Diversify with Asia-Pacific’s top financial players: ETF combines growth potential and income

The Lion-OCBC Securities APAC Financials Dividend Plus ETF provides investors with exposure to the 30 largest and most tradable companies listed in the region

Kenette Gelyn Cabotaje

The global economic landscape is currently fraught with uncertainties. Geopolitical tensions simmer, inflation remains a concern, and interest rates are unlikely to retreat from their current levels anytime soon.

For investors, the uncertainties are presenting a significant challenge: How to safeguard portfolios against volatility while ensuring consistent income streams.

Fund managers and investors have been turning their attention to this part of the world, drawn by the strong performance of the financial sector of numerous Asian markets and Australia. Singapore’s three local banking groups – DBS, UOB, and OCBC^ – all reported record profits and announced higher dividends in 2023.

Even as the broader economy struggles, widening interest rates margins and surging demand for services like insurance and asset management have boosted the financial industry’s performance.

Investors seeking to capitalise on this regional strength can look beyond individual banks – and towards the Lion-OCBC Securities APAC Financials Dividend Plus ETF. This exchange-traded fund (ETF) offers exposure to Asia-Pacific’s leading financial institutions* while providing regular quarterly dividends#.

“Whether you’re an income investor holding local banks and real estate investment trusts (REITs) or a growth investor focused on US tech stocks, including the Lion-OCBC Securities APAC Financials Dividend Plus ETF in your portfolio can add diversification and potentially help to weather market volatility,” says Wilson He, managing director of OCBC Securities.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Gaining exposure to the 30 largest and most tradable companies listed in Asia-Pacific

The ETF tracks the iEdge APAC Financials Dividend Plus Index, a carefully curated basket of the 30 largest and most tradable financial institutions* across Asia-Pacific. Chinese stocks are included in the basket through H-shares listed in Hong Kong. The index undergoes rebalancing every six months, ensuring it reflects the ever-evolving landscape of the region’s top financial players.

The ETF distributes dividends quarterly, with the first payout expected in September 2024.

For the initial two years, Lion Global Investors, the fund manager, has committed to a minimum annual distribution of five Singapore cents per unit, translating to 5 per cent of the ETF’s issue price#. This aligns neatly with the current dividend yield of over 5 per cent for many financial institutions in the region.

The index construction also prioritises diversification. A country weightage cap of 20 per cent prevents any single market from dominating the index, while a 7-per-cent cap on individual stocks ensures no single company exerts undue influence. This safeguards the ETF’s ability to provide exposure to a broad spectrum of Asia-Pacific financial stocks.

