Outperform volatile markets with core-satellite approach to investment portfolio

Opportunities are still available for investors to stay invested amid market volatility.

WITH geopolitical tensions and supply chain disruptions wreaking havoc on markets, investors face a litany of challenges as they seek to grow their wealth amid volatile markets.

Despite these challenges, opportunities remain for investors to strengthen their portfolios by taking a core-satellite approach to balancing risk and reward amid more uncertain times.

Inflation, as well as rising interest rates that central banks have implemented to fight the phenomenon, have had a chilling effect on markets.

In July this year, the annual US inflation rate eased slightly to 8.5 per cent from a multi-decade high of 9.1 per cent a month ago.

Still, investors’ hopes of some reprieve from the US Federal Reserve were dashed, after Fed Chair Jerome Powell sounded a hawkish tone.

At the latest Jackson Hole Economic Symposium on Aug 26, Powell signalled the central bank’s determination to bring inflation under control. As a result, interest rates would go higher for longer.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time,” he said. “The historical record cautions strongly against prematurely loosening policy.”

Powell’s speech was likely at odds with market expectations, as investors priced in potential rate cuts next year as economic growth slows. In the wake of his speech, the broad-based S&P 500 index fell 3.4 per cent on Aug 26.

DBS chief investment officer (CIO) Hou Wey Fook noted that as inflationary pressures linger, the Fed will feel compelled to maintain its hawkish stance. He added that market indicators have priced in another 100 basis points of rate hikes.

As consumption represents some 70 per cent of US gross domestic product (GDP), Hou is concerned about how tightening financial conditions and rising prices could harm consumer spending.

In June, the Federal Reserve Bank of New York found only a 10 per cent chance of a “soft landing” for the US economy with its economic model.

“Certainly, investor concerns of an impending recession over the next 6 to 12 months are growing, and this could have a negative bearing on corporate earnings,” he said, adding that the year-to-date fallout in markets has priced in this risk to some extent.

Furthermore, he said that for risk assets to bottom and recover from current levels, investors would be looking to see economic data that points to both a lower risk of recession and a lower inflation rate.

These challenges have also been exacerbated by geopolitical and macroeconomic developments in other geographies.

To start with, Russia’s ongoing invasion of Ukraine since February this year has upended world markets, leading economists to sound the death knell of the peace dividend that the West has enjoyed for decades.

Both Russia and Western nations have retaliated with tit-for-tat moves aimed at causing pain in their respective economies. As a result, commodity prices have soared, threatening the energy and food security of various countries in the world.

China, on the other hand, has also locked down its cities numerous times this year in an effort to stem the spread of Covid-19 with its zero-Covid strategy.

This has necessitated the snap lockdown of cities and even buildings where Covid-19 transmission has been detected, reducing factory output and consumption in the world’s second-largest economy.

Coupled with a cooling property sector that has led to mortgage strikes, industrial output growth eased to 3.8 per cent in July, unexpectedly missing analysts expectations of a 4.6 per cent increase in a Reuters poll.

On Aug 15, China then cut its 1-year medium-term lending facility and 7-day reverse repo rate by 10 basis points each, which economists point to as evidence of deeper malaise within its broader economy.

Hou noted that while the ongoing Russia-Ukraine crisis and the Covid-19 situation in China have largely been priced-in by markets going into the third quarter of this year, persistent inflation and a hawkish Fed, along with the rising risk of recession and earnings downgrades, have not.

With these factors in mind, he believes that investors could look at strategies that can enable their portfolios to rise above inflation.

When deciding on how to structure their portfolio, investors could take a core-satellite approach to ensure that their investments are diversified and resilient.

This will involve keeping a “core” portfolio of investments in multiple assets across bonds, equities and cash over a long-term time horizon.

“The long-term orientation enables the portfolio to harness ‘risk premiums’, which refers to incremental returns embedded in risk assets of equities and credit,” said Hou.

Furthermore, Hou said that he employs a “barbell” approach to building a core portfolio, which will expose investors to both income-generating assets as well as growth equities.

For income-generating assets, he further noted that investment grade bonds are an attractive proposition today as their yields have risen above 4 per cent - the highest it has been in the last 10 years. He also favours dividend equities in sectors like Singapore and China banks, Singapore real estate investment trusts (S-Reits) and global integrated oil companies.

