Capture yield via high-quality US dollar bank bonds

They offer a compelling blend of income and resilience amid a complex macroeconomic landscape

[SINGAPORE] With the trajectory of interest rate cuts still uncertain and inflationary pressures lingering, investors are increasingly focused on stable income sources.

One corner of the market that continues to attract attention is US dollar-denominated bonds issued by globally systemic banks such as HSBC, Barclays, Standard Chartered, Macquarie and BNP Paribas.

These issuers offer a compelling blend of income and resilience amid a complex macroeconomic landscape.

H1 2025: divergent performances, common strength

The first half of 2025 highlighted the varying strategies banks are adopting to navigate persistent inflation, rising geopolitical tensions and the initial fallout from global tariffs. While Barclays capitalised on market volatility with stronger trading income, others such as HSBC and BNP Paribas remained more defensive amid credit deterioration and one-off divestments.

Still, the overall sector remained fundamentally sound. Most banks saw improvements in income, albeit accompanied by modest increases in credit provisions. Net profits across these major players held steady, underpinned by solid balance sheets and robust capital buffers.

Capital and liquidity strength

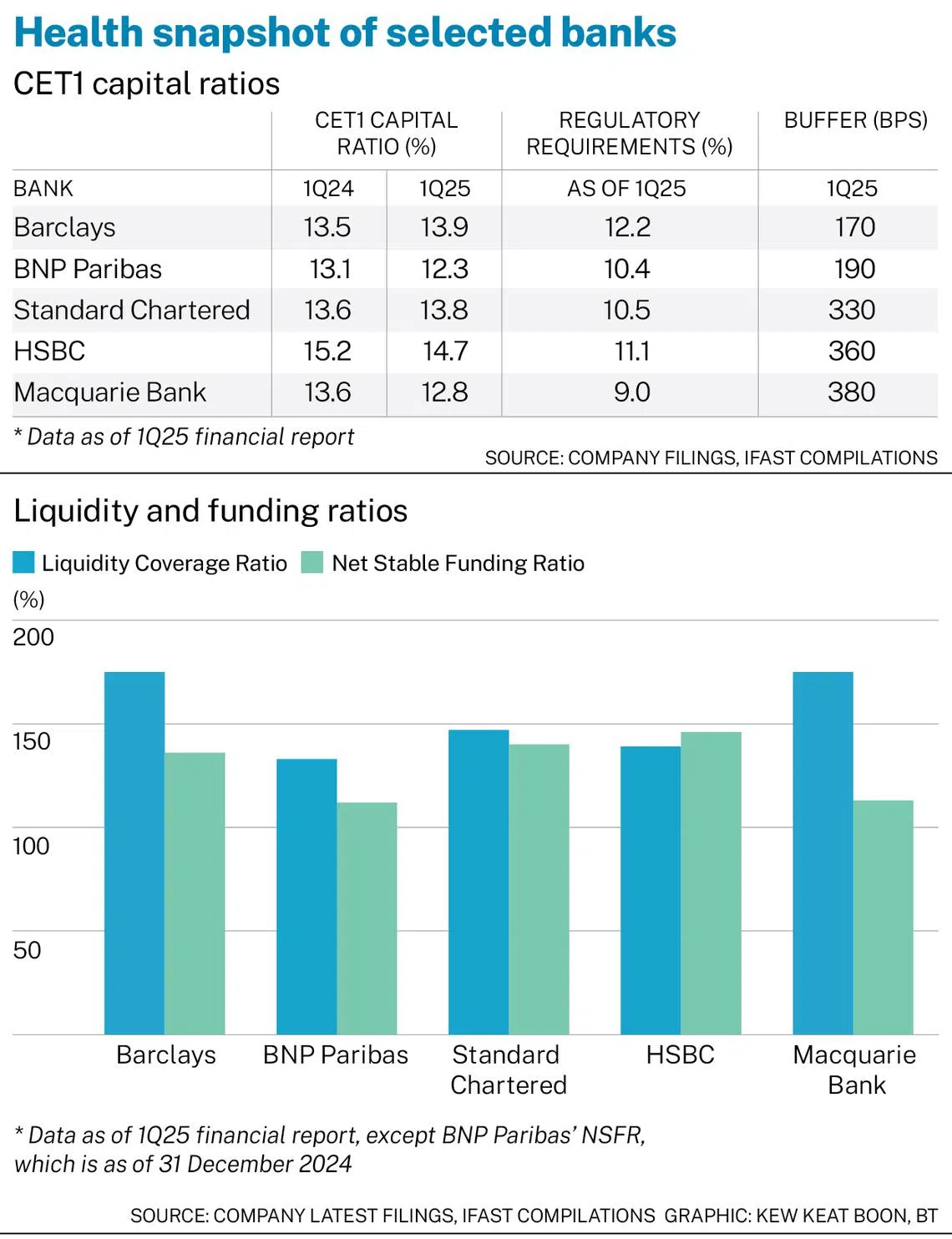

A key source of confidence for investors lies in the banks’ strong capitalisation and liquidity profiles. As at Q1 2025, average Common Equity Tier 1 (CET1) ratios remain well above regulatory requirements, with buffers ranging from 170 to 380 basis points.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Liquidity coverage ratios (LCR) also exceeded 130 per cent for all five banks – a reassuring sign of balance sheet resilience coupled with net stable funding ratios (NSFR) above regulatory minimum of 100 per cent. These position the banks with a solid footing to weather further macroeconomic headwinds while continuing to support bondholders.

Highlights of major banks

Barclays delivered robust results, with income buoyed by fixed income trading and a healthy rise in net interest income. Return on tangible equity exceeded both internal and long-term targets; and capital and liquidity remained comfortably above regulatory thresholds.

