Staying invested even as trade war fears rattle markets

Remain calm, and manage risk through portfolio diversification and dollar-cost averaging

US PRESIDENT Donald Trump has imposed hefty tariffs of 25 per cent on goods from Mexico and Canada, and 10 per cent on imports from China. Energy imports from Canada, including oil and electricity, will face a lower 10 per cent tariff.

Trump’s tariffs deliver on a threat to punish the three countries for what he says is a failure to prevent the flow of undocumented migrants and illegal drugs over the US border.

The tariffs on three of America’s biggest trading partners take effect at 12.01 am Eastern Time (1.01 pm, Singapore time) on Tuesday (Feb 4), and it is unclear if that offers a last-chance window for a deal.

Quantifying the trade impact

Collectively, the three countries accounted for 42 per cent of the nearly US$3 trillion worth of global imports into the United States in 2024.

Canada was the top market for US exports last year, with goods valued at US$322 billion transported across the border. It was followed by Mexico and China, which received US$309 billion and US$131 billion worth of goods, respectively. The three countries accounted for more than 40 per cent of the US$1.9 trillion worth of goods that the US exported globally last year.

The Trump administration gave no specific benchmark for the tariffs to be lifted, other than the cessation of the drugs and undocumented migrants coming into the country.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Homeland Security Secretary Kristi Noem will inform Trump if the countries have taken adequate steps to alleviate the concerns over migration and drugs, and the tariffs will be removed if he agrees.

Trump’s move is expected to draw retaliatory tariffs, potentially disrupting more than US$2.1 trillion in annual two-way US trade with the three trading partners.

Canada said that it will impose tariffs of 25 per cent against US$106 billion of US goods, while Mexico pledged retaliatory tariffs. China stated that it will file a complaint with the World Trade Organization and will take corresponding countermeasures to resolutely defend its rights, without announcing any new tariffs.

Trump’s orders included retaliation clauses that will increase US tariffs if the countries respond in kind. If he executes on these clauses, the trade war could escalate.

Economic impact

The latest tariffs go well beyond Trump’s first-term tariffs. They may have significant implications for the auto and energy sectors and will raise the cost of food, housing, and petrol for Americans.

Parts of the US, such as the Midwest for example, which is home to 23 per cent of the country’s refining capacity, is reliant on Canadian oil supplies, and there are few near-term options to substitute these with US supplies.

As for the auto sector, the US imported US$87 billion worth of motor vehicles and US$64 billion worth of vehicle parts from Mexico last year (excluding December). Both are likely to get more expensive with the tariffs affecting Mexican car exports to the US. For decades, automakers have operated as if Canada, Mexico and the US were one unified market, moving vehicles and parts across borders as they assembled vehicles.

In terms of steel, Canada now accounts for nearly a quarter of the steel imported by American businesses by weight, while Mexico accounts for about 12 per cent.

Gas, fresh produce, consumer electronics – some of the top goods that the US imports from Mexico, China, and Canada – could also get more expensive with blanket tariffs.

According to the Tax Foundation, an international research think tank based in Washington, DC, the tariffs on the three US trading partners could amount to an average tax increase of more than US$830 per US household in 2025, and cause US economic output to shrink by 0.4 per cent.

Tariffs would also put upward pressure on US import prices, increasing the risk of the Federal Reserve not cutting interest rates any further from the current 4.25 to 4.5 per cent.

A look back at how Trump’s tariffs in 2018 affected the economy shows that US economic growth eased from 3 per cent in 2018 to 2.5 per cent in 2019. But, part of the slowdown may also have been due to the impact of tighter US monetary policy in 2018.

In terms of inflation impact, the core personal consumption expenditures price index, which is the Fed’s preferred gauge of inflation, rose from 1.6 per cent in 2017 to 1.9 per cent in 2018, before easing to 1.7 per cent in 2019.

So, the impact of Trump’s tariffs on the US economy in 2018 was not catastrophic. This year’s tariffs will also cause some slowdown in the US economy and may push up inflation, but they may not have severe consequences for the US economy and stock markets.

