Harnessing changing winds: Why flexibility matters in fixed income investing

L&G’s investment experts Matthew Rees and Amelie Chowna share why an unconstrained approach can help investors navigate volatile markets

FINANCIAL markets have been a rollercoaster in recent years; and no-one knows the twists and turns of the track ahead. The volatility, largely shaped by geopolitical and economic events, sees no sign of abating. Uncertainty seems to be the new certainty.

Current market dynamics also threaten higher interest rates due to upward pressure on prices – which can be a very challenging situation for fixed income investors.

In this market environment, considering an active and flexible approach to fixed income investing can help investors navigate future surprises. Flexibility is key to capturing potential opportunities and mitigating risks across the multi-faceted fixed income spectrum.

Different types of bonds behave differently depending on the market conditions. For example, government bonds can offer valuable risk-offsetting features in risk-off environments driven by recession fears.

Bonds with credit risk may deliver better returns in environments with stable growth and corporate health, but can come under pressure when investors worry about risks of downgrades and defaults. As for bonds issued by emerging market countries, they typically offer additional yield due to higher political and geopolitical risk, but may underperform when conflicts arise.

The market movers and shakers

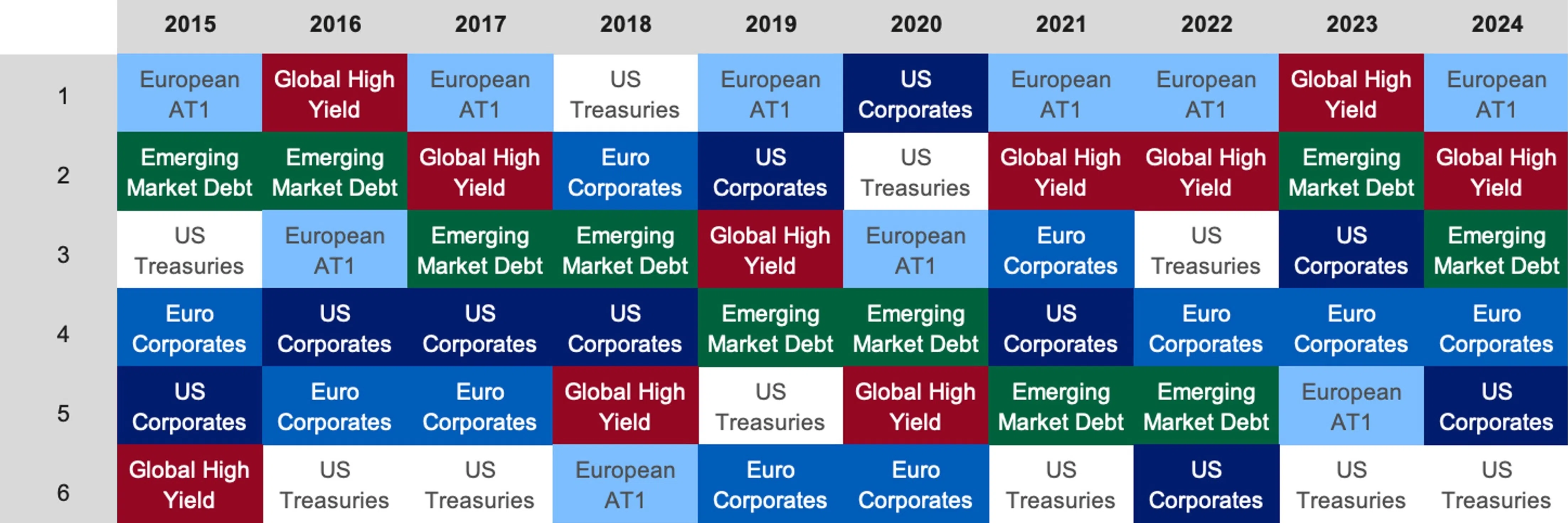

If we look at annual returns across six key fixed income markets over the past 10 years, there have been significant variations in performance in both high and low interest rate environments. The below chart shows this data, ranking returns from the highest (1) to lowest (6).

A ranking of the top six key fixed income markets according to annual returns between 2015 and 2024

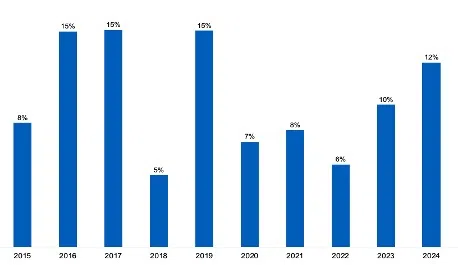

The following chart shows the return differential between the top performing market and the worst performing fixed income market on a calendar year basis, using the same data as the return matrix above. The lowest differential in the past 10 years was 5 per cent in 2018, and the highest was 15 per cent in 2016, 2017 and 2019, three years in a low-interest rate environment, with an average of 10 per cent.

