Mid-year outlook: Fed, AI and the US elections

In understanding economic and market trends, structural forces now play a more critical role than traditional economic analysis

IN 2024, a major unexpected development has been the expectation for interest rate cuts by the Fed. At the start of the year, the market was expecting around seven rate cuts, as indicated by the Fed Funds Futures market. This expectation has since been moderated to just one to two rate cuts, potentially at the Federal Open Market Committee meeting in September at its earliest. This shift is largely due to a higher-than-expected inflation reading in the first quarter. The annualised first quarter’s core Personal Consumption Expenditure price index rose 3.5 per cent, surpassing both the fourth quarter of 2023 and the Fed’s target.

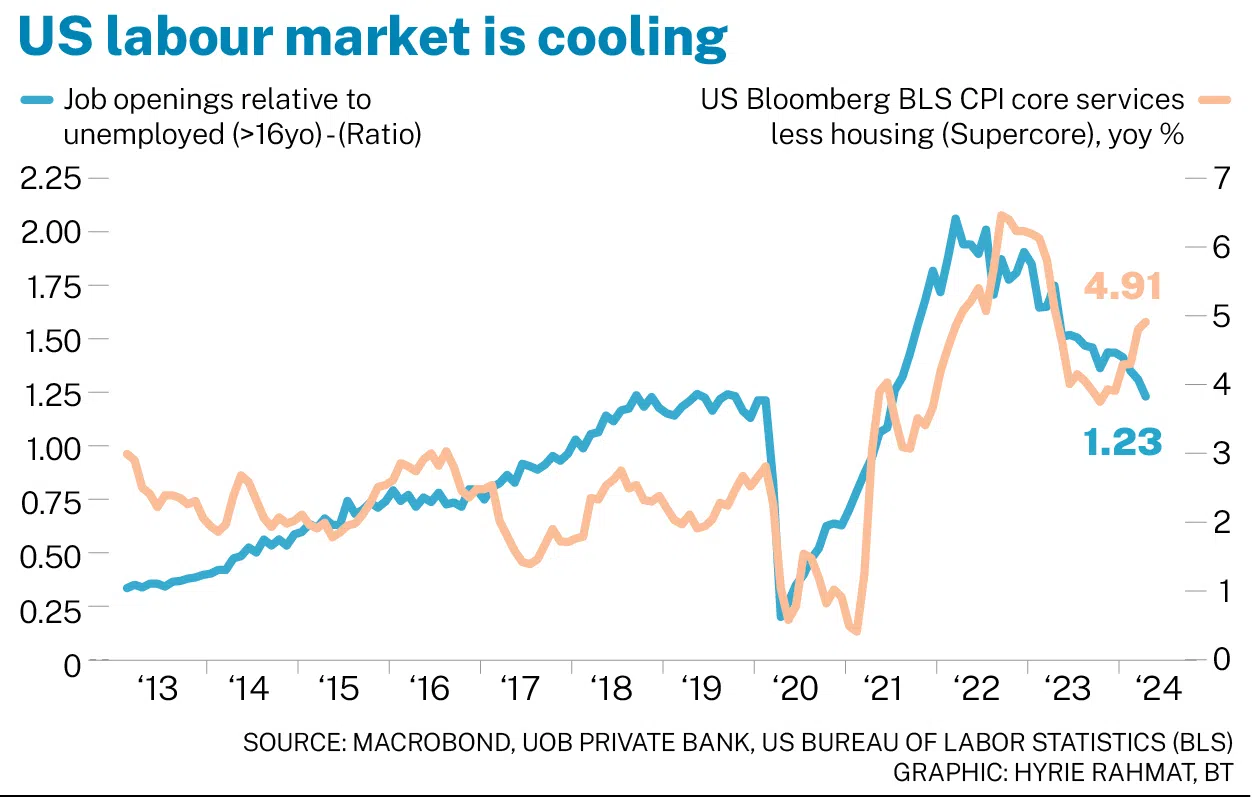

While inflation is persisting for a longer-than-expected period, it is projected to decline. This is due to the Owner Equivalent Rent component in the Consumer Price Index (CPI) lagging the decline seen in new rents which will converge. Another area of concern is services inflation. Inflation from core services excluding housing, or the Supercore CPI, had a quarterly growth of 1.98 per cent from 0.99 per cent in the fourth quarter of 2023. However, with the labour market cooling as the current job-workers gap returns to the pre-pandemic level, services inflation is likely to fall.

