Secure your future, protect loved ones: Tailored investment solutions to help grow your wealth

OCBC Premier Banking’s range of exclusive wealth solutions and personalised services can help you achieve your desired lifestyle and dream retirement

Charlotte Kng YT

FOR many, the dream of a comfortable retirement is the driving force behind their long-term financial strategies.

This is particularly true for millennials and Gen X, who are caught in a generational sandwich, their hearts and resources pulled in opposing directions by love and duty.

On one hand, there is the weight of responsibility for ageing parents. On the other, there is the duty of securing a bright future for the next generation. Somewhere in the middle, there are unspoken dreams of travelling the world – and of having a well-funded nest egg to retire comfortably themselves.

A recent survey conducted by OCBC found that an overwhelming eight in 10 respondents identify being able to retire comfortably as their main wealth goal. More than half of the respondents prioritise taking care of the needs and comfort of loved ones.

Says Bob Ng, head of Personal and Premier Banking Singapore at OCBC: “The aspiration to achieve financial security often arises from the desire to sustain day-to-day living while also embracing life’s uncertainties without compromising lifestyle or the well-being of loved ones.

“Contrary to what many people might think, you don’t have to make a choice between today’s needs and tomorrow’s dreams.”

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The survey, conducted from May to June this year, aimed to understand the financial attitudes and behaviours of individuals from households with over S$400,000 in assets under management. A total of 157 respondents, who are either the main or co-decision makers of their household finances, participated.

These individuals perform a delicate balancing act when managing their household finances, as they juggle immediate needs with long-term goals.

Says Ng: “For these Singaporeans, we believe effective financial management would be about crafting a comprehensive strategy that goes beyond just covering daily expenses. It should aim to maintain their desired lifestyle while building a robust safety net for uncertainties, including rising healthcare costs and unexpected emergencies, and ultimately paving the way for a worry-free retirement.”

Multiplying your savings

Many value simplicity in managing their wealth. According to the survey, nearly a third of the respondents feel overwhelmed by the array of financial solutions for wealth growth.

The good news is that financial planning does not have to be complicated.

Having access to a one-stop integrated banking service can help. The OCBC Premier Banking programme, which spans deposits, investments and timely investment insights, is an example of a service you can tap.

“Disciplined saving and investing are crucial in building a solid foundation for your financial future. Regular savings provide a sense of financial stability, allowing you to handle financial challenges with ease, while investments help you to grow your wealth over time, ensuring a comfortable and secure retirement,” says Ng.

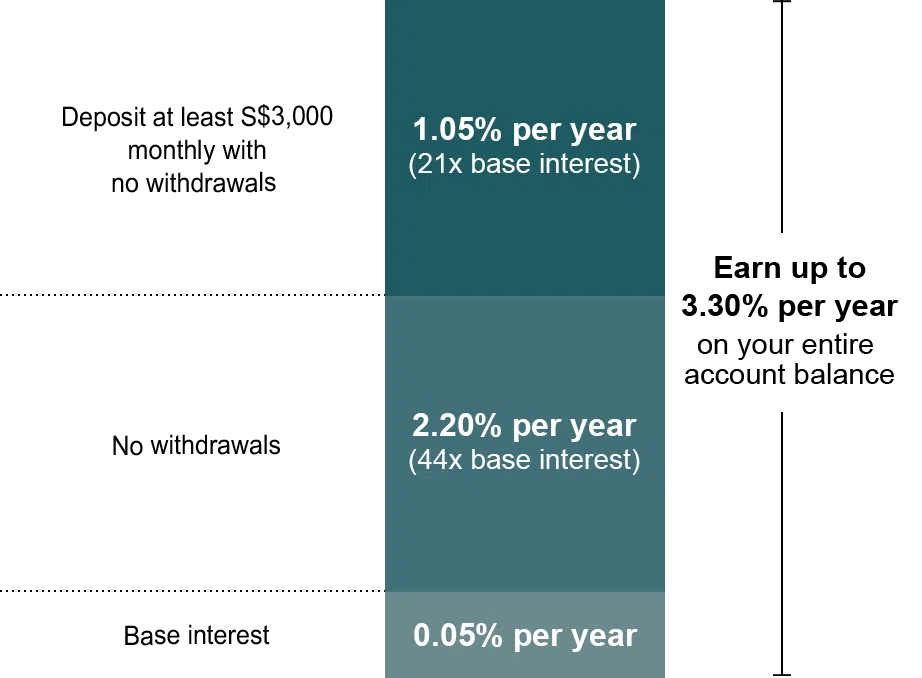

A time-tested way to counter inflation is putting money in savings accounts that offer attractive interest rates. Take the OCBC Premier Dividend+ Savings Account1 for example. An account exclusive to OCBC Premier Banking customers, it enables your entire savings balance to grow at up to 3.3 per cent yearly – which is higher than the MAS-forecasted core inflation rate of 2.5 per cent – as long as you, the account holder, deposit at least S$3,000 monthly and make no withdrawals within the month.