Percentage differential in returns between the top and bottom performing fixed income asset classes over the years

We believe there is a clear theme to this story. Given all the idiosyncratic risks facing markets, it may be more prudent to adopt an agnostic and pragmatic approach by exploring opportunities in fixed-income markets globally, rather than focusing on one sector or region. This approach might have better potential to drive consistent returns compared with strategies which are focused on individual markets.

A keen interest in rates

Interest-rate risk is one of the main risks facing fixed-income investors, and in an uncertain and volatile world, that risk is likely to be heightened.

The return of inflation in 2021 has complicated things further for bond and multi-asset investors. Central Banks have had to prioritise bringing inflation down towards their target range, rather than supporting growth by lowering interest rates. This has shaken the perception, built up over the benign inflationary period post the 2008 global financial crisis, that bonds are usually negatively correlated with equities. Since 2021, we have seen the two asset classes move more frequently in tandem.

Unconstrained bond strategies can help investors navigate uncertainty in the outlook for interest rates and can offer some benefits from increased diversification and flexibility.

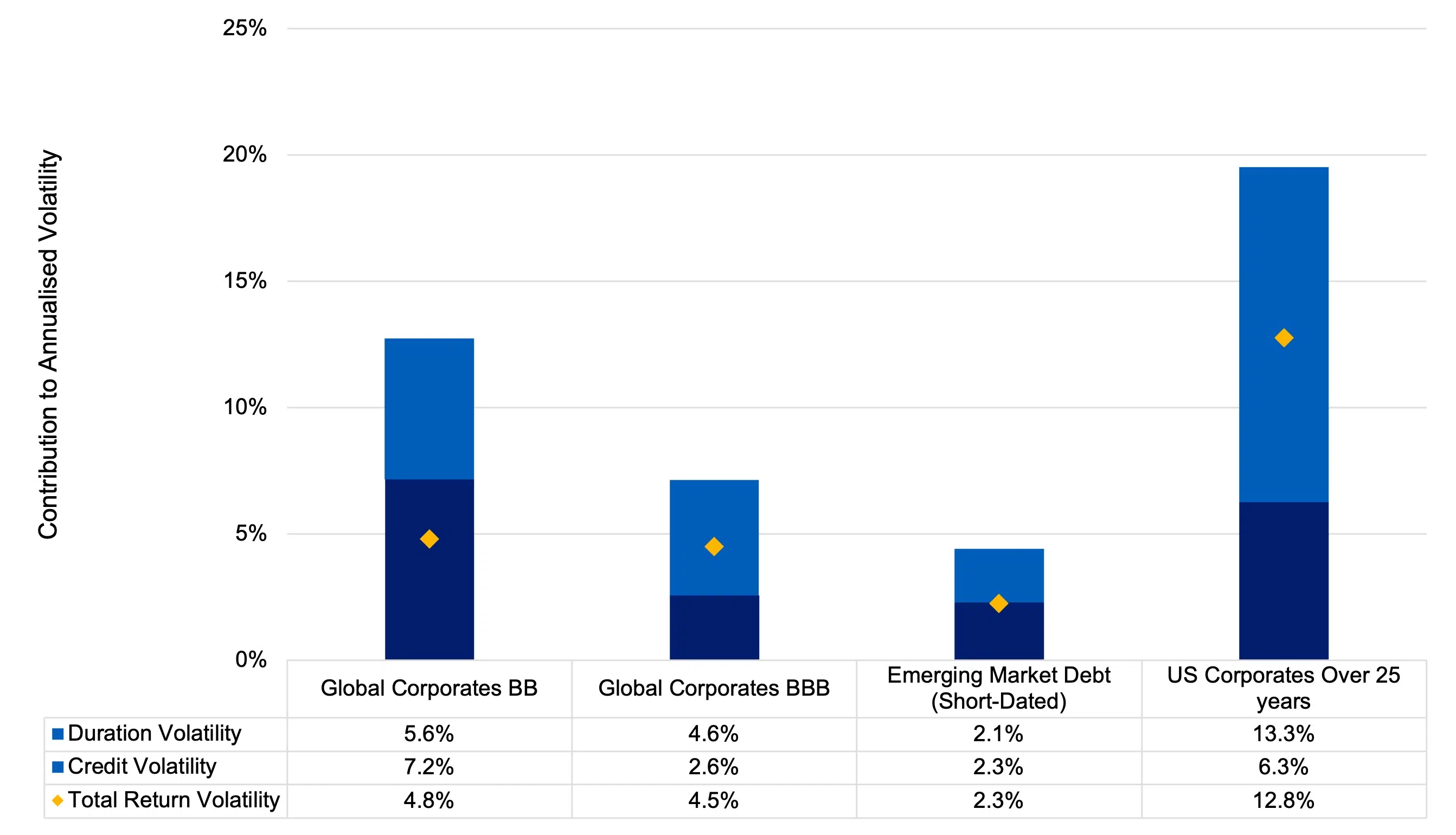

Owning bonds with longer duration can be valuable over time but is also a considerable risk for fixed income portfolios. We have analysed the drivers of return volatility across different credit sectors and found that duration is a key driver of return volatility for many credit assets over the past 10 years. For example, bonds with a maturity of more than 25 years face double the return volatility risk from duration than credit risk. In contrast, more credit-sensitive areas such as high yield BB-rated bonds are less affected by duration.

A breakdown of the volatility levels across asset classes

Changing macroeconomic dynamics, inflation that remains persistently above target, and the return of fiscal spend have also led to much more volatility in government bond markets, which has fuelled an increase in volatility in duration-sensitive assets.

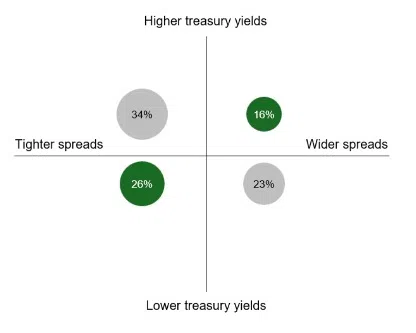

The evidence that duration is a good hedge for credit risk can also be debatable. Our analysis of monthly credit spread and government bond yield series between 2002 and July 2025 also showed that 42 per cent of the time, credit spreads and government bond yields move in the same direction.

The relationship between treasury yields and credit spreads, and their frequency of occurrence

