Three faces of Trump and their implications for markets

Textbook and erratic Trump have been priced into markets to different degrees, but curveball Trump has not – and it represents potential value for investors

DONALD Trump’s election victory is likely to be significant for fixed-income investors worldwide. But how significant it will be depends on which version of Trump we will get.

The fixed income and currency markets had priced in a high probability of his victory ahead of the US presidential election. The question investors now face is which Trump they are likely to face. There are three possibilities, each of which has different implications for the markets.

First, there is the textbook Trump, or the Trump that the markets were anticipating. Here, investors take his proposed policies at face value, on the basis that he is likely to follow through. This version, which includes aggressive tariffs, corporate tax cuts and deregulation, has largely been priced into the market.

Then there is the volatile, erratic Trump, who might stick to his promises, but might equally likely veer off in an entirely different direction. This unpredictability should translate into higher implied volatility – which is being priced into some assets, but not all.

Finally, there is the curveball Trump. This is the Trump who is looking to cut deals, using his initial, extreme stances merely as starting points for negotiating settlements that are favourable to the US, but far short of the headlines.

We think the last Trump is the version that markets have not discounted. Therefore, it represents potential value for investors.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It’s the economy

Complicating matters for fixed-income investors is how the US Federal Reserve’s reaction function might change in light of the election results.

The Republican control of both the executive and legislature opens the door to Trumpian policies of lower taxes and higher deficits, both of which have implications for the yield curve.

An unexpectedly strong economy has already forced investors to revise their expectations about the current rate cycle.

The Fed is expected to cut rates further, but by less than previously anticipated. Trump tariff and immigration policies are likely to be inflationary, as are higher fiscal spending and lower taxes.

Both could push up the Fed funds’ terminal rate, where the official interest rate is ultimately likely to settle, as well as the route to it.

For fixed-income investors, the higher inflation component of the yield curve is likely to be compounded by higher-term premia – basically a risk premium for holding long-dated bonds. That is because of risks associated with the US’ burgeoning deficit.

