Climbing the wealth ladder

Nick Maggiulli’s new book helps the reader to understand what is required to create large lifestyle changes in his financial journey

AT SOME point in your wealth accumulation phase, you might have wondered why the needle simply isn’t moving. Perhaps, you are stuck at a certain level, frustrated that your hard work and diligent saving isn’t moving you forward in your financial journey.

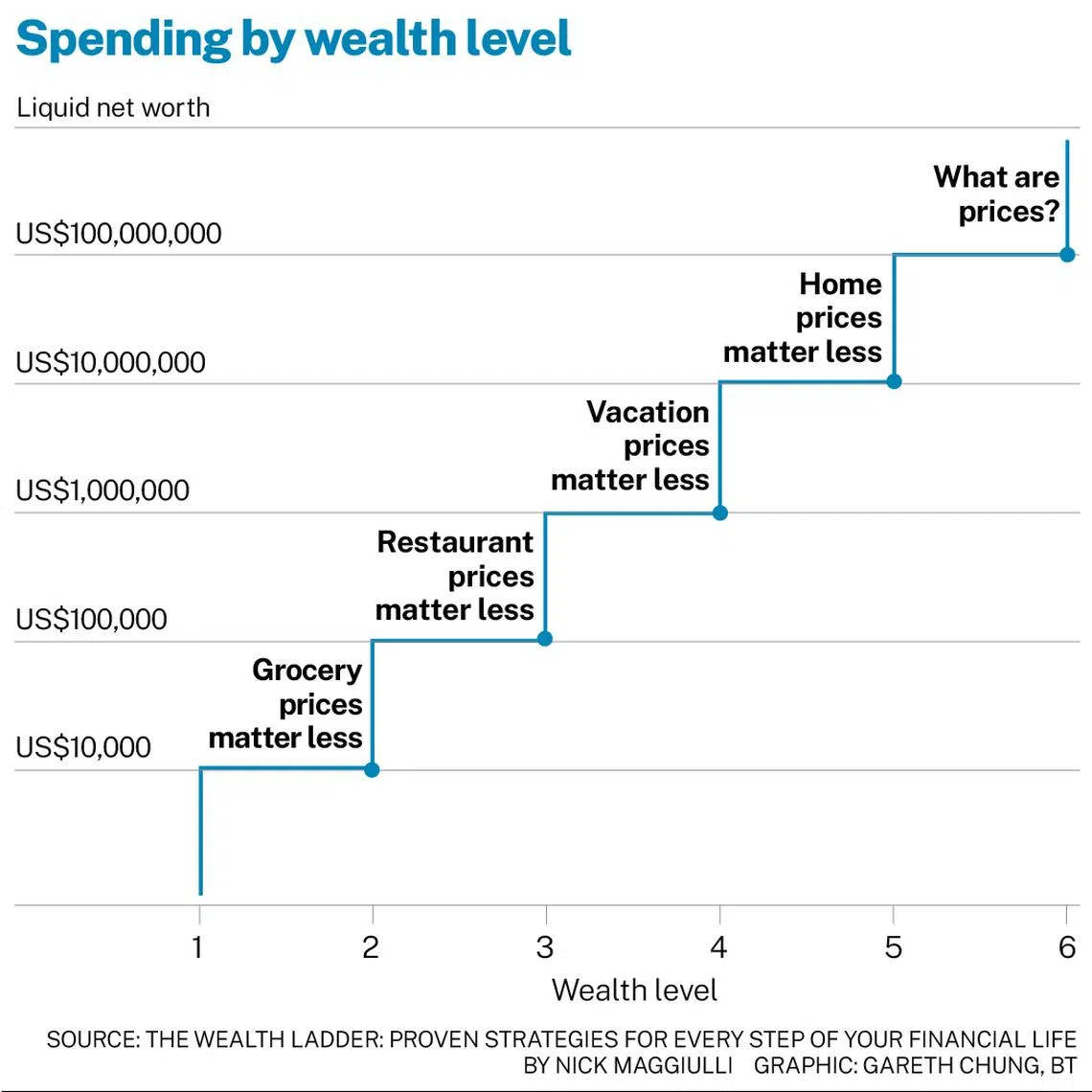

Nick Maggiulli’s new book, The Wealth Ladder – Proven Strategies for Every Step of Your Financial Life, presents a compelling way to visualise this journey and offers some clarity on how to advance from one wealth level to the next. Maggiulli suggests that wealth isn’t a straight line but a ladder. He identifies six wealth levels, each separated by a factor of 10, arguing that this corresponds with the increase in wealth needed to create a large lifestyle change.

The Wealth Ladder

- Level 1 (less than US$10,000) Pay cheque-to-pay cheque: You are conscious of every dollar you spend. This includes people with crippling debt.

- Level 2 (US$10,000-US$100,000) Grocery freedom: You can buy what you want at the grocery store without worrying about your finances.

