Making sense of the crypto crisis: Boon or bane for financial system?

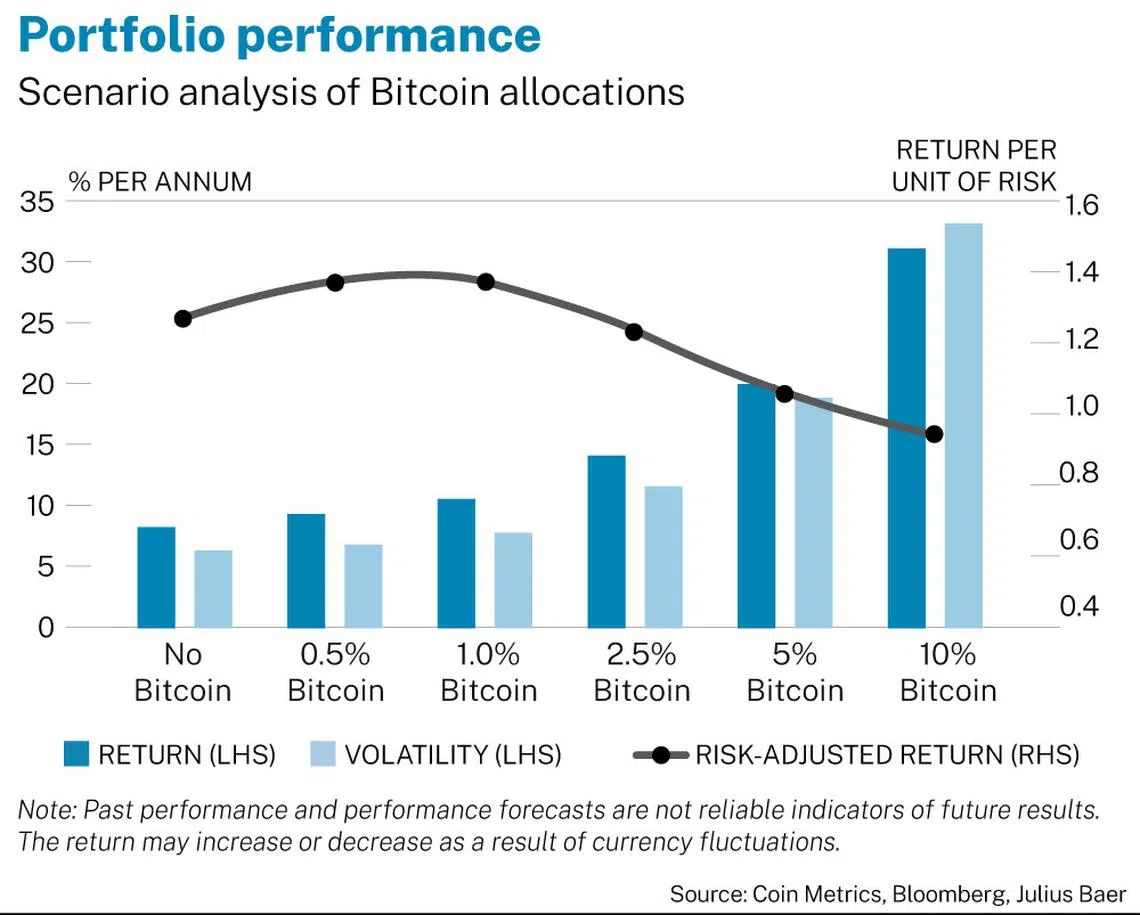

A relatively small allocation of Bitcoin to portfolios of 0.5 to 1 per cent could improve risk-adjusted returns, but benefits diminish with incrementally higher allocations

WITH digital assets, we are witnessing the rise of a new and nascent asset class built on a technology that has the potential to revolutionise the global financial system. We have entered uncharted territory, given the favourable monetary regime that digital assets have enjoyed for years, which is an important consideration when assessing the overall performance of the asset class and the impact of the recent crypto crisis.

Digital assets’ valuation reached their peak in November 2021, attaining a total market capitalisation just shy of US$3 trillion. This year, both top-down macroeconomic and bottom-up crypto-specific headwinds have been blowing strongly for digital assets, resulting in the biggest ever drawdown in terms of value destruction.

First episode of the crisis

Since the initial announcement from the US Federal Reserve in November 2021 to taper their asset purchases and tighten monetary policy, risk assets have suffered from strong selling pressure. As a high-volatility asset class, digital assets were not immune to this pivot away from risk assets, which ultimately saw the total market capitalisation fall by around two-thirds from the peak. We believe that the elevated correlations among the leading tokens suggest a currently low level of sophistication and differentiation between the value propositions of different digital assets.