BNP Paribas saw stable underlying momentum despite a year-on-year decline in reported profits due to the absence of one-off gains in Q1 2024. Liquidity and capital positions remain healthy, with CET1 at 12.3 per cent and LCR above 130 per cent.

Standard Chartered posted a solid Q1 2025, with income growth driven by Hong Kong and improving operating profit. Despite higher overlays for China and Hong Kong commercial real estate exposures, the bank maintained strong CET1 and liquidity metrics.

HSBC experienced a decline in headline earnings following the absence of prior-year one-offs and higher expected credit losses, especially in commercial real estate. Excluding these, earnings remained steady, and the bank reaffirmed its commitment to return capital via buybacks.

Macquarie Bank saw moderate growth in FY25 despite headwinds from lower trading income and rising credit charges. Net profit rose 18 per cent year on year, with strong CET1 ratios and liquidity providing ample buffer.

Quality amid uncertainty

In today’s environment, we believe high-quality USD bank bonds remain a reliable income-generating asset class where income and quality are both in focus. Bonds from these financial giants present attractive opportunities across a range of risk and duration profiles.

Senior bonds from names such as BACR 7.385% 02Nov2028 Corp (USD), HSBC 7.390% 03Nov2028 Corp (USD) and STANLN 6.301% 09Jan2029 Corp (USD) offer investors relatively lower-risk exposure with yields above 5 to 7 per cent and tenors within the three to six-year range. These are ideal for investors seeking stability and visibility on returns.

Subordinated Tier 2 bonds such as MQGAU 6.798% 18Jan2033 Corp (USD) and STANLN 4.300% 19Feb2027 Corp (USD) provide an appealing middle ground. They come with higher yields but also modestly higher risk due to regulatory loss absorption features. However, Basel III rules that reduce capital recognition post-call date offer a strong incentive for issuers to redeem on schedule, increasing predictability for investors.

By combining senior and subordinated exposures from these issuers, investors can construct a diversified bond portfolio that balances income, duration and credit quality.

The writer is a research analyst with the research and portfolio management team of FSMOne.com, a Singapore subsidiary of iFast Corporation

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.