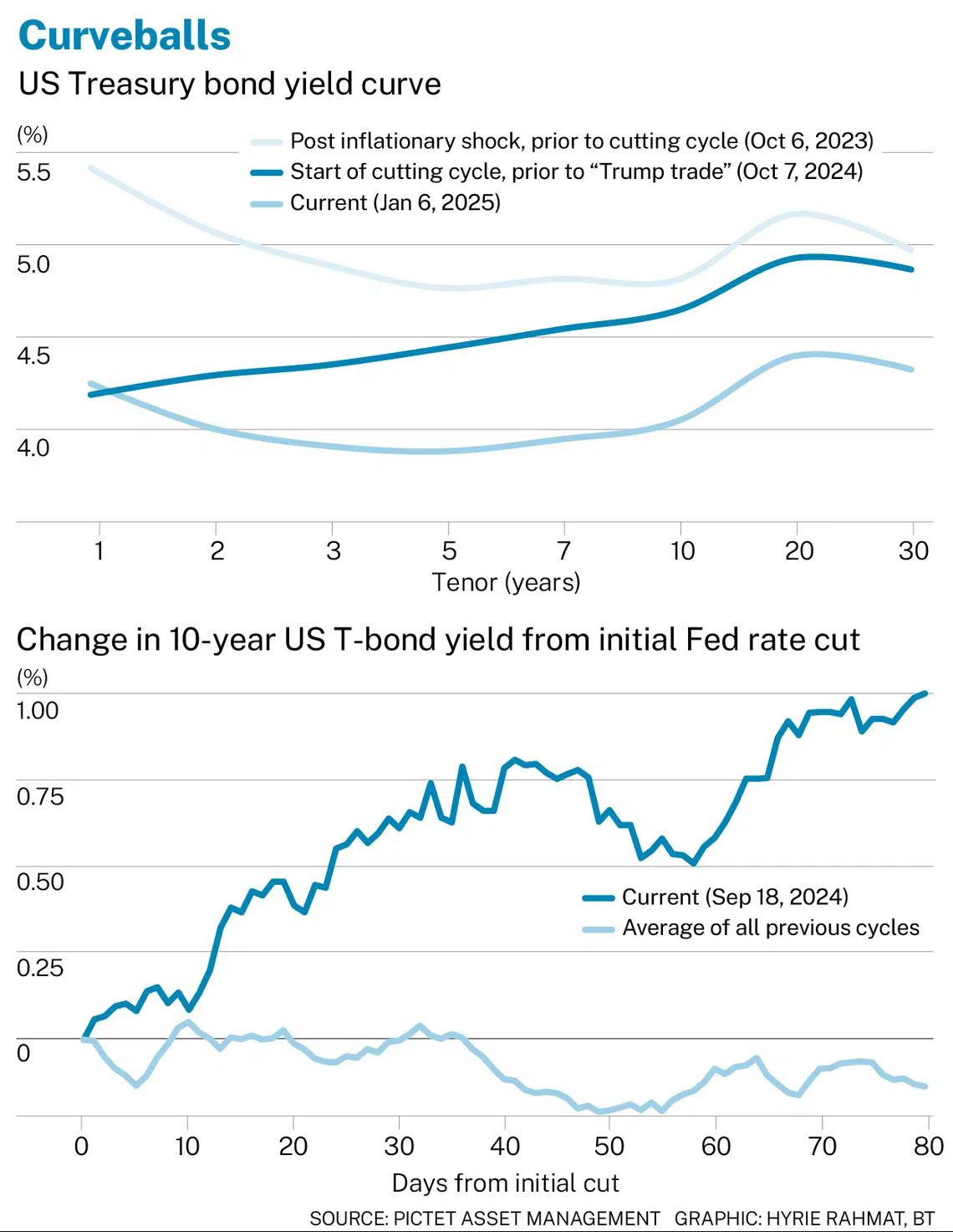

These effects are already being played out in the yield curve, which has already started to shift higher from the lows earlier last year. Indeed, it has been an unusual start to the Fed’s cutting cycle, with 10-year Treasury bond yields rising rather than easing back in the days following the first cut.

Whither the dollar?

Tariffs tend to boost the currency of the country imposing them.

Whether Trump actually levies the 60 per cent tariff on China that he said he would is open to debate. But the market thinks there will certainly be significant anti-trade measures. The US dollar was already enjoying a lift from the state of the economy, and is further boosted by Trump.

But if, as we think, Trump ends up pulling his punches on trade, the greenback could end up giving back some of its gains.

A strong US dollar tends to be bad for emerging market debt. Countries that borrow in US dollars have more to pay back in terms of their own currencies and output.

But China could end up mitigating this. The Chinese government has already provided two trillion yuan (S$374.5 billion) of monetary stimulus (equivalent to 1.6 per cent of gross domestic product). It authorised struggling local governments to issue 10 trillion in debt over five years to restructure their finances. It indicated that it would consider yet more fiscal measures.

If Beijing feels that it needs to do more in response to Trump’s bid to curtail Chinese imports, it has the fiscal headroom to do so. Any supersized China stimulus will inevitably give a boost to other emerging market economies, particularly those of its near neighbours.

Meanwhile, the European Central Bank (ECB) is likely to respond both to the threat of American tariffs and a weak eurozone economy with further monetary easing. We think there is a good chance the ECB will find itself having to reduce rates to below its natural rate in light of these pressures.

Geopolitical conundrums

Underlying Trump’s near and medium-term effects on the economy is what he implies for geopolitics. Will he force a settlement on Ukraine, thus ending its war with Russia? Would Russia then turn its eye to the Baltic states?

Will China use its instinctive isolationism as an opportunity to target Taiwan? What is the implication for the current state of the Middle East – will Trump’s victory embolden Israel to further target Iran? Will it make Iran, backed against the wall, lash out?

Geopolitical uncertainty could add more risk premium to asset prices more generally. Indeed, there is a Trumpian risk premium that is not fully priced into markets. However, as his administration develops, it will undoubtedly be full of surprises.

Mary-Therese Barton is chief investment officer (fixed income) and Mickael Benhaim is head of fixed income investment strategy & solutions, Pictet Asset Management

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.