What’s behind China’s falling corporate bond yields

Investors need to differentiate between the bonds issued by local government funding vehicles in regions with varying financial strength.

ONGOING challenges confronting China’s property market and property bonds have raised investor concerns over the bonds issued by China’s local government funding vehicles (LGFV). LGFVs are set up by the local governments and primarily engage in financing, investing in and operating local public infrastructure and social welfare projects (public policy projects). While LGFV bonds are technically corporate bonds, investors typically price in some form of implicit support by the local governments.

The slowdown in land sales has led to a decline in the land transfer fees to the local governments, which historically have accounted for more than 90 per cent of local government funds and are an important source of local fiscal revenue. In addition, some LGFVs have participated either directly or in partnership with private property developers in real estate projects, and are also affected by the weaker property sales.

The woes of China’s property market have weakened the ability of local governments to support the LGFVs, as the shortfall between their fiscal revenues and expenditures rises. In view of this, investors would need to differentiate between the bonds issued by LGFVs in regions with varying financial strength.

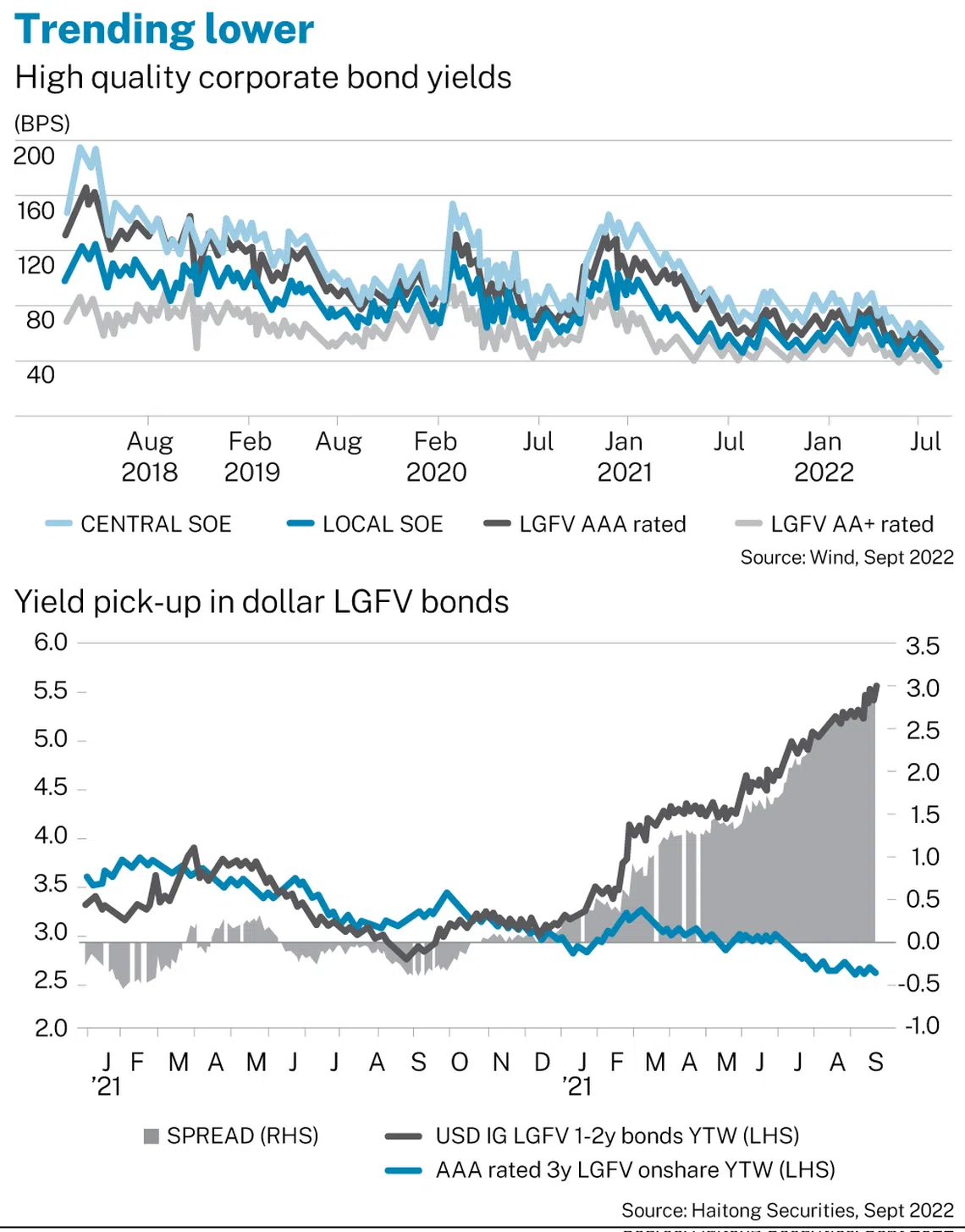

One would expect the spreads of the LGFV bonds and that of China’s corporate bond market to widen on the back of China’s troubled property market and overall growth concerns, but the reverse appears to be happening. While the 10-year China government bond yields have range traded in the last few months, the yields of higher quality LGFV and government-linked bonds have trended lower. Overall, the yields of China’s onshore corporate bonds are at historically tight levels. This has helped to underpin the performance of China’s onshore corporate bond market.

This phenomenon reflects the significant amount of liquidity that is residing in China’s interbank system, as banks remain reluctant to lend to private companies and creditworthy borrowers stay cautious. That the People’s Bank of China has kept monetary policy easy while other central banks are busy tightening has also helped.

As onshore bond spreads tighten, domestic investors, including banks’ wealth management subsidiaries and insurance companies, have turned to the offshore LGFV bond market, where the US dollar-denominated bonds offer a higher yield pickup over their local currency counterparts.

Amid healthy demand, supply is relatively tight in the dollar LGFV bond market due to the higher costs of financing arising from higher Fed rates. Tight supply would be positive for the prices of the existing bonds. That said, local knowledge and credit differentiation are important in accessing the dollar LGFV bond market, given the lower liquidity and unrated status of many of the issuers. In addition, investors often need to make a judgement call on the potential level of implicit government support – municipal, provincial or central – which would have significant bearings on the bond prices. For these reasons, many foreign investors may choose to forgo the opportunities within the offshore LGFV bond market.

As highlighted above, while uncertainty remains over China’s macro environment and policymaking, there will be tactical opportunities in China’s onshore and offshore bond markets for active managers. We expect China’s monetary policy to remain loose, although we believe that the odds of another policy rate cut this year have fallen. In our view, a cut to the reserve requirement ratio is more likely if China’s economic recovery remains subdued. We remain defensively positioned in duration and look for new opportunities, while re-balancing out of our local government bond trades.

The writer is head of fixed income, Eastspring China.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.