Three reasons to focus on energy-transition infrastructure

Allocations to this area are highly differentiated. Growth in energy demand makes this a sunrise market. And environmental and sustainability benefits are on tap

FOR more than 200 years, the global economy was dependent on fossil fuels for its energy needs. This is rapidly changing. Renewable energy, driven by the so-called “power trio” of decarbonisation, affordability and energy security, is becoming a critical factor in meeting future power needs. The global energy transition thus represents a potentially unparalleled and attractive investment opportunity.

The International Energy Agency (IEA) estimates that around US$4.5 trillion needs to be invested each year into the energy transition from the early 2030s, an almost three-fold increase from 2023, itself a record year. This investment is on a global basis, with almost universal support for evolving a decarbonised, cheap and secure energy system.

Even in the US and despite a shifting political climate, there has been broad, widespread and largely bipartisan support for renewables investment over a number of years, given that the sector is a key engine for job creation and that it increasingly delivers energy cost-competitiveness.

Despite this, a question we often get asked is: Why invest solely in the energy transition? The assumption inherent to the question is that an investment into a wider infrastructure mandate – including exposure to energy-transition assets, as well as other sectors such as utilities, transport and digital infrastructure – could offer a broader opportunity set.

Given that investors’ capacity to allocate to alternative assets is finite (on average representing around 14 per cent of portfolios according to Schroders research), and is therefore a scarce resource, the value of which must be utilised to its full potential, we believe maximising investment in energy transition is crucial for a high-performing portfolio, for three key reasons.

Highly differentiated

The first reason is that energy-transition allocations are highly differentiated, relative to other investments you hold in your portfolio.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

A historical analysis of annualised returns and risk (volatility) between 2014 and 2024 shows that the overall, long-term risk-and-return characteristics of energy-transition infrastructure largely align with those of broader infrastructure portfolios. This in itself is an interesting observation, contradicting the widely held belief that diversified infrastructure portfolios must be less risky due to their diversified nature.

The analysis is also limited by assessing aggregate risk and return independently. It doesn’t capture the dynamics of specific, underlying risk exposures within energy transition infrastructure and how these can translate to long-term return potential.

Intuitively, the risks associated with energy-transition infrastructure are highly diversifying, exposing investors to a unique mix of risk premia, compared to non-energy infrastructure sub-sectors and other asset classes. Here are some sources of risk:

- Inflation risk: Returns are typically linked to inflation, helping to maintain the real purchasing power of a portfolio.

- Positive power price risk: Energy transition assets benefit from increases in electricity prices, unlike other asset classes and non-energy infrastructure, where electricity is a major cost input.

- Resource/weather risk: Few other parts of a portfolio are as meaningfully impacted, positively or negatively, by meteorological factors as renewables assets.

- Technology risk: Each renewable technology and asset, whether it is a solar park or a wind farm, carries specific risks – and diversification opportunities.

- Geography/policy risk: Policy and regulation supporting the energy transition are rapidly developing in most regions around the world, providing a favourable investment climate.

These differentiated risk premia associated with energy-transition assets result in robust diversification benefits. Correlation data supports this, with energy-transition infrastructure demonstrating low year-on-year return correlation to all asset classes – including diversified infrastructure – and even negative correlations to more economically cyclical equity and fixed income assets.

So, while the overall, long-term risk and return of energy-transition infrastructure has historically been broadly similar to traditional infrastructure, the underlying “pattern” and drivers of returns are very different. This in turn suggests that including an energy-transition allocation, even in place of diversified infrastructure, has the potential to bring positive diversification benefits to portfolios.

Energy investment as a primary focus

The second reason is that energy transition assets are part of the infrastructure market that is growing. New capital is expected to be constantly required over the next 20 to 30 years to build out a new, sustainable global energy system, and respond to significant ongoing growth in energy demand.