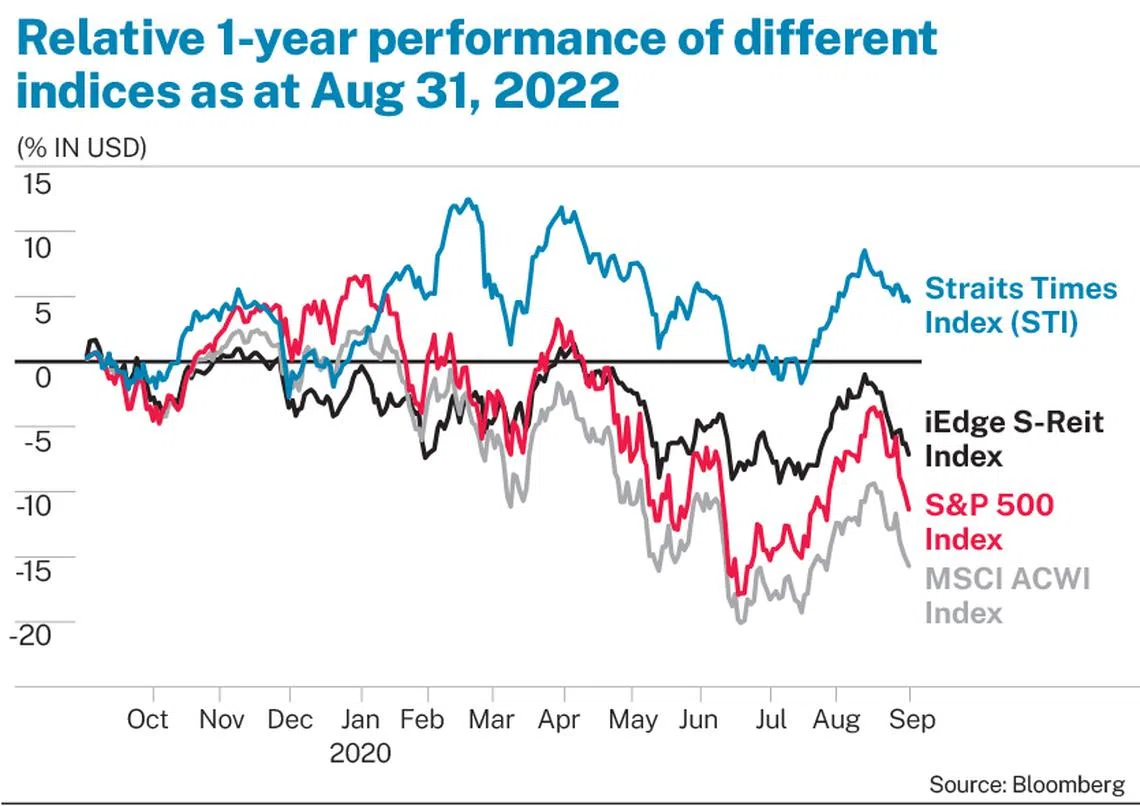

As at Aug 31, 2022, the MSCI all-country world index has generated -15.8 per cent in total returns year-on-year, while the S&P 500 has returned -11.3 per cent. Over the same period, the Straits Times Index has returned 8.6 per cent, while the iEdge S-Reit index has returned -3.6 per cent in total returns.

Meanwhile, “satellite” investments take advantage of short-term opportunities that arise from market mispricing and from price momentum trends, said Hou.

These include individual stock picks or actively managed ETFs and unit trusts in areas like technology and clean energy.

“For investors who are new or less active when it comes to trading financial markets, a larger portion of their surplus wealth should be invested in the long-term core portfolio,” said Hou.

After deciding on their approach, investors could then look for their edge over inflation in 2 groups of companies: price setters and quality plays.

Key sectors like energy, real estate and consumer staples, he said, are likely to outperform the market in an inflationary environment.

“A common factor underpinning the outperformance of these sectors is the company’s ability to pass on rising costs to end-consumers given that they operate in the ‘essentials’ space, providing basic necessities like fuel, housing, and food,” he added.

While rising inflation could increase revenue for other companies due to higher average prices, they may see margin erosion instead if they are unable to pass on higher input costs.

As for quality plays, Hou said such companies would likely benefit from their strong market positioning and are expected to outperform the broader market should bond yields stay elevated.

“The impact of rising bond yields has led to a highly bifurcated performance between ‘emerging tech’, which represents companies that have yet to be profitable, versus the ‘Big Tech’ companies,” he said, adding that the former has sold off some 70 per cent while the latter has remained resilient.

“Hence, our advice for investors is to stay with high-quality companies in this period of higher interest rates and tightening liquidity,” he said.

Still, Hou advised against applying the same conclusions as that of the dotcom era to today’s US tech sector.

He noted that during the dotcom crash, the US tech sector corrected by some 70 per cent amid a 55 per cent decline in forward earnings and 56 per cent contraction in valuations.

“The situation today is vastly different. The US tech space has corrected some 20 per cent from the highs...

“However, the pullback was entirely attributed to the 30 per cent contraction in valuations while corporate earnings continued to grow, albeit at a slower 4 per cent clip,” he said.

“Today’s tech sector is backed by robust earnings and the recent pullback is more a function of investors’ risk aversion, as opposed to fundamentals.” he said, adding that while rising bond yields may have impacted tech companies’ valuations, it could have limited bearing on their long-term earnings.

Taking all these factors into account, the “modern affluent” may still need personalised approaches to wealth management, since they may have earned their wealth through a myriad of ways.

To make sure that any wealth management plan is well considered, investors should consider what their wealth goals are and what their risk appetite is.

Head of DBS Treasures Singapore Steven Ong said that financial goal setting should consider whether investments made are intended for capital growth, wealth preservation, regular income generation or any other requirements, as well as the required return from the investments.

Investment products like unitised fund solutions and insurance plans like endowment funds can help investors achieve these goals, he added.

An investor’s time horizon is also an important factor to consider, in addition to their financial situation and their psychological appetite for risk.

“Generally, an investor with a longer time horizon can stomach more risk, as their portfolio will have a longer runway to recover,” Ong said.

Such financial and suitability profiling can be done with relationship managers from priority banking programmes like DBS Treasures, where they can then determine a client’s financial goals and risk appetite as a starting point.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.