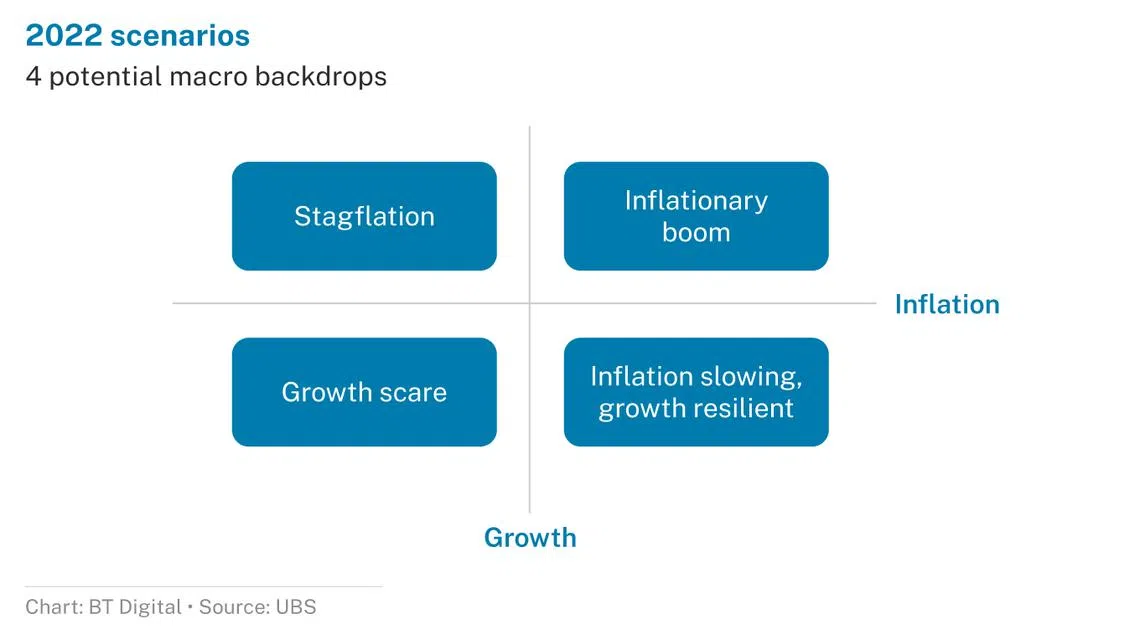

Four growth and inflation scenarios for 2022

There is a wide range of possible outcomes based on the trajectories for growth and inflation for the rest of the year.

COMPARED to what has transpired over the prior 2 decades, the persistence of elevated price pressures is a crucial differentiating factor in this economic cycle. The many forces keeping inflation high around the world are increasing the risks that global economic growth heads lower. Macroeconomic uncertainty is high because investors are constantly reassessing how much and how fast central banks will raise rates to tamp down inflation and economic activity – and if they will deliver too much tightening and have to reverse course.

As such, market participants are likely to entertain a wide range of outcomes based on the trajectories for inflation and growth during the rest of 2022. Four potential macro backdrops arise: a growth scare; a soft landing; stagflation and an inflationary boom.

While there is no certainty as to which regime markets will eventually settle into over the next 6 to 12 months, our team at UBS Asset Management believes it is a close call between a growth scare that culminates in a recession and a soft landing. That said, however, sequencing is important.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services