Sovereign green bonds: bigger, stronger and more diverse in 2024

A record 35 countries globally issued sustainable bonds totalling US$169 billion in 2023

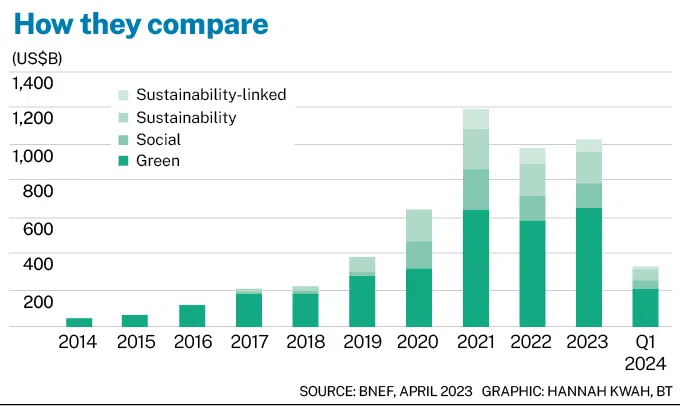

GREEN, social and sustainable (GSS) bond issuance was resilient in 2023, rising by 2 per cent year on year despite sluggish economic growth. While the GSS bond market is unlikely to rebound to 2021’s record US$1.1 trillion in issuance, we expect it to hold up well, even with challenges such as higher-for-longer interest rates and moderating growth.

Moody’s projects that GSS bond issuance could reach US$950 billion in 2024, slightly higher than 2023’s US$946 billion, and S&P forecasts issuance to surpass the US$1 trillion mark.

Although supranational entities, financial institutions and agencies initially led the way in GSS bond issuance, sovereigns now account for a growing proportion of new bonds. Bonds issued directly by government departments have risen from about 7 per cent of the total market value at end-2017 to over 20 per cent at the end of March 2023, according to MSCI data.

In 2023, a record 35 sovereigns globally issued sustainable bonds totalling US$169 billion, exceeding the 2022 high-water mark of 26 issuers with US$141 billion in issuance. Of these, 17 were developed countries and 18 were emerging market (EM) sovereign issuers; the EM issuers included seven who entered the market for the first time.

Over recent years, EM sovereigns have contributed more to global GSS sovereign bond issuance, accounting for 25 per cent in 2023, underscoring the significant climate finance gap for developing economies to build resilience to climate change and fund the shift to a low-carbon economy.

These national, regional and local governments face not only high exposure to physical climate risk and carbon-transition risk, but often also lack the fiscal and institutional capacity to tackle these problems on top of facing higher costs of capital. Such challenges require continued innovation in their financing approaches.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

We believe sustainable finance will be a growing source of funding as emerging market sovereigns present national-energy transition plans and climate adaptation goals.

The Sharm El-Sheikh Implementation Plan drawn up at COP27 in 2022 included an estimate that investments needed to transition to a low-carbon economy globally would total US$4 trillion to US$6 trillion a year. Sovereign GSS bond issuance could provide a significant proportion of this financing. At the following COP28 meeting, climate finance was again a hot topic, and we expect it to continue to be a key focus for developing and emerging markets.

Improving standards

Standards in the GSS bond market are improving. From late 2024, the European Union Green Bonds Standard (EUGBS) is set to transform issuance across the bloc in terms of reporting and transparency. The standard requires a close alignment with the EU taxonomy for sustainable activities and its six environmental objectives for sustainable activities:

- Climate-change mitigation

- Climate-change adaptation

- Sustainable water and marine use

- Circular economy

- Pollution control

- Biodiversity

Issuers of bonds under the EUGBS will be required to disclose detailed information about how the proceeds will be used to ensure alignment with the taxonomy. They must explain how the funds contribute to the sustainable transition, ensuring green investments are not negated by unsustainable activities in other areas.

The EUGBS builds on existing green bond frameworks, including the Green, Social and Sustainability Bond Principles formulated by the International Capital Market Association, alongside frameworks in China and India covering local markets.

The shift from voluntary to regulatory standards should enforce greater market discipline and encourage increased issuance of green, social and sustainable bonds.

A diversifying climate finance tool

Building on these improving standards, we have seen issuances covering a steadily widening range of themes in the last six months. Clean transportation – particularly railway-related financing – continues to dominate issuance from a thematic standpoint, but the market is seeing increased diversification.

Iceland, already the world’s most gender-equal country, has become the first sovereign to issue a gender-based bond aimed at closing the gender gap further. Previously, only companies and development banks had issued gender-labelled bonds. Iceland’s entry into this segment is notable, as it issued its first GSS bond – a 750 million-euro (S$1.1 billion) green bond – only in March 2024.

Entering the GSS bond market in 2022, Canada was the first sovereign issuer to include nuclear-energy expenditures in its March 2024 GSS bond of C$4 billion (S$3.96 billion) after the government updated its Green Bond Framework to include nuclear in its eligible investment areas.

The EU Taxonomy includes provisions for nuclear, so this could become a recurring GSS bond theme in the months ahead.

Other debutants to the green bond market include Turkey, which has raised US$2.5 billion, with the transaction more than three times oversubscribed. It was one of the first EM sovereigns to allocate a significant portion of the funds (47 per cent) to environmentally sustainable management of natural resources and land use.

Brazil debuted in the market with a US$2 billion sustainable bond in November 2023. Its proceeds will be allocated to deforestation control, biodiversity conservation and poverty reduction programmes.

A vehicle to realise net-zero goals

Sovereign green, social and sustainable bonds can be seen as a robust climate-financing instrument that facilitates collaboration between investors and sovereign governments on environmental aims.

Investors can showcase the green credentials of their portfolios, while sovereigns can progress towards their net-zero commitments and goals, particularly as two key net-zero milestones in 2030 and 2050 approach.

Adherence to industry-established guidelines, such as those by the Partnership for Carbon Accounting Financials and International Capital Market Association, can enhance bond efficacy. These frameworks underpin the methodologies for carbon footprint calculations and guide the selection of impact reporting indicators at the project level, ensuring transparency and accountability in the financing of climate action.

Sovereign engagement

Direct investor engagement with sovereigns can be a powerful tool to catalyse climate action.

The Collaborative Sovereign Engagement on Climate Change is an initiative led by the Principles for Responsible Investment to assist governments in addressing climate change.

Its goal is to have investors join forces in encouraging governments to undertake comprehensive measures to combat climate change, adhere to the objectives of the Paris Agreement, and strive to limit the rise in the average global temperature to 1.5 deg C.

Members of the initiative, including BNPP AM as a founding member, have identified Australia as a sovereign debt issuer that would be a suitable candidate for the initiative’s pilot project. The country passed a Climate Change Act in 2022, but has done poorly compared to peers on climate and environmental measures in sovereign risk ratings.

If successful, a similar sovereign engagement programme will target other issuers.

The writer is sustainable fixed-income lead (Emea), BNP Paribas Asset Management

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.