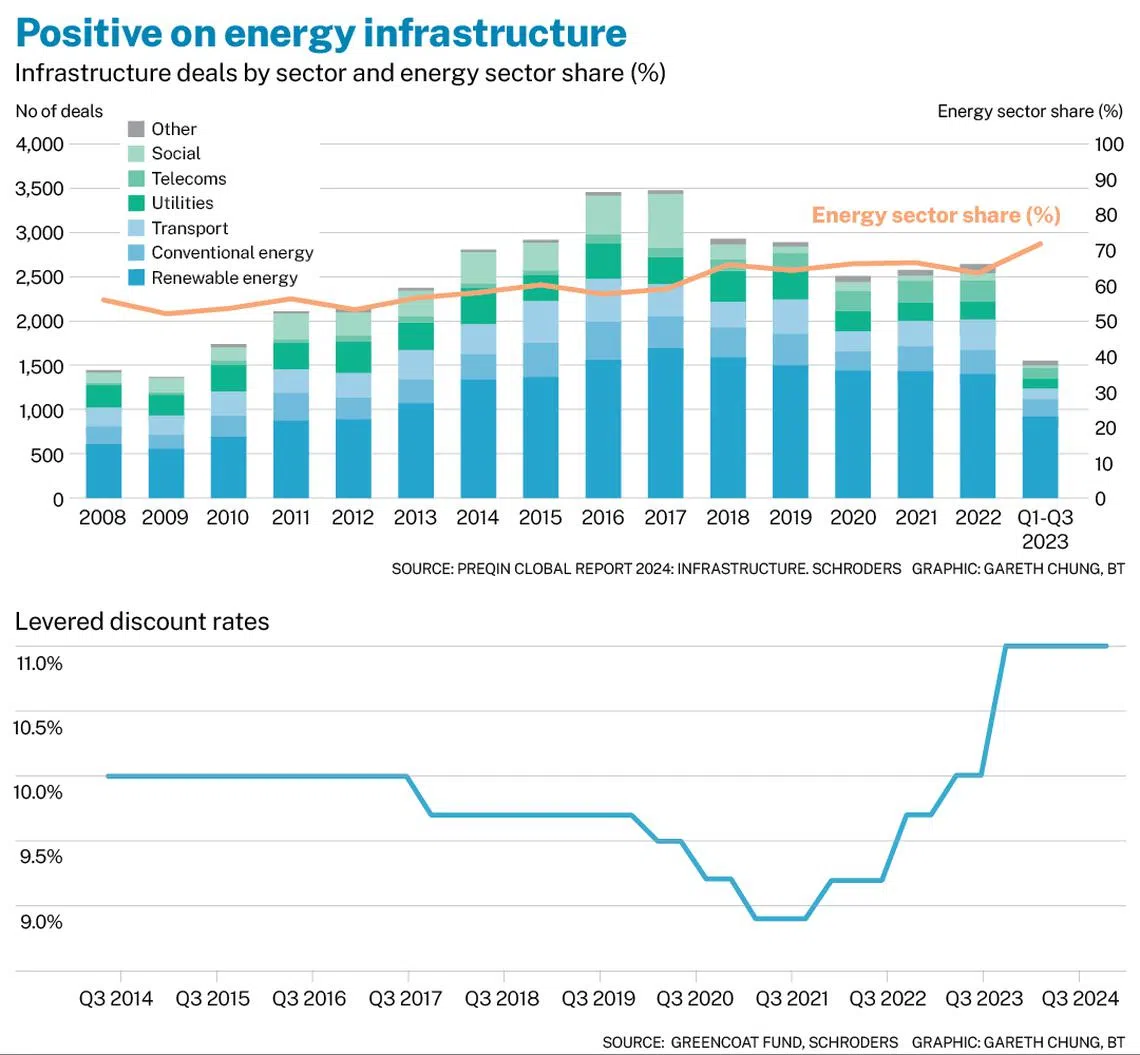

In terms of deal activity in global infrastructure, energy is by far the largest sector by deal volume. Within this, renewable energy is by a wide margin the largest energy sub-sector – and is, in fact, the largest single sector within infrastructure as a whole, accounting for 48 per cent of all investment over the past 15 years.

The growth in renewable investment opportunities is of crucial importance, as it speaks not only to the opportunity set, but also to pricing. As a growing market, the energy sector needs to consistently incentivise and attract capital. New opportunities are consistently being developed, requiring capital at all stages of an investment’s life cycle, from earlier stages of development to investment in assets that developers, utilities or investors have already taken through construction and into operations, allowing them to recycle capital into new projects.

With many developers’ capital constrained, the requirement to recycle capital through the sale of operational assets is particularly pronounced in today’s market, contributing to a scenario where there are motivated sellers, which in turn can help to underpin strong returns.

The accompanying chart shows the levered discount rate (effectively the expected rate of return) of a portfolio of wind assets held in a listed investment trust managed by Schroders Greencoat, which shows that the rate today is at a higher level than it has been over the past 10 years.

Given a relatively consistent risk profile over that time, especially over the past three to four years, this rise has primarily been driven by two key factors. The first is increasing bond yields, which necessitate higher returns to maintain risk-adjusted premiums over risk-free rates (returns from low-risk treasury bonds). The second, equally important, factor is this market dynamic between buyers and sellers.

Sustainability risks and benefits

The third reason is that we believe that there are environmental and sustainability benefits to investing in energy transition. Regardless of an individual’s stance on climate change and net zero, it’s nearly impossible to dispute that it is a key trend significantly influencing economies, markets, and both domestic and global politics.

Crucially, the path to net zero is often drawn by economists as a straight line, but those who follow history will recognise that any economic transformation is not without its volatility; it is likely that there will be “energy-transition shocks” along the way. In those times, which are likely to lead to energy prices and inflationary spikes, energy-transition assets are positioned to perform well.

A recent example of this occurred in 2022, when as a result of the Russia/Ukraine conflict and related energy security issues, we observed global spikes in power prices and inflation. Energy-transition infrastructure strategies performed positively, while other asset classes generally struggled – and equities and bonds both recorded negative returns for the first time in half a century.

In conclusion, energy transition offers exposures and risk premia that are materially different in a portfolio context, including diversified infrastructure. These exposures translate into a very low correlation between underlying returns and the drivers of returns, even if historical risk and return metrics have been broadly similar. Moreover, there is potential for the unique return drivers within the energy-transition infrastructure to produce outperformance as the global energy transition evolves.

The writer is global head of infrastructure, Schroders Capital

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services