Positive underpinnings for gold price

Demand from a diverse range of sectors, such as jewellery, investment, central banks and technology, means that the precious metal remains attractive

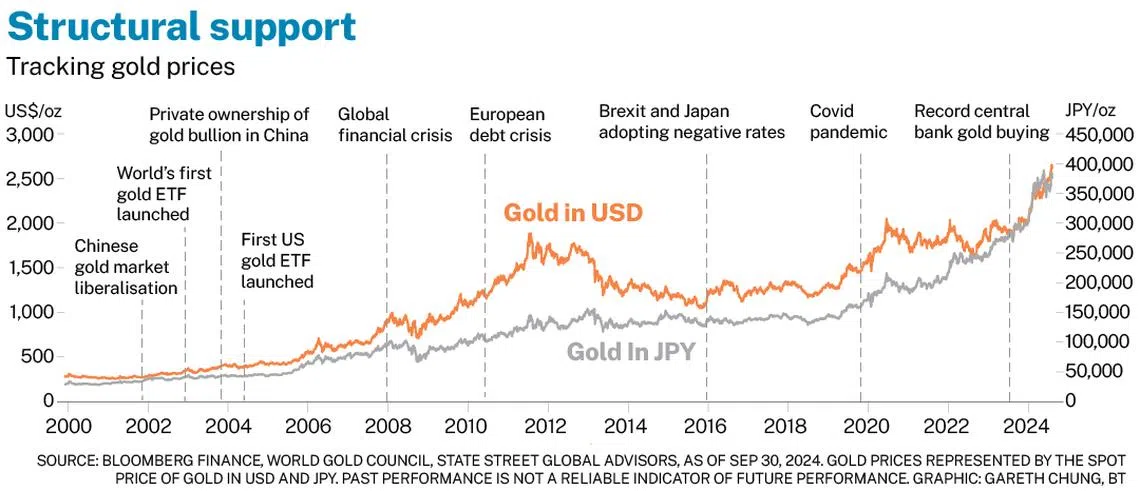

THE spot price of gold has been hitting record-highs in 2024 and continues to defy investor expectations.

The global gold market has seen resilient demand this year, driven by escalating geopolitical tensions in the Middle East, robust central bank gold purchases and interest rate cuts by major central banks, including the European Central Bank and the US Federal Reserve.

A global equities sell-off in July also increased investor appetite for gold as market volatility spiked. Gold ended the third quarter of 2024 at US$2,635 per ounce, up 28 per cent year to date and outperforming most other major asset classes.

Gold’s stellar run in 2024 continues to be underpinned by demand from a diverse range of sectors such as jewellery, investment (gold bars and coins, gold-backed exchange-traded funds or ETFs), central banks and technology.

According to the World Gold Council, jewellery was the largest source of global gold demand in the first half of 2024, accounting for 46 per cent of the global demand, followed by central banks (24 per cent), investment (22 per cent) and technology (8 per cent).

However, jewellery’s share of global gold demand has significantly declined over the past two decades, and investment and central banks are taking a bigger piece of the pie.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Twenty years ago, the jewellery sector was by far the largest consumer of gold. In 2004, jewellery accounted for 86 per cent of global gold demand, followed by investment (16 per cent), and technology (12 per cent). At that time, central banks were net sellers of gold and contributed 16 per cent to the global gold supply.

But more global investors have since come to accept gold as a reliable and tangible store of value that moves independently of other financial assets. Even a modest allocation to gold can, over time, protect and enhance the performance of an investment portfolio.

The launch of the first gold-backed ETF in the US in 2004, and subsequent new launches and listings globally, also accelerated investments in gold through a transparent and cost-effective investment vehicle. Central banks accumulated gold at record pace in the first half of 2024, but it was the global financial crisis (GFC) in 2008 that prompted a fundamental shift in central bank behaviour towards gold.

The aftermath of the GFC encouraged a reappraisal of gold’s role and relevance in reserve asset management. Since then, emerging-market central banks have stepped up their official gold purchases, while European banks have ceased selling. The central bank sector now represents a significant source of annual gold demand.

Technology continues to use gold as an industrial metal in a broad range of consumer electronics and automotive applications. Gold’s chemical and physical properties combine to make it irreplaceable in high-end devices.

As gold transformed from a household jewellery item into a strategic asset and diversifier held by global investors and central banks, it became one of the best-performing asset classes over the past 20 years. Between Jan 1, 2004, and Sep 30, 2024, the spot price of gold rose from US$415 per ounce to US$2,635 per ounce, representing an annualised return of 9.3 per cent over the period.

In that same time, global equities (including dividends) and global bonds (including coupon payments) registered an annualised return of 8.2 and 2.8 per cent, respectively.

Over the 20 years, gold exhibited a monthly correlation of 0.19 and minus 0.02 with global equities and global bonds, respectively. This low correlation is a key factor in constructing a diversified investment portfolio.

Over the last two decades, a global 60/40 portfolio (60 per cent global equites, 40 per cent global bonds) would have generated an annualised return of 6.1 per cent. A portfolio comprising 10 per cent gold, 55 per cent global equites and 35 per cent global bonds would have generated an annualised return of 6.6 per cent.

Looking ahead at the next 20 years, gold’s unique investment characteristics, with diverse sources of demand led by jewellery, technology, investment, and central bank sectors, mean that the precious metal will continue to serve multiple roles in investment portfolios, including in risk management, capital appreciation and wealth preservation.

We may continue to see gold investment rise globally as investors gradually move away from the traditional 60/40 asset mix into multi-asset portfolios with strategic allocations into alternatives, including gold.

We anticipate central bank demand to remain resilient in the future, as these institutions continue to navigate an increasingly complex geopolitical and financial environment, making their gold reserves management more relevant than ever.

The jewellery sector’s contribution to global gold demand may decline slightly in the future, but it should remain the largest source of demand due to gold’s profound economic, cultural and historical significance and importance in China and India, the world’s two largest consumers of gold jewellery.

Finally, demand from the technology sector could further support gold prices, as the metal is increasingly adopted to make high-end chips for artificial intelligence applications and high-performance computing.

Over the next few months, favourable tailwinds, including lower real interest rates in the US, weakness in the US dollar, persistent Middle East geopolitical tensions and stock market volatility ahead of the US presidential election, are likely to accelerate demand and keep the price of gold well supported until the end of the year.

The writer is Asia-Pacific gold strategist, State Street Global Advisors

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.