Extreme market concentration: Why index funds and ETFs may not give you the diversified exposure you expect

RQI Investors’ David Walsh shows how concentrated benchmarks can create blind spots in portfolio construction, and offers practical fixes for building more resilient investments

IN TODAY’S markets, concentration risk is a growing concern for investors. What appears to be a diversified portfolio can, in reality, be dominated by a handful of names, especially US technology and growth stocks.

David Walsh, head of Investments at RQI Investors – an active, quantitative global equities investor – shares findings from his research on extreme market concentration, lessons from past economic events, and what investors should consider when building resilient and truly diversified portfolios.

Q: You authored a paper on market concentration recently. Could you talk us through your findings?

A: Since 2015, the US’ share of the overall equity markets has grown sharply and more recently, we have seen it concentrated in a handful of mega-cap stocks.

We thought it was worth finding out the level of concentration, how significant it was for our portfolios, and the extent to which it was influencing our investment processes.

We concluded with three main findings.

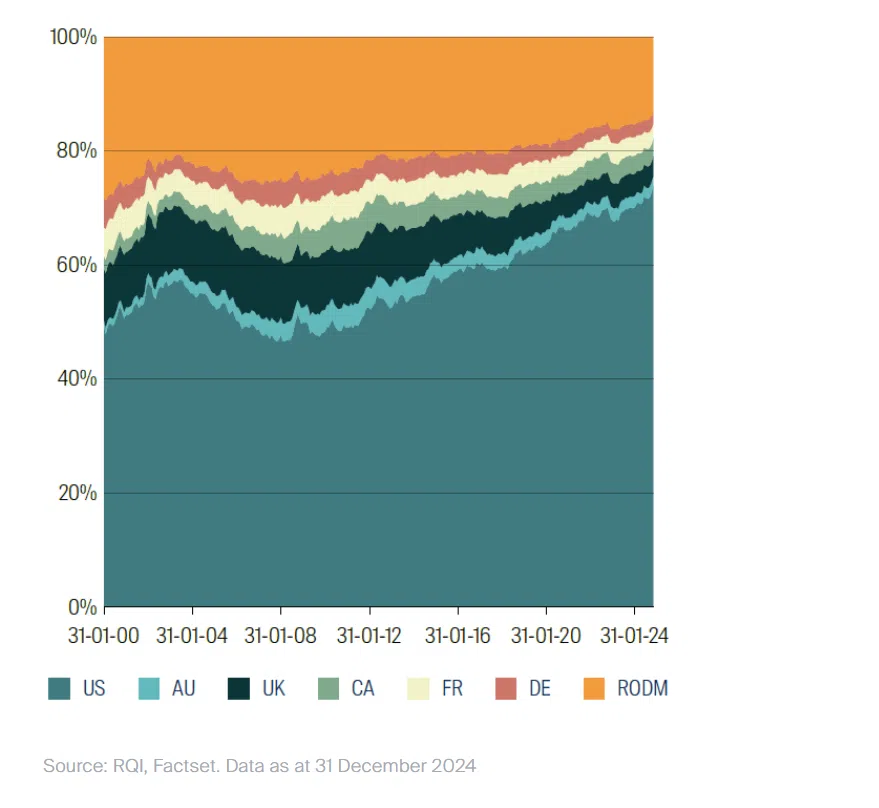

Firstly, markets are indeed very concentrated – especially with US names. The US’ share of developed market equities has grown rapidly in the past two decades, as shown in the country breakdown of the MSCI World benchmark in the chart below.

Chart 1: Proportion of MSCI World benchmark in various countries

The US’ share of the index rose from 49 per cent at the beginning of 2000, to 57 per cent at the beginning of 2015, and finally to 74 per cent by the end of 2024. The run-up in weight post the Global Financial Crisis was very strong and accelerated further in recent years.

While this has driven remarkable returns for a narrow slice of the market, it raises critical questions about diversification, valuation and risk for equity investors.

