Singapore’s wealthy want advisers to incorporate AI into offerings: survey

There is, however, a ‘measured caution’ especially in terms of data privacy, accuracy and maintaining a human touch

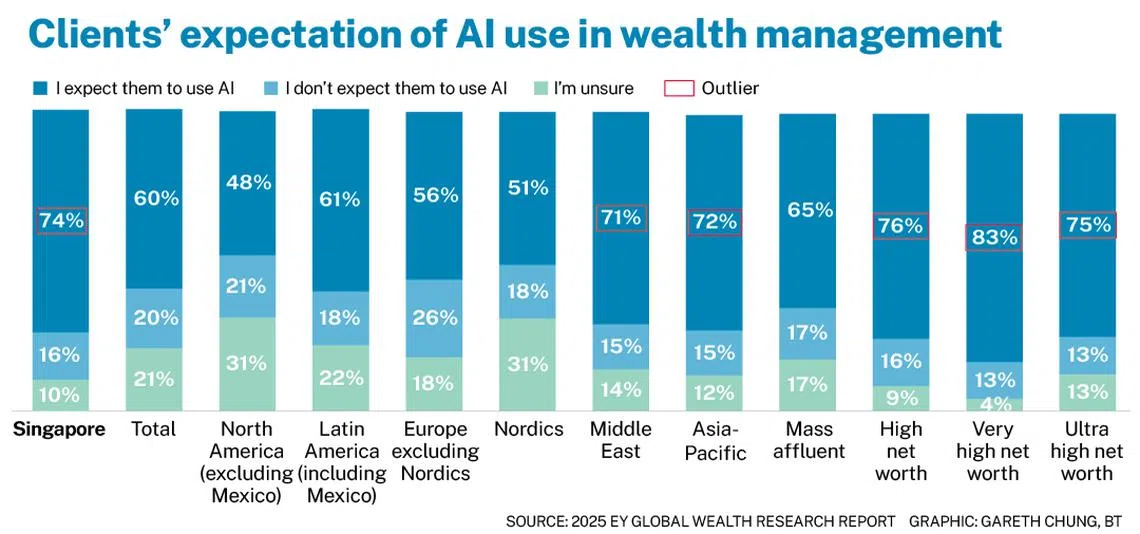

[SINGAPORE] Private wealth clients in Singapore expect their wealth managers or advisers to incorporate artificial intelligence (AI) into their offerings, more than clients globally or in the Asia-Pacific (Apac), the 2025 EY Global Wealth Research Report has found.

This expectation was named by 74 per cent of Singapore respondents, compared with the global average of 60 per cent and 72 per cent in Apac.

Yeoh Swee Yen, EY Asean financial services wealth and asset management leader, said Singapore clients are “the most forward-leaning in their expectations around technology”.

There is, however, a “measured caution” especially in terms of data privacy, accuracy and maintaining a human touch.

“They see the promise of AI, not just for efficiency but also for smarter, more predictive insights and seamless experiences... The challenge for wealth managers is to integrate AI in ways that genuinely add value – not just automate – and to do so without losing the trust and judgment that clients still rely on,” said Yeoh.

EY’s latest global wealth report, published once every two years, is based on a survey of about 3,600 respondents globally, including more than 170 in Singapore. Clients represented wealth segments spanning the mass affluent with between US$250,000 and US$1 million in assets, to the ultra high net worth with at least US$30 million.

For wealth advisers, the good news is that client satisfaction in Singapore and globally is high. The challenge, however, is that more than a third (39 per cent) in Singapore indicate they are likely to switch their primary wealth manager – higher than the global and Apac averages.

Investment performance is overwhelmingly the most important factor for Singapore clients in their selection of their primary wealth manager.

“High-net-worth clients in Singapore are increasingly eyeing a change in their primary wealth provider – driven by a strong desire for better investment performance and returns. At the same time, they’re becoming more proactive and hands-on with their portfolios, responding to ongoing market volatility with a sharper focus on cash and cash equivalents,” said Yeoh.

Over the next three years, 42 per cent of Singapore respondents plan to raise their portfolio allocations in cash and cash equivalents. This does not necessarily mean clients are risk-averse, said Yeoh.

“It reflects a desire to stay agile, liquid and responsive. After several years of market shocks and shifting macro conditions, many Singapore investors are prioritising optionality. They want the flexibility to move when opportunities arise, but without committing to long-term strategies that may no longer align with current market realities,” she added.

Globally, clients, especially in younger and wealthier segments, are contacting advisers more often and becoming more involved in decision-making. This is even more so among Singapore investors, 53 per cent of whom exercised more control over their investments compared with the global average of 44 per cent.

The survey found that while traditional investment products remain vital, 51 per cent of clients globally have some exposure to alternative investments, and advisers consistently underestimate client demand for alternatives.

Among Singapore respondents, 54 per cent have some exposure to alternatives and 33 per cent would like to learn more. But financial advisers have discussed alternative investments with only around 18 per cent of clients.

In terms of fees, a fixed fee structure has become the preferred pricing mechanism globally for the first time, followed by a performance fee (22 per cent). In Singapore, the preferred fee arrangement is performance-based (28 per cent), followed by a fixed fee (24 per cent).

The report noted a “strongly decreasing appetite” for transaction-based fees. Singapore clients’ preference for transaction-based fees fell from 20 per cent in 2022 to 8 per cent.

The majority of Singapore clients understand what fees are for, and believe they get value for money. But concern over hidden costs remains high at 65 per cent, compared with 45 per cent globally.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.