The AI revolution: Are we at the tail-end of the hype cycle?

Also, the market has been abuzz with artificial intelligence (AI) as an investment theme, with Nvidia – which clocked in a nearly ten-time gain from the lows in 2022 – leading the pack. Companies providing cloud services for AI deployment, such as the hyper-scalers, are also enjoying significant revenue growth. Unlike past technological “hypes” such as the Metaverse, investments in generative AI are yielding immediate and visible returns across various industries.

Generative AI’s versatility and general application are comparable to past technology cycles such as the information and communication technology boom in the 1990s, which revolutionised office work and introduced new industries such as e-commerce and ride-hailing. Historically, analysts had always underestimated the growth potential of such technologies. According to research by Morgan Stanley, analysts typically underestimate user growth for technologies such as personal computers (PCs), the Internet, and cloud services by an average of 38 per cent.

The widespread deployment of generative AI will require substantial infrastructure investments, particularly in modern data centres that demand significant electrical power. Energy constraints, as noted by Meta’s chief executive officer Mark Zuckerberg, is the largest bottleneck in building AI data centres. Addressing these constraints will benefit not only the technology companies, but also the broader industrial sector. Additionally, the recent launch of Microsoft’s Copilot+ PCs, which takes AI from the cloud to the edge, is expected to drive demand in upgrading legacy devices. Apple’s launch of Apple Intelligence at the recent Worldwide Developer Conference will also drive consumer upgrades.

The recent speech made by Jensen Huang, the founder and CEO of Nvidia, suggests that the recent AI revolution led by ChatGPT, which captured the world’s imagination, is only the beginning. The next frontier is to move from digital media to the physical world of robotics and full autonomous driving.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In summary, AI is poised to trigger a broad-based investment cycle spanning a wide spectrum of industries and companies beyond the few obvious winners so far.

Opportunities amid US-China tensions

US-China tensions have been a significant concern for investors since former president Donald Trump first initiated tariffs on Chinese imports. Despite retaliatory actions, the overall impact has not been catastrophic for either side. President Joe Biden has maintained Trump’s tariffs and intensified restrictions on high-tech exports, employing a “small yard, high fence” strategy.

The upcoming US elections in November could significantly impact US-China relations. Currently, Trump holds a slight lead in the swing states, but the race remains too close to call. A potential Trump presidency and Republican control of Congress could lead to higher tariffs – up to 60 per cent on Chinese imports and 10 per cent on other geographies. Such protectionist measures will lead to a huge contraction in global trade and income levels.

Having said that, these geopolitical tensions and Covid-19-related supply chain diversifications have opened up opportunities for other countries. China’s loss of market share has been redirected to nations such as those in Asean, India and Mexico, fostering a manufacturing renaissance in the US. This shift will require substantial investments in the development of infrastructure.

Investment opportunities

The convergence of Fed policy, shifting geopolitics, and AI will shape financial markets. AI and geopolitical changes could drive a prolonged investment cycle, benefiting companies that are involved in infrastructure development, such as data centres, power transmission and industrials. As generative AI moves from the cloud to end devices, the technology sector will see a demand for upgrades across mobile and personal computing devices. Other sectors including healthcare and financials will also benefit significantly from new AI-driven offerings and productivity enhancements.

In understanding economic and market trends, structural forces now play a more critical role than traditional economic analysis. While the business cycle will still drive cyclical shifts in economies and markets, identifying such secular trends and their impacts will allow companies and investors to discover profitable investment opportunities.

The writer is chief investment officer at UOB Private Bank

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.