No alternative to the greenback and US investments – for now

Despite economic challenges, volatility in policymaking and the rise of alternatives, there are practical limitations to diversifying away from the US dollar and assets

DOOMSAYERS say “the end is nigh” when it comes to US hegemony.

Arguments ranging from an economy burdened by unsustainable deficits, to rising competition in a multipolar world, compounded by unpredictable policy, are often cited in support of fading US influence in geopolitics and economics.

In the investment world, many recommend diversifying away from both the US dollar and US investments.

We do not debate the conceptual validity of these arguments. However, not only do these trends take a long time to emerge, specific catalysts are as critical.

We posit that despite economic challenges, volatility in policy making and the rise of alternatives, there are practical limitations to diversifying away from US assets and the greenback – for now, there really is no alternative.

Challenges to US exceptionalism and the US dollar

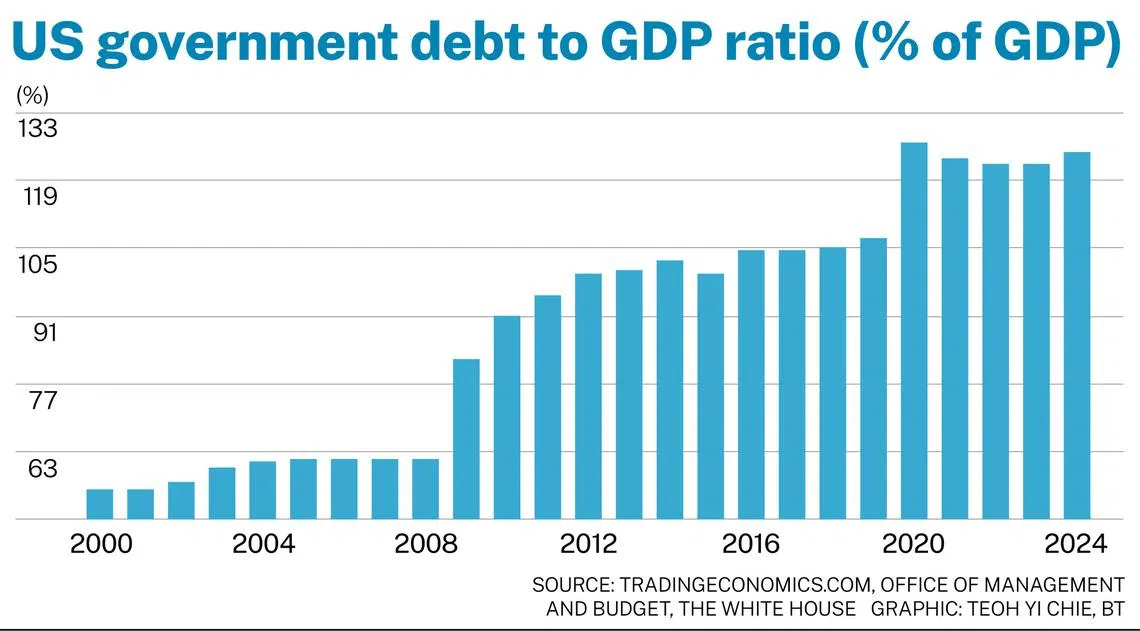

Even with the ability to print the world’s reserve currency, concerns and challenges to the US dollar’s dominance are valid. This is especially so when considering the US’ inability to balance its budgets, resulting in debt levels that now resemble emerging markets of the past.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

To compound the issue, neither the current administration nor previous ones appear interested in actually tackling the problem.

These, however, are not new issues; the same argument could have been made a year back too. What has brought the debate to the foreground is the divisive and volatile policy environment, potentially emboldening competition. In this respect, the US dollar’s unchallenged status is critical. If that is under threat, then so is US exceptionalism.

The challengers

A single, identifiable enemy is always easier than being flanked on multiple sides. The reality today, though, is a multipolar world – from the European Union to China and India, and of course the Global South.

The euro should have been the most viable challenger, but the common currency suffers from the lack of political union, which often challenges the currency union.

China clearly has ambitions, as does India, in promoting trade settled in their respective currencies, and at the margin, this is growing. In the case of China, arguably the one-belt initiative, akin to modern day colonialism, helps the cause.

Then there is the Global South – a very diverse grouping, seeking to challenge the world order and eventually the US dollar.

The problem with the challenge

A major limitation for the yuan or the rupee to become viable challengers, aside from the fact that they are not “freely convertible” currencies, is that they lack the depth and liquidity of the US treasury market to invest in.

We do trade in the yuan, but what can we buy with that – real estate? For the US dollar to lose its pre-eminent reserve currency status, there needs to be treasury alternatives in the yuan and the rupee and other such currencies. Marginal gains remain likely, but probably not enough to make a dent.

We remain deeply sceptical about the Global South, as it has deep ideological differences. A grouping so large is unlikely to be able to agree on decisions of magnitude. Besides, as seen in the case of the euro, a common currency minus political union can only go so far.

Can investors diversify?

One might argue that while the reserve currency status may not face an immediate challenge, investors have the theoretical ability to diversify away from the US dollar – albeit to a limited extent. But how meaningful is that opportunity set?

Investors seeking to invest in non-US dollar financial instruments – especially debt – face not just poor liquidity, but also a lack of choice. That can change over time; but for now, investing meaningfully in non-US dollar instruments is hampered by inadequate issuance.

When it comes to growth investing, aside from few choices in North Asia, the reality is a lack of choice. Europe, India or most South-east Asian countries simply do not have the inventive, innovative, cutting-edge technology companies to attract growth investors.

There are a few alternatives, such as in North Asia, but at an aggregate level, the scale of opportunity in the US is multifold, when compared to the rest of the world combined.

Gold and crypto

The romantics hark back to the purity and the self-regulating capabilities of the gold standard.

An argument can be similarly made for “digital gold” or Bitcoin. While theoretically possible, we find it a stretch to believe that central banks are even remotely interested in giving up control of monetary policy, especially the ability to print fiat currency.

For investors, these are currencies – we classify crypto not as assets, but as currencies – that deserve an allocation as currency diversifiers, but not enough to make a meaningful difference.

Is there a catalyst for change?

Our scepticism aside, and long-term as these changes may be, nothing – not even the US dollar’s dominance – is forever.

It is not that we wish for conflicts, but World War I marked the beginning of the end of the dominance of the pound sterling and the United Kingdom.

Major geopolitical upheavals can be a catalyst for change. In this respect, the outcome of multiple geopolitical flashpoints – territorial and economic – bears watching.

The writer is managing director and chief investment officer, Lighthouse Canton

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.