Higher margins, untapped growth potential

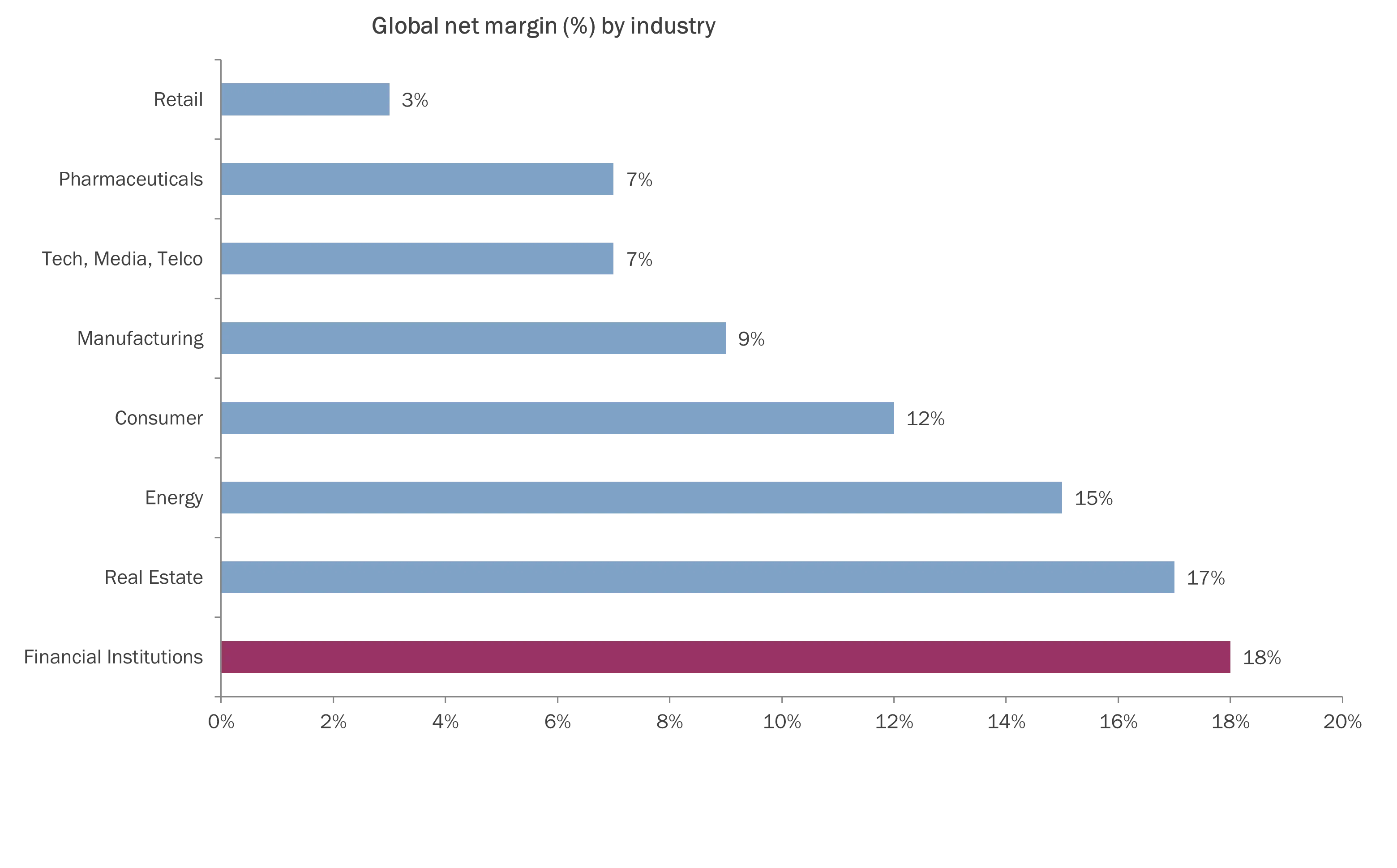

While technology companies often capture investor imagination, the financial sector boasts significantly higher net profit margins.

A 2023 report from Boston Consulting Group found that global financial institutions average a net profit margin of 18 per cent, compared to just 7 per cent for the tech, media, and telecommunications sector. Financial institutions are adept at leveraging technology to streamline operations and boost margins through digitalisation.

Asia-Pacific presents a particularly compelling proposition. The region benefits from a growing middle class, rising wealth accumulation among the affluent, and financial inclusion initiatives that extend banking services to underserved communities.

Consequently, APAC banks have consistently delivered high dividends, exceeding US$130 billion in the past two years, while leading other regions in terms of performance, according to S&P Global1.

“Asia Pacific’s financial ecosystem has evolved over the past decade. The financial sector includes not just banks, but wealth management, insurance and exchanges, with many of them playing a much bigger role today. Asia Pacific economies and the financial sector will continue to grow in tandem and investors can participate in this growth by investing in the Lion-OCBC Securities APAC Financials Dividend ETF,” says Teo Joo Wah, chief executive officer of Lion Global Investors.

Attractive valuations present an opportunity

Despite their strong 2023 performance, Asia-Pacific financial institutions currently trade at attractive valuations. Take South Korea’s KB Financial Group^, which owns Kookmin Bank and KB Life Insurance. It trades at a historical price-to-earnings (PE) ratio of just 6.5 times despite reporting record profits last year2.

The 30 financial stocks within the Lion-OCBC Securities APAC Financials Dividend Plus ETF currently boast an average PE ratio of around 10, which sits comfortably below the Straits Times Index’s PE ratio of 16+, as of March 31, 20243.

While the ETF’s dividend yield of 5 per cent# of the ETF issue price for the first two years might fall short of the 6 per cent offered by some Singapore REITs, it is crucial to consider the payout ratio.

In the Asia-Pacific region, the dividends paid by the 30 financial institutions* have payout ratios of between 25 and 50 per cent4, compared to the 90 to 100 per cent payout ratio common among Singapore REITs5. This translates to a more sustainable dividend stream for the ETF, as financial institutions have greater room to maintain payouts even if earnings dip.

In times of market volatility, a diversified portfolio is paramount. By combining growth potential with a steady stream of income through regular dividends, investors can build portfolios that offer greater resilience during downturns.

The Lion-OCBC Securities APAC Financials Dividend Plus ETF can offer investors an opportunity to tap into the growth story of Asia-Pacific’s financial sector while enjoying stable dividend payouts.#

Visit the Lion-OCBC Securities APAC Financials Dividend Plus ETF website for more information.

^Securities referenced are not intended as recommendations to buy or sell.

+Past performance, yields and payments are not necessarily indicative of future or likely performance, yields and payments.

*The company’s business sector must be classified as “Banking, Insurance, Investment Services, or Specialty Finance & Services”, as defined by FactSet’s Revere Business Industry Classification System (RBICS).

#As set out in the prospectus, the minimum payout of 5% per annum is only for the first 2 years. Distributions are not guaranteed. Distributions may be made up of income, capital gains, and/or capital. Please refer to our website for more information on the income disclosures.

1S&P Global, Sep 2023

2Bloomberg, Mar 2024

3Bloomberg, Mar 2024

4Shinhan Financial Group and UOB Group webpages, May 2024

5REIT Association of Singapore webpage, May 2024

Disclaimer – Lion Global Investors Limited

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation for the purchase or sale of any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or needs.

