Building and managing data centres - the huge warehouses that host hundreds of computer servers - used to be a business that only large corporations and extremely wealthy individuals could invest in because of the tens of millions of dollars required.

Such data-centre investments allow investors to profit from the development of the facilities as well as collect rents once the projects are completed, unlike listed real estate investment trusts, which focus on completed properties and rely on rents to generate most of the returns.

While large institutional investors continue to be the main backers of such build-and-operate projects, the development of blockchain technology has opened such investments to a wider pool of investors.

One such project is a data-centre investment rolled out by Singapore-based digital investment platform SDAX, which allows accredited investors to participate with a minimum investment of S$10,000.

Secure and accessible investments through tokenisation

The ability to offer unlisted assets to retail investors in a safe and cost-efficient manner is made possible by the blockchain, a digital ledger that resides on millions of computers and is thus more robust and secure than a central database controlled by a financial institution.

Through a process known as tokenisation, information about the assets is stored on the blockchain as tokens that cannot be altered.

These investments can then be fractionalised into thousands of smaller units.

All transactions involving these digital assets are clearly recorded on the blockchain, providing clarity on ownership and what ownership of the tokens entail.

Shaking up traditional investing

The development of the blockchain and the ability to divide large physical assets into digital tokens have created many new opportunities in the world of investing.

Many non-listed investments, which were once the preserve of large institutions and private bank customers, can now be accessed by a wider range of investors through tokenisation and the smaller investment quantum.

Besides the data centre mentioned earlier, SDAX also offers investors alternative opportunities not found on stock markets, such as a fund that invests in social housing in the United Kingdom, and private credit deals for enterprises reaching their next frontier of growth.

For companies and fund managers, SDAX helps them tokenise their assets and provides them with a platform to reach a much broader pool of investors.

