Seeking opportunities in Singdollar, ringgit and US dollar bonds

Investors are set to benefit with more stability and options in the fixed income space in 2024

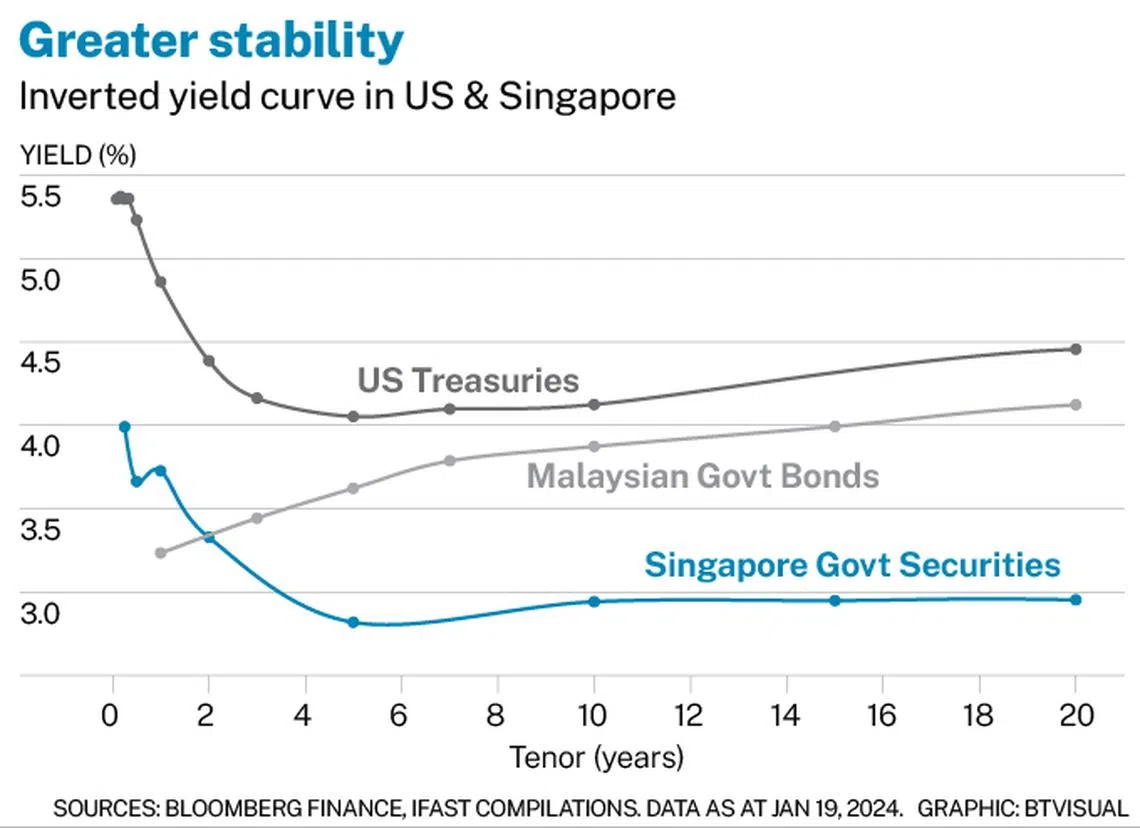

LAST year saw many hurdles in bond markets, with key headwinds in the form of inflation surprises and policy rate hikes. In 2024, with the US Federal Reserve likely to hold rates, we hope to see greater stability – and at the same time, more opportunities in the fixed income space.

US dollar bond market

In 2024, we believe that bond yields and interest rates will remain elevated for a longer period. Inflation is unlikely to fall back towards policymakers’ target of 2 per cent. Especially as the risk of recession fades, the Fed may not be motivated to cut rates within the year. We also expect a potential imbalance between supply and demand for US Treasuries in 2024, which would put further upward pressure on Treasury yields. Hence, we think that long-term bond yields have room to rise.

Therefore, we remain positive on short-term US Treasuries (USTs) with tenors of less than two years. Owing to the rate hikes, yields of the short-term USTs are at their highest level since 2007, and remain attractive for investors who seek stable and decent returns with minimal risk.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services