- Level 3 (US$100,000-US$1 million) Restaurant freedom: You eat what you want at restaurants.

- Level 4 (US$1 million-US$10 million) Travel freedom: You travel when and where you want.

- Level 5 (US$10 million-US$100 million) House freedom: You can afford your dream home with little impact on your overall finances.

- Level 6 (US$100 million+) Philanthropic freedom: You can use money to have a profound impact on the lives of others (buy businesses, engage in large-scale philanthropy, and so on).

The levels are defined by net worth (assets minus liabilities), so Level 1 is for those with less than US$10,000; level 2 covers the US$10,000 to US$100,000 range, and so on. To be more conservative, I find it useful to consider liquid net worth instead.

Liquid net worth (liquid assets minus debts) is a more crucial indicator of financial well-being than total net worth, as it measures your capacity to handle emergencies and make discretionary spending decisions without being forced to sell non-liquid assets such as real estate or retirement funds.

Maggiulli’s core idea is that the enjoyment of wealth doesn’t increase with every extra dollar we get, but something that increases in steps. This is because most people in the same level of wealth tend to consume in much the same way.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

For instance, at level 3, the individual with net worth of US$900,000 lives somewhat similarly to one with US$500,000. While the person with higher net worth may have a nicer car or a larger house, they won’t typically have a chauffeur, own a yacht or fly in a private jet. Despite the US$400,000 difference, they have similar lifestyles, even if one is a fancier version.

Maggiulli also notes that the same amount of money given to people on different wealth levels would have a different impact. For example, if you are in level 3, an extra US$10,000 won’t move you to level 4. However, if this amount of money is given to a person in level 1, it may get him to level 2.

The Wealth Ladder also helps us understand why some people don’t feel rich, despite having a lot of money, particularly if they are at, say, level 4 and comparing themselves with people at level 6.

How to climb the Wealth Ladder

The financial strategy to get you from level 1 to level 2 will be very different from the strategy you use to get from level 5 to 6. That is, what got you here may not get you there. The book highlights that as you move up the wealth ladder, you spend less time working for money and more time having money work for you, such as through business ownership and investments.

For level 1, the author’s advice is to build a robust safety net – whether it is financial safety or emergency funds – to avoid falling back financially. In a zoom session with customers who pre-ordered his book, he said that those in level 1 should try to get into some level of safety, so they don’t have to worry about financial setbacks. Once that is achieved, focus on increasing income and “escape level 1 forever”.

This resonates with my own experience. When I embarked on my financial journey in my 20s, I adopted the “Pay Yourself First approach” and committed to saving in a disciplined manner. By setting aside a pre-determined amount of savings once my monthly pay cheque came in, I was able to build an emergency fund of at least six months of expenses quickly. The excess savings were then deployed in investments to make my money work harder for me.

As you move from level 1 to level 2, for most people, the focus is on working smarter, rather than harder, said Maggiulli. This means building your skill sets and/or attaining a higher level of education so that you get paid more per hour. You should therefore be deliberate in your career choices and be mindful of what skills would increase your income over the next few years.

Level 3 is where career advancements, side hustles and individual investments can make a bigger difference in your income. Of course, in my view, you need not wait to reach level 3 before you begin investing. Research which investments are suitable for you and invest in products that can compound over time and grow your income streams.

Once you are in level 4, the book states that the best way to increase your income is through career pivots, starting a business, and making additional investments. You may also find yourself stuck in level 4 permanently because it is the most difficult level to break out of. Relying on your job alone will likely not move the needle enough to get you to the next level.

The “most realistic way” to climb beyond level 4 is through business ownership, especially one that can be sold at a significant profit in the future.

Spending money according to your wealth level

To ensure a sustainable climb, it’s prudent to spend money according to your current level. For instance, if you are in level 2 and splurge on a lavish vacation without caring about the costs (a characteristic of level 4 – travel freedom), then it would be difficult to move further up the ladder. Until you have the money to spend with more freedom, manage your spending carefully in that level. When you are disciplined in this, your chance to progress up the ladder increases.

On a personal note, I believe that it’s acceptable to reach a certain wealth level and find contentment there. For example, if you are already at level 3 or 4 and have enough wealth to pursue your goals in life and fund your financial freedom, that is commendable.

Furthermore, building wealth requires time. The typical millionaire in the US, for example, tends to be in their 60s, having had more time to save and invest their money. Understanding this allows you to have realistic expectations of your own journey.

Other types of wealth

Financial health alone is not enough. Maggiulli highlighted other types of wealth: social wealth (quality of our relationships), mental health (psychological and emotional capabilities), physical wealth, and time wealth. To this list, I would like to add another aspect of wealth and that is understanding your life purpose. This refers to the motivating force in your life, providing focus and a sense of direction and meaning.

The author is head of financial planning literacy at DBS Bank, and author of bestsellers Retire Smart and Money Smart

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.