How SDAX works

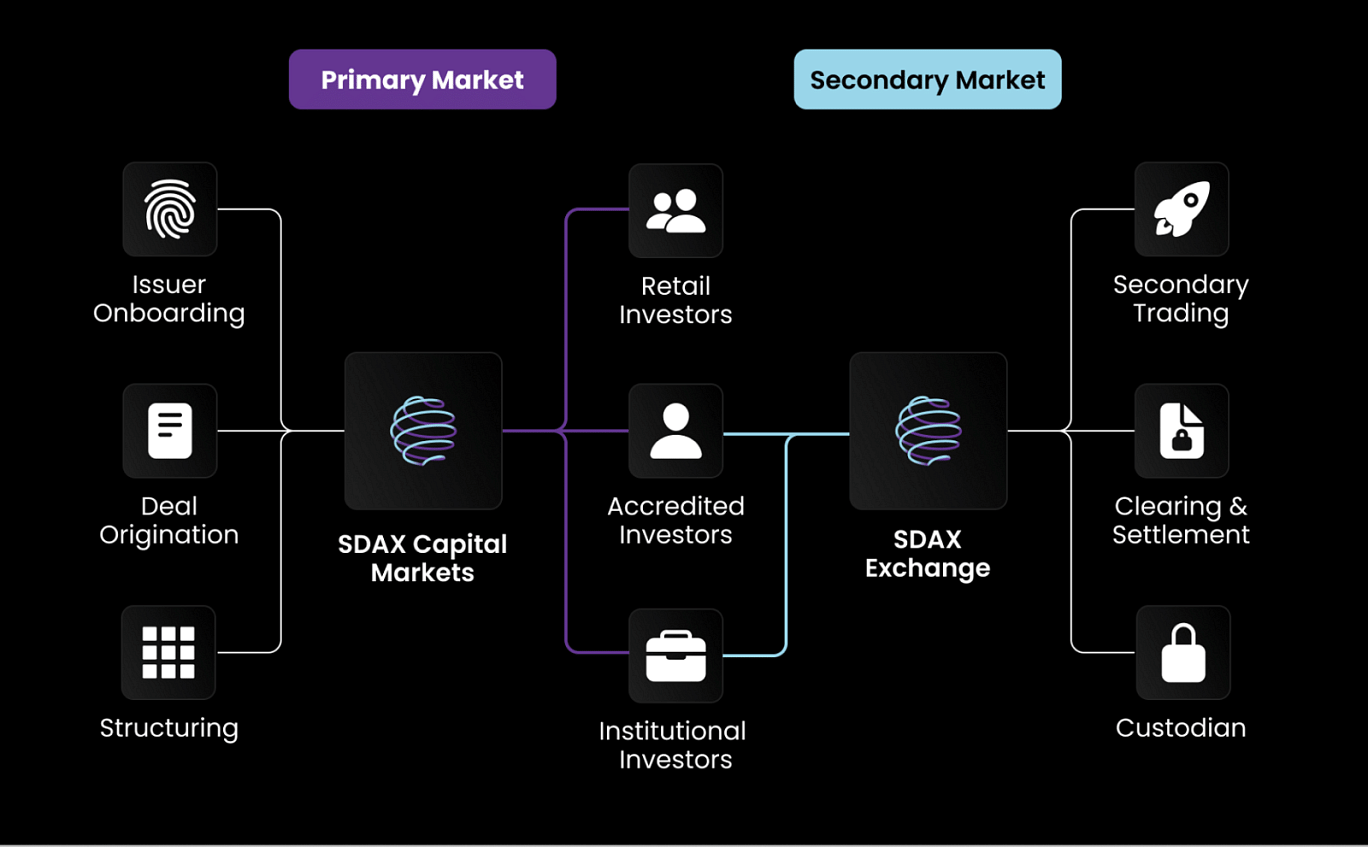

As seen from the attached diagram, companies and fund managers that want to raise debt or equity will first work with SDAX to structure the investment. After rigorous due diligence, the details of the offering are published on the SDAX platform for investors to assess and subscribe if they wish to.

Once the fund raising is completed, the digital tokens can be traded on SDAX's exchange much like stocks on a listed stock exchange, providing investors with liquidity.

While retail investors can invest in many of the digital tokens offered via SDAX, trading is restricted to institutions and accredited investors to comply with MAS regulations.

SDAX's chief executive officer Raymond Poh says: "Unlike many digital exchanges, SDAX seeks to offer interesting, higher-quality and well-managed risk investments that have been screened by our curation process. Every debt or investment security that appears on our platform has been vetted and is backed by physical assets or strong cash flows."

"We place great emphasis in curating the right deals based on sound financial principles, using blockchain as the enabler for the next level of private market investments," he adds.

As a regulated institution, SDAX works with other fully regulated partners, including its banking and custodial service providers, to ensure that the assets of the investors on SDAX's platform are safeguarded.

Pedigree and vision

Licensed by the Monetary Authority of Singapore, SDAX focuses on institutional-grade real estate and environmental, social and governance (ESG)-related investments. Its backers include well-known companies such as PSA International (which is owned by Temasek), Straits Trading and ESR, the world's third largest listed manager of real estate real assets.

ESR, which has some US$140 billion (S$197 billion) in assets under management, focuses on new economy assets such as data centres, warehouses and other industrial real estate.

SDAX's vision is to become a leading global digital investment ecosystem that enables impactful wealth creation. It aims to provide investment assets that are fit for institutions to all investors through financial innovation, as well as help in the world's transition to a net zero carbon future through their focus on ESG.

Connecting companies and investors

SDAX has to date helped a range of issuers raise US$300 million for periods from six months in the case of some debt securities to as long as 10 years for investment funds. Nearly nine in 10 deals were fully funded within the same day of their launch.

SDAX works with companies and asset owners looking to raise funds by providing structuring expertise to help them create the right financing instrument. Looking at the business and capital structure of companies holistically, SDAX optimises the fund-raising experience for both issuers and investors by balancing their specific needs and interests.

As these investments can be traded on the SDAX Exchange, investors who participate in the initial fundraising have the option of selling to other investors well before the maturity date, while other investors can invest via the secondary market with full confidence about the parties they are transacting with.

"In today's increasingly volatile and unpredictable world, investors are looking for a range of investments for diversification and wealth preservation. Many of these investments cannot be found on stock markets," says Mr Poh.

"SDAX seeks to bridge this demand, by sourcing transactions which were previously available only to large institutions and the ultra-high net worth, and facilitating these opportunities by making them available on its platform at smaller entry sizes."