This supports the idea that actively managing duration in fixed income portfolios is more beneficial in the current market environment. Over the 40 years to 2021, investors could take a simple ‘buy and hold’ approach to duration. However, with today’s shorter, more volatile cycles, it is not only important to focus on managing the duration for the entire portfolio, but also on its interaction with risk assets.

An unconstrained approach can offer more flexibility, allowing investors to adjust duration based on the correlation of returns between government bonds and credit spreads.

An unconstrained approach for uncertain times

We believe there are long-term rewards for holding credit assets, but the balance between credit risk and interest rates risk must be carefully managed.

Duration can be a powerful hedge for credit risk in risk-off environments, but it may offer little value as a hedge in environments where inflation risk is the main concern. In the latter, reducing duration exposure and focusing on harvesting credit returns through measured allocations between markets and issuer selection may be more effective.

With markets continuing to look unpredictable, it may be worthwhile for investors to consider opportunities in fixed income, using diversification to potentially generate returns from different sources. Given the likelihood of continued volatility, flexible duration management will remain key to adapting to future market moves.

This article was written by Matthew Rees, Head of Global Unconstrained Fixed Income for L&G’s Asset Management division, and Amelie Chowna, Senior Fixed Income Specialist within L&G Asset Management’s Global Fixed Income team.

Rees joined L&G in 2009 and has led the Global Bond Strategies team since 2019. He was the co-head of the Euro credit portfolio management team prior to his current role. Before joining L&G, Rees was a partner at Banquo Credit Management and has worked at UBS, Merrill Lynch and the rating agency Fitch IBCA. Rees qualified as a chartered accountant with Coopers & Lybrand in 1996 and holds a BA (hons) in English from the University of York.

Chowna joined L&G in 2011 from AXA Investment Managers and held a variety of roles within L&G before joining the Global Fixed Income team. She was a portfolio manager for the Global Bond Strategies team prior to her current role. Chowna graduated from ESSEC Business School and holds an MBA. She has been a Chartered Financial Analyst since 2015.

Learn more about L&G’s unconstrained strategies.

Key risk warnings:

The value of investments and the income from them can go down as well as up and you may not get back the amount invested. Past performance is not a guide to future performance. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of L&G as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

Issued by:

Singapore: LGIM Singapore Pte. Ltd (Company Registration No. 202231876W), regulated by the Monetary Authority of Singapore (“MAS”). This material has not been reviewed by the MAS.

Share with us your feedback on BT's products and services