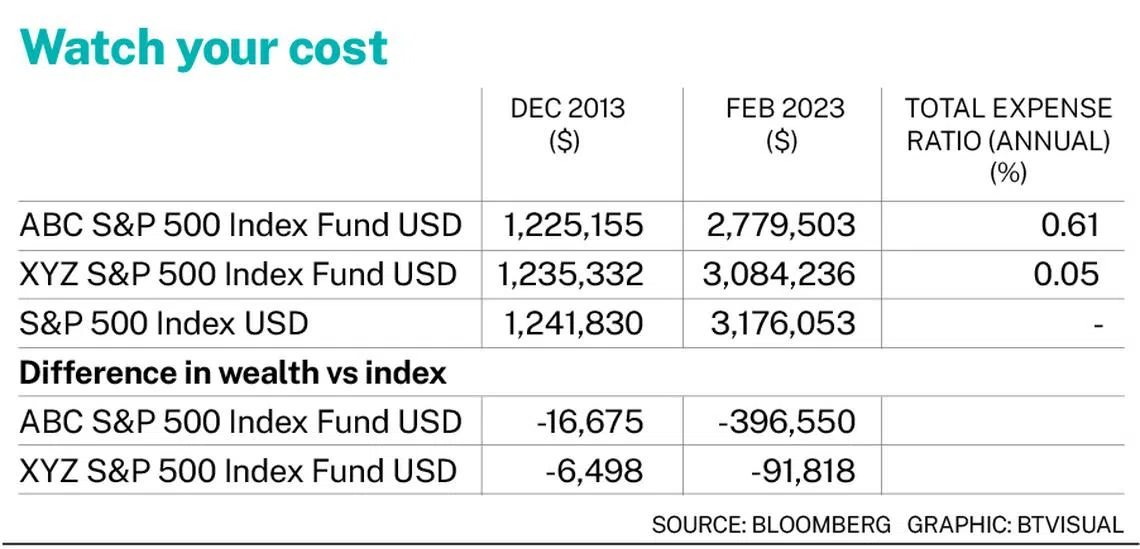

Let’s look at two actual funds tracking the S&P 500 index, but with different total expense ratios (TER), or fund-level fees. One fund, “ABC” Index Fund, has a higher TER of 0.61 per cent, while the other, “XYZ” Index Fund, is cheaper at 0.05 per cent.

Over a decade, US$1 million invested in the costlier ABC fund would have made US$304,732 less than the same amount invested in the cheaper XYZ fund. The difference started out small, but grew exponentially. Just like returns, costs compound over time. Use the power of compounding to work in your favour, not against you.

Investors should keep a cool head and rely on empirical evidence, not on emotion. The science of wealth proves this time and time again. We ignore this at our own – and our investment portfolio’s – peril.

Samuel Rhee is chairman and chief investment officer, and Min Axthelm is director of research at Endowus, an independent wealth platform advising over S$5 billion in individual and family client assets across public and private markets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services