And from now till Sept 30, customers who deposit at least S$5,000 into their OCBC Premier Dividend+ Savings Account can enjoy a higher annual interest rate of 3.45 per cent as long as no withdrawals are made within the month.

Building a resilient portfolio

The survey also showed that one in five respondents prioritised protecting their wealth by focusing on low-risk or risk-free investments for growth. Conversely, over half of the respondents prefer to grow their wealth through higher-risk activities, such as investing or trading.

Regardless of risk appetite, building a diversified investment portfolio is another key pillar of a future-proof retirement plan, says Ng.

With OCBC Premier Banking, you can tap a broad range of investment products such as unit trusts, bonds, equities, real estate investment trusts and exchange-traded funds. These selections span across a number of geographical coverage, including those in Singapore, Hong Kong and the United States. Such wide variety can enable you to tailor your portfolio according to your specific financial goals and risk tolerance.

Bonds, for example, may offer a stable income stream as coupons are typically paid out on a regular basis. This can supplement other sources of income and contribute to the accumulation of a retirement nest egg. As a customer of OCBC Premier Banking, you can enjoy exclusive access to high-yield and corporate bonds.

The OCBC Premier Banking service makes it easier for time-starved professionals to manage wealth as well. Through the OCBC app, you get access to a comprehensive suite of products at your fingertips. The app also consolidates your investments and asset allocations, simplifying portfolio management.

As an OCBC Premier Banking customer, you have your own dedicated relationship manager who is just a phone call away. You may also drop by any of the over 60 Premier Banking centres across Asia for more services on investing and wealth management. This personalised support, combined with the bank’s expanded suite of products, can help you navigate the complexities of wealth planning.

Tapping financial insights from experts

OCBC Premier Banking customers receive weekly and monthly market insights published by a team of experts from OCBC Bank, OCBC Investment Research, Lion Global Investors, and the Bank of Singapore.

Twice a year, the bank hosts a by-invite-only market outlook seminar for customers in its OCBC Premier Private Client programme. OCBC Premier Banking customers enjoy exclusive invites to tune in virtually.

The aim of the OCBC Premier Banking programme, says Ng, is to give customers the opportunity to access exclusive services that can help optimise their investments so that they can be a step closer to their desired lifestyle and dream retirement.

“We are committed to supporting our customers every step of the way in their journey towards financial sufficiency and realising their vision of a comfortable, worry-free retirement,” he says.

To qualify for OCBC Premier Banking and unlock welcome rewards of up to S$12,350, deposit or invest S$350,000 (or equivalent in other currencies) in fresh funds with the bank2.

Contact OCBC to begin your OCBC Premier Banking journey today.

Unlock more perks with the OCBC Premier Private Client programme

- Clients who have grown their wealth to at least S$1.5 million can get an upgrade to the OCBC Premier Private Client (PPC) programme.

- On top of all the privileges and solutions enjoyed by OCBC Premier Banking customers, PPC clients also get to attend regular wealth seminars in person. At these events, they gain the latest market insights and global trends, meet like-minded people and network with members of the senior management at OCBC.

- PPC clients enjoy additional benefits that come with their Voyage credit card. These include the ability to earn 2.3 Voyage Miles for every S$1 spent in foreign currency and on local dining, unlimited transfers from their homes to Changi Airport, unlimited airport lounge access and support from a one-stop personal concierge.

- From now until Sept 30, deposit S$1.5 million in fresh funds to enjoy welcome rewards of up to S$52,5002.

General disclaimer:

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

This is for general information and does not take into account your particular investment and protection aims, financial situation or needs. You should seek advice from a financial adviser before committing to a purchase. Otherwise, you should consider the suitability of the investment.

Investments are subject to investment risks, including the possible loss of the principal amount invested.

All promotions, privileges and services mentioned are accurate as of the article’s publication date. OCBC reserves the right to modify or update these promotions and services at any time without prior notice.

Footnotes:

1 Insured up to S$100k by SDIC. Terms and conditions apply.

2 SGD deposits are insured up to S$100k by SDIC. Terms and conditions apply.

Copyright SPH Media. All rights reserved.