Stablecoin shakedown

Stablecoins initially attracted investors with the touted benefits of decentralisation and blockchain technology, while mitigating the infamous volatility of free-floating cryptos such as Bitcoin and Ethereum. While there are many different types of stablecoins, one of the increasingly popular methods of construction became algorithmic stablecoins. These instruments rely on complex automated mechanisms and incentive structures to maintain their 1:1 peg with the underlying fiat currency, without holding fiat-denominated cash or near-cash securities.

TerraUSD, once the third-largest stablecoin, suffered a sustained depegging from its 1:1 level with the US dollar. Ultimately, the value destruction due to this collapse was immense. At this point, crypto-specific bottom-up headwinds started to compound the already low sentiment due to the existing top-down macroeconomic headwinds from tightening monetary policy.

DeFi liquidity crisis

While there are many theories on what ultimately caused the initial depegging and resulting collapse of the stablecoin, one aspect that most agree on after the fact is that the yields that were paid by some of decentralised finance (DeFi) protocols, in particular lending protocols, were unsustainable, and there was a clear underappreciation of the risks of a funding gap emerging for these protocols. The collapse of the Terra/Luna ecosystem triggered fears of a collapse of the other stablecoins and contagion for the broader crypto markets. The ripple effects of the Terra/Luna collapse continued to be felt by DeFi protocols that also offered unsuitably high yields and/or had significant exposure to the falling prices of the crypto assets held in their liquidity pools, highlighting the high degree of interdependencies between large actors in the DeFi ecosystem.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The total value of crypto assets locked into DeFi protocols, so-called TVL, is one of the main metrics that investors use to gauge the level of activity and overall value in the DeFi ecosystem. In this regard, we have seen a dramatic decline in values since the beginning of the year. Lending protocols in particular saw a very big chunk of their TVL drop as investors were spooked by the TerraUSD collapse, driving them to exchange tokens held in lending pools into stablecoins, with the ultimate intention to cash out into more secure fiat currencies.

Compound, which was one of the leading lending protocols to survive, saw its TVL decline, highlighting how even those protocols that did not collapse have also been severely impacted. Looking ahead, we are convinced that the wounds of this stablecoin shakedown and the DeFi crisis will take some time to heal. Once calm is restored, traders may return to the DeFi space seeking to benefit from what will be lower, more sustainable, but still attractive yields from DeFi activities.

Wall Street spillover

As digital assets gain in acceptance, an increasing number of institutional investors have warmed to them as an asset class. The push by institutional investors such as hedge funds and other asset managers into digital assets has not gone unnoticed by the Wall Street, with several high-profile banks rapidly building up their expertise and capabilities.

Three Arrows Capital was the first high-profile name to report significant losses from their crypto trading activities. As the fund filed for bankruptcy, estimated losses ran into billions of dollars, marking one of the largest hedge fund trading losses of all time.

Crypto in a portfolio

When considering the recent crypto crisis, some questions arise: Is there still merit in holding cryptos? What proportion of a portfolio should be allocated to digital assets? Due to the nascent nature of the asset class, we have based our analysis on Bitcoin, which is the largest, most established and most mature crypto coin.

As highlighted in the chart, a relatively small allocation of between 0.5 and 1 per cent to Bitcoin resulted in better risk-adjusted returns, compared to the reference portfolio of solely bonds and equities. However, at the margin, when adding incrementally higher allocations of Bitcoin above the 1.5 per cent threshold, these benefits started to diminish, with the risk-adjusted returns coming down gradually relative to the non-Bitcoin portfolio due to the added volatility. Significantly higher Bitcoin allocations would have caused a significant change in the portfolio’s characteristics. Most notably, risk-adjusted returns would have dipped below 1.

We continue to see crypto primarily as a return enhancer in a portfolio. Historically, this assessment is backed by the fact that the addition of cryptos to a portfolio beyond a small weight of 1 per cent or less has caused an increase in realised returns as well as realised volatility. Allocations up to 5 per cent may be appropriate for risk-seeking investors, while higher allocations would cause a significant change in the portfolio’s characteristics and may ultimately result in lower risk-adjusted returns.

We maintain our view that cryptos are only suited for investors who have the ability and willingness to bear the related risks. However, these risks could be rewarded with very appealing returns due to the potential disruptive power that we see primarily in the world of decentralised finance. Risk seekers should exercise caution, as digital assets are still a very unregulated area.

Rising regulation should instil trust in the asset class and ultimately foster adoption. Due diligence is key: If something seems too good to be true, it probably is.

The writer is head of next generation research, Julius Baer.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.