You should read the prospectus and Product Highlights Sheet of the Lion-OCBC Securities APAC Financials Dividend Plus ETF (“ETF”), which is available and may be obtained from Lion Global Investors Limited (LGI) or any of the its distributors and appointed Participating Dealers (“PDs”), for further details including the risk factors and consider if the ETF is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to purchase units in the ETF. Investments in the ETF are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the ETF is not guaranteed and, the value of its units and the income accruing to the units, if any, may rise or fall. Past performance, payout yields and payments, as well as, any prediction, projection, or forecast are not necessarily indicative of the future or likely performance, payout yields and payments of the ETF. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to LGI’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the ETF. Any references to specific securities are for illustration purposes and are not to be considered as recommendations to buy or sell the securities. It should not be assumed that investment in such specific securities will be profitable. There can be no assurance that any of the allocations or holdings presented will remain in the ETF at the time this information is presented. Any information (which includes opinions, estimates, graphs, charts, formulae or devices) is subject to change or correction at any time without notice and is not to be relied on as advice. You are advised to conduct your own independent assessment and investigation of the relevance, accuracy, adequacy and reliability of any information or contained herein and seek professional advice on them. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information. The ETF may, where permitted by the prospectus, invest in financial derivative instruments for hedging purposes or for efficient portfolio management. The ETF’s net asset value may have higher volatility as a result of its narrower investment focus on a limited geographical market, when compared to funds investing in global markets. LGI, its related companies, their directors and/or employees may hold units of the ETF and be engaged in purchasing or selling units of the ETF for themselves or their clients.

The units of the ETF are listed and traded on the Singapore Exchange Securities Trading Limited (“SGX-ST”), and may be traded at prices different from its net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem units in the ETF directly with the manager of the ETF, but you may, subject to specific conditions, do so on the SGX-ST or through the PDs.

© Lion Global Investors Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies).

Disclaimer – OCBC Securities Private Limited

The distributions will be a minimum of 5% per annum of the issue price per unit during the ETF’s initial offer period for the first 2 years. Thereafter, there will be a targeted dividend yield of around 5% per annum of the Net Asset Value per unit, less expenses. Distributions may be paid from distributable income, capital gains and/or capital. These distributions are not guaranteed and are subject to the fund’s distribution policy. For full details, refer to the fund prospectus.

The information provided herein is a compilation or summary of materials and data based from external sources available to OCBC Securities Private Limited (“OSPL”), and does not represent OSPL’s view on the matters mentioned. The information herein are not meant as recommendation or advice in any manner from OSPL. Where any graph, chart, formula or device are included, there maybe limitations, and difficulties in respect of the use, of such graph, chart, formula or device (as the case may be). Whilst we have taken all reasonable care to ensure that the information contained in this advertisement or publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Trading in capital market products and borrowing to finance the trading transactions (including, but not limited to leveraged trading or gearing) can be very risky, and you may lose all or more than the amount invested or deposited. Where necessary, please seek advice from an independent financial adviser regarding the suitability of any trade or investment product taking into account your investment objectives, financial situation or particular needs before making a commitment to trade or purchase the investment product. If you choose not to seek independent financial advice, please consider whether the trade or product in question is suitable for you. You should consider carefully and exercise caution in making any trading decision whether or not you have received advice from any financial adviser. You should also read the relevant prospectus and/or profile statement (a copy of which may be obtained from the relevant fund manager or any of its approved distributors), prior to any trading or investment decision. In relation to collective investment schemes, the value of the units and the income accruing therefrom, if any, may rise or fall. Past performance, yields, and payments, as well as any predictions, projections, or forecasts, are not necessarily indicative of future or likely performance, yields, or payments. For funds that are listed on an approved exchange, investors are not allowed to redeem their units in those funds with the manager, except under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units. No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OSPL and it should not be relied upon as such. OSPL does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. OSPL shall not be responsible for any loss or damage howsoever arising, directly or indirectly, as a result of any person acting on any information provided herein. The information provided herein is intended for general circulation/discussion purposes only and may not be published or circulated in whole or in part without our written consent. All trademarks, registered trademarks, product names and company names or logos mentioned herein are the property of their respective owners, and you agree that you will not do anything to infringe or prejudice those rights. Reference to any products, services, processes or other information, does not constitute or imply endorsement, sponsorship or recommendation thereof by OSPL. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. © OCBC Securities Private Limited. (UEN/ Registration No. 196600262R)

Disclaimer – Singapore Exchange Limited

The units of the Lion-OCBC Securities APAC Financials Dividend Plus ETF are not in any way sponsored, endorsed, sold or promoted by the Singapore Exchange Limited (“SGX”) and/or its affiliates and SGX and/or its affiliates make no warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the iEdge APAC Financials Dividend Plus Index and/or the figure at which the iEdge APAC Financials Dividend Plus Index stands at any particular time on any particular day or otherwise. The iEdge APAC Financials Dividend Plus Index is administrated, calculated and published by SGX. SGX shall not be liable (whether in negligence or otherwise) to any person for any error in the Lion-OCBC Securities APAC Financials Dividend Plus ETF and the iEdge APAC Financials Dividend Plus Index and shall not be under any obligation to advise any person of any error therein. Intellectual property rights in the iEdge APAC Financials Dividend Plus Index vest in SGX. The iEdge APAC Financials Dividend Plus Index is used by Lion Global Investors Limited under licence.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.