Reshoring not reducing dependence on China

CONNOISSEURS of global diplomatic-speak may have noticed a recent rebranding of the Biden administration’s approach to trade with China, from “decoupling” to “reshoring” and “friend-shoring” to “de-risking”.

One could be tempted to dismiss this as yet another exercise in geopolitical jargon. But it may also hint at an overdue assessment that earlier attempts to freeze out China from international trade were unrealistic.

The basic political idea behind decoupling efforts sounds easy enough. After pandemic shutdowns in China led to shortages in critical supplies, and as tensions have risen between China and the West, the US would reduce trade dependence on China and shift supply chains to other countries.

In a way, this policy is an outgrowth of the Trump administration’s tariff imposition launched in 2018 and maintained since.

Indeed, US imports from China are now running at a 10-year low, while its bilateral trade deficit with China is now down to levels last seen at end-2019.

So, case closed, and an all-clear for a broader G7 implementation of decoupling?

Not so fast.

Looking under the hood

A look under the data hood reveals important qualifications. First, the overall volume of Chinese exports has not receded from its post-lockdown highs. Not only that, but as the volume of global imports has declined over the same period, this implies an increase in China’s global export share.

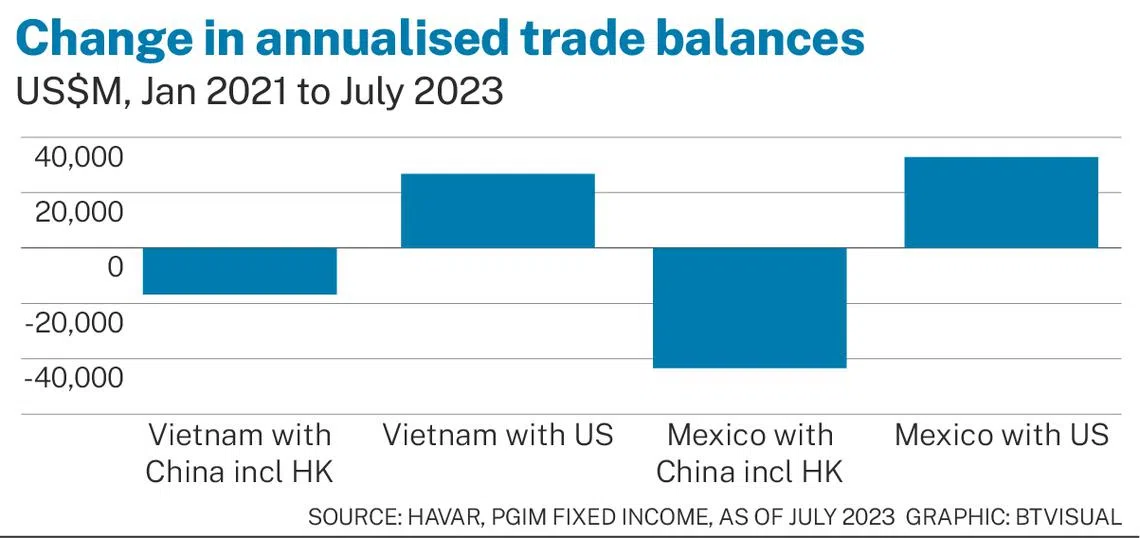

How does this square with news about increased export penetration – that is, friend-shoring of supply chains to countries such as Mexico and Vietnam? Well, those countries have imported a lot more from China – their higher trade surpluses with the US have, to a significant extent, been offset by increases in their deficits with China.

In the case of Mexico, they have been more than offset, as illustrated in the chart, which shows the respective changes in trade balances with the US and China for Mexico and Vietnam since January 2021.

Of course, such round-tripping and diverting trade will come with real efficiency costs. The same goods that would have come directly from China are now taking an expensive detour and time-consuming pit stop.

Economists will not be surprised. They have long emphasised the distinction between trade creation and trade diversion, and the attendant higher efficiency gains from multilateral trade liberalisations, where every trading partner gets the same treatment, compared to those of more narrowly tailored free-trade areas that exclude non-member countries.

So, despite de-risking, China remains the “world’s factory” and logistics hub, with ample spare capacity, while Vietnam and Mexico are running into capacity constraints.

Risks of de-risking

Moreover, this de-risking adds its own risks. “Friends” to which supply chains have moved come with their own social and geopolitical risks.

Without taking a view as to how resilient the supply chains relocated to these countries are, it bears mentioning that Vietnam’s economy resembles the free-wheeling Chinese economy pre-2012, while investors in Mexico frequently cite rule-of-law concerns.

In any case, the importance of Chinese investment in these countries has also increased, shifting China’s dependence to more countries.

Given the above, the rebranding from decoupling to de-risking could well be truth in advertising – a realisation of the exorbitant costs implied if decoupling were to be attempted in earnest.

However, while decoupling from China seems to be less of an objective, the decoupling of economic policies from past practice is gathering steam, such as the widespread adoption of industrial policies and government-directed investment in the US and Europe. Just as in the case of de-risking, there is ample historical evidence to be worried about the attendant costs.

And in the case of trade restrictions, governments allocating capital to their chosen winners usually does not end well.

Evidence ranges from the failures of German investment in magnetic levitation trains, to Chinese over-investment in the real estate sector, all the way to Northern Ireland’s attempt at becoming a car industry capital (though we have them to thank for the DeLorean).

While currently sanguine investor perceptions of a soft landing for the economy after a period of high inflation and central-bank rate hikes may assuage such concerns, the question is whether this new consensus on trade and industrial policy will survive the next recession.

Will policymakers then grasp at opportunities, to once again lift underlying efficiency and growth by returning to open trade, and drop restrictive policies? Or will they double down in an effort to protect jobs from foreign competition?

The answer to that question will be a key input in deciding whether the world will end up in a lower-growth, higher-inflation environment than seen between 1990 and 2020.

So what does all of this mean for Australia, and other US allies obviously included in the “friends” category? Optimists may see a scope for welcome industrial and export diversification, but the reality is probably less sanguine.

In particular, any onshored manufacturing will likely be less efficient, and on balance further tighten labour and real estate markets, as is happening in Mexico. Moreover, any commodity export re-routing will likely come at the cost of lower exports to China, and still be dependent on overall global goods demand, which is falling currently.

Thus, better to keep expectations in check.

The writer is lead economist for Asia at PGIM Fixed Income

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services