Enhancing your retirement planning with CPF

CONSIDERING an upgrade to your retirement planning? Tapping into your Central Provident Fund (CPF) savings to construct a multi-asset class portfolio can be a savvy move. It is essential to understand that while investing does come with inherent risks, diversifying across various asset classes may lead to higher risk-adjusted returns. This article is not an invitation to forgo the security of bank savings or CPF accounts, but rather about sharing an added strategy to potentially grow retirement savings.

The 60/40 rule in investing

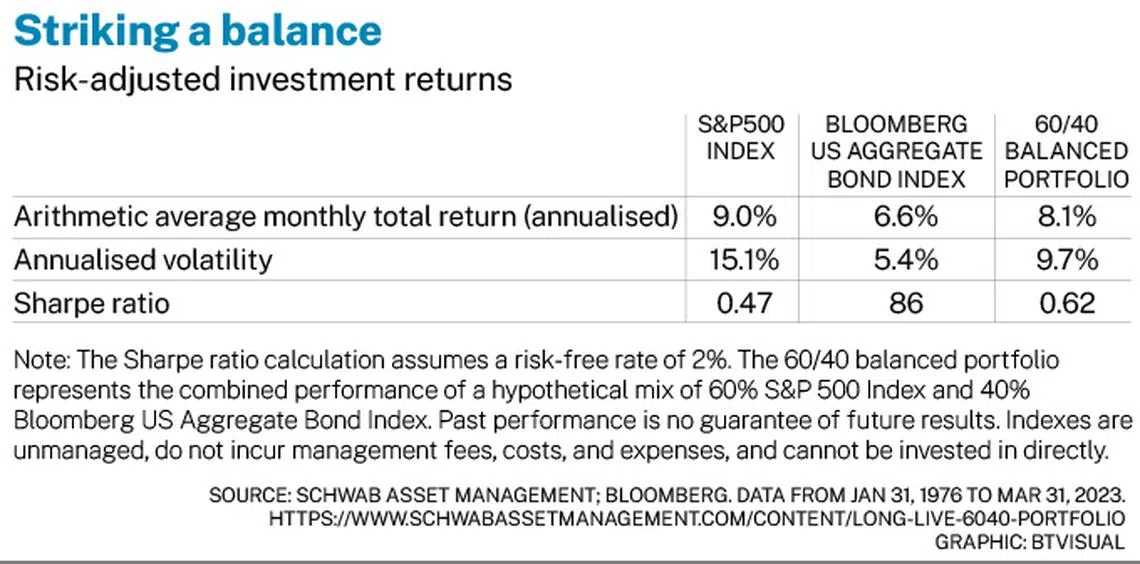

Historically, the portfolio allocation of 60 per cent equities and 40 per cent fixed income has been discussed extensively in financial literature. The rule strikes a balance between aggressive and conservative investment strategies. The aim is to maximise equity-market gains and counterbalance the risks using bond holdings. To put it in perspective, a 60/40 equities and fixed-income portfolio historically showcases one of the best risk-adjusted performances for individual investors, as illustrated below:

Equities, in the long run, are expected to provide higher returns. However, introducing fixed income ensures regular income and stability during volatile market conditions. And having other asset classes like gold or private equity further diversifies one’s portfolio further, offering potential for returns to investors that have less correlation with stocks and bonds.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services