Market impact

Trump has said that more tariffs are on the way – on European goods and on steel, aluminium, copper, and on pharmaceuticals and semiconductors.

Uncertainty about Trump’s policies on tariffs going forward, and the response from the US’ trading partners, means that US and global stock markets could be a headed for a period of greater volatility in the coming weeks or months.

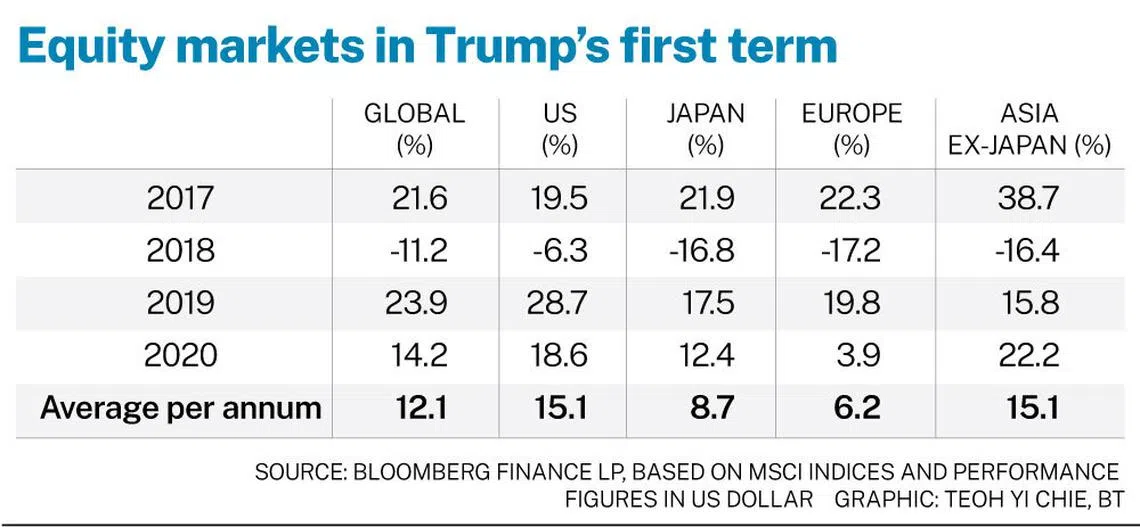

In Trump’s first term from 2017 to 2020, global equity markets did well over the four-year period. The exception was in 2018 when Trump launched his trade war with China and other major economies in Europe and Asia.

However, it would be unfair to put all the blame on the trade war for the 2018 market correction. The sharpest dive in the US stock market took place in the final quarter of 2018 when the S&P 500 fell almost 20 per cent. Several other factors were behind the fall, which are not present today. For one, the 2018 correction took place after the US stock market had experienced the longest bull run in history, lasting almost nine years. This time, we are into only the second year of a bull market that began in early 2023.

Other factors included four rate hikes by the Fed in 2018, and quantitative tightening in June 2018. We are currently seeing the Fed cut rates and ease monetary policy.

Investment strategy

Investors need to tread cautiously in the short term until there is greater clarity, especially with regard to Trump’s tariffs and immigration policies. Stay calm, stay invested, but manage risk through portfolio diversification and dollar-cost averaging.

Trump has a penchant for surprises. If he reverses or dials down on tariffs, this could be a tailwind for markets.

Clearly, stock-market losses bother Trump, and such market falls could rein him in. In December 2018, after a sharp sell-off in stock markets, Trump and Chinese President Xi Jinping agreed to a trade war ceasefire after talks in Argentina.

Overall, Trump’s pro-business, anti-regulation and pro-market stance should augur well for risk assets, especially US equities, over the medium term as he aspires to further America’s exceptionalism. Trump is also likely to extend his 2017 tax cuts, which expires at the end of this year. This could be positive for US equities; in 2017, tax cuts benefited Wall Street and spilled over into other global markets.

All in all, we remain positive on the medium-term investment outlook and see opportunities in both equities and bonds, especially on any sharp pullbacks.

The writer is managing director, investment strategy, OCBC

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.