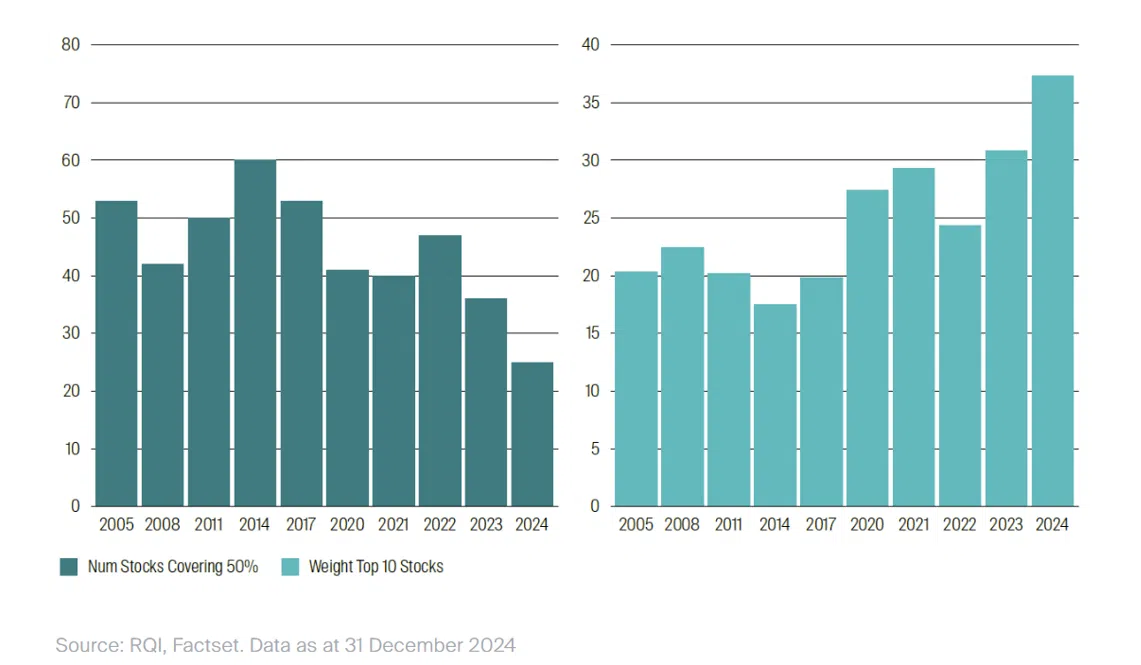

Secondly, the concentration of stocks within the US has also risen sharply. At the end of 2022, the top 47 stocks aggregated up to 50 per cent of the S&P 500 index weight. By the end of 2024, this number had almost halved, to 26 stocks. At the same time, the top 10 stocks now account for 37 per cent of the index weight, up from 24 per cent at the end of 2022.

Chart 2: Number of stocks in the S&P 500 required to make up 50 per cent of the index weight, and the total weight of the top 10 stocks. Data is as of end-2024.

Which leads me to my third and last finding – because there are only a handful of names at the top, you end up with a style or sector tilt which is quite uncommon in a benchmark. If you bought an index fund or an exchange-traded fund (ETF) hoping for a diversified equity exposure, you might need to rethink that strategy.

Some of these investments in very concentrated positions, particularly the most expensive ones, do not reward you for the equity risk you are taking. If you are owning an equity portfolio or a handful of equity stocks, you expect to earn a premium because they are riskier than bonds. That is fine in general and on average, it is true. But in the current market with very concentrated portfolios, it is very hard to find. For the most concentrated stocks, the equity risk premium is probably negative in reality – you end up taking on more risk than you want to, and getting paid less for it in terms of returns.

Q: Have markets seen this level of concentration in the past?

A: We can go back in history and find many different events that look a lot like this. In 2020, for example, we saw emerging market growth that was driven by just a handful of companies. The tech boom in China and South-east Asia became so pronounced that the top five companies made up more than 27 per cent of the benchmark. The MSCI Emerging Markets Index has around 1,300 companies, yet just five of them accounted for more than a quarter of the index – a sign of very heavy concentration.

Q: Where do you think we are at now?

A: The paper was written based on data that ran to the end of 2024, and there has been a little bit of turmoil in the markets since then.

Concentration has unwound somewhat, and markets have fallen, but we have not seen the spread in valuation corrected a great deal. While concentration has eased, it still exists. Those stocks still constitute an unusually large proportion of the benchmark compared with historical levels, and certainly a very large proportion of the benchmark than what we hold in our portfolios.

Q: What has that meant for RQI Investors in terms of navigating that sort of event?

A: At RQI Investors, we construct a core investment model based on non-market cap benchmark numbers. We use the economic size of the company to construct our core, not the market cap size. This means that we do not have to chase prices in any way. If the stock we own increases in economic size, we will increase their weights as well. As a result, we can avoid that lack of diversification issue.

We are much more diversified than the benchmark. For example, the top 10 names that make up 25 per cent of the MSCI Developed Markets Index at the end of 2024 only account for 10 per cent in our portfolio and it has been very stable since 2015.

We do own companies like Apple and Microsoft1 in our portfolio because they are large companies that generate revenues, are profitable and in some cases, pay dividends – but we do not hold anywhere near as much as the benchmark does. The trade-off for being underweight Apple and Microsoft is that we will underperform during a strong growth period, such as in late 2024.

What we do to compensate for that is we build a portfolio which is not tilted towards the most expensive names, but towards the best quality – value stocks which should cushion that fall and prevent the portfolio from being impacted the same way.

Our performance has been very strong as the growth selloff has happened. We have had a significant performance boost from the selloff. Even then, we are still seeing strong market concentration. The strong tilt towards tech and US stocks in all those benchmarks is still apparent, which shows that the issue of concentration in benchmarks, and consequently in index funds and ETFs, still exists.

1Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same.

Important information The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Group believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither First Sentier Group, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. The information herein is for information purposes only; it does not constitute investment advice and/or recommendation, and should not be used as the basis of any investment decision. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. The value of investments and the income from them may go down as well as up and you may not get back your original investment. Past performance is not necessarily a guide to future performance. Please refer to the offering documents for details, including the risk factors. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Group’s portfolios at a certain point in time, and the holdings may change over time. This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of First Sentier Group. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of First Sentier Group. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction. In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Group, First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Group (registration number 53507290B), First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business names of First Sentier Investors (Singapore). First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Group, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Group includes a number of entities in different jurisdictions. To the extent permitted by law, MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested. © First Sentier Group

Share with us your feedback on BT's products and services