Why markets rise in the long run

Humans are meant to grow and multiply – the markets reflect this innate design

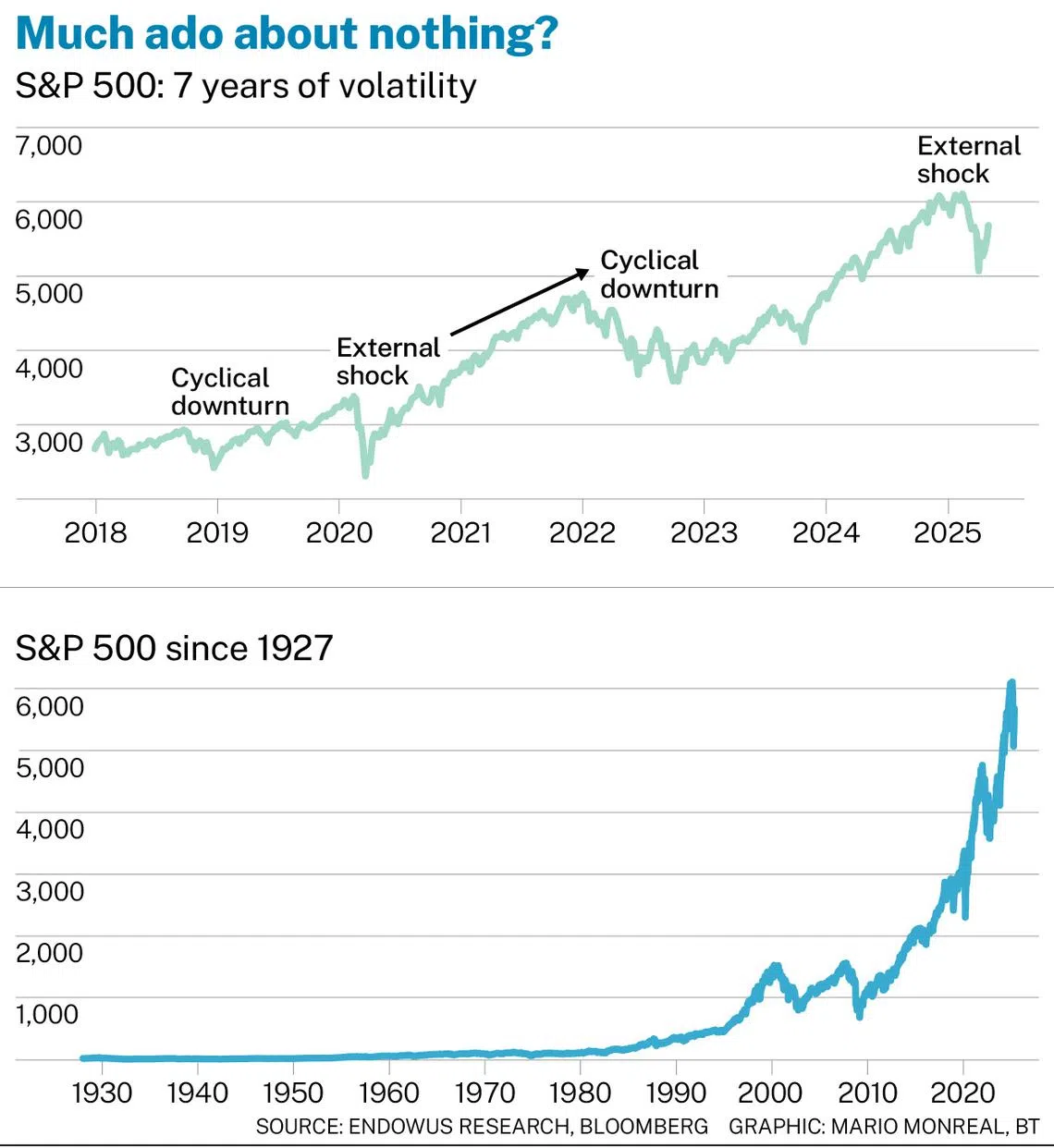

US STOCKS are on a tear. The S&P 500 has risen for nine consecutive days – the first time it has done so in nearly 21 years – rebounding by 14 per cent from the recent low. It was also the best nine-day winning streak in percentage gains in history. This was not supposed to happen.

When the US dropped a bombshell announcing new punitive tariffs on Apr 2, markets – already off their highs – plunged further. The subsequent shock and escalation of tariffs, especially between the US and China, led to sharp falls.

People were panic selling, questioning whether this was the beginning of the end. Concerns about a recession and a bear market arose. The term “stagflation” reappeared in the media and social posts. More than US$9 trillion in wealth was wiped out.

But then, almost overnight, things reversed.

On Apr 9, US President Donald Trump declared on social media: “This is a great time to buy.” That marked the bottom, and the market has not looked back since.

He also announced a pause on some tariffs and signalled a willingness to negotiate trade deals. This week, China quietly exempted about a quarter of US imports from tariffs, following a similar move by the US earlier. Now, there is even talk of negotiations. How quickly situations can change.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

And so, just weeks after intense volatility, the market has essentially returned to where it started. The global stock market is now flat for the year. Europe and China have performed better, but the US and tech sectors have lagged. In hindsight, it seemed to be much ado about nothing.

Why the best investors look further

In my 30 years of investing, I have found that the best investors – those who navigate volatility with grace – are not just skilled with numbers.

They are also historians and philosophers. They dig beneath the surface, looking beyond headlines and short-term market moves to discern the deeper forces at work.

Even greats such as Warren Buffett, Howard Marks, or George Soros do not attempt to time the market. What sets them apart is a strong investment philosophy and a grounded perspective. These traits enable them to stay patient, even when sentiment is at extremes.

Now is a good time to revisit one of those grounding perspectives: the idea that growth in markets – and in life – is embedded in the laws of nature. Investors often forget or overlook the inherent strength and power of markets, especially during periods of high volatility and uncertainty.

The universe expands – and so do markets

Since the beginning of time, the universe has been expanding. In fact, scientists say that the universe expands at an accelerating pace. The point of creation, or Big Bang, saw an initial rapid surge in early expansion, referred to by scientists as “inflation”. It is no coincidence that this same concept underpins our economic systems.

Humanity, likewise, has never stopped growing. Since the 1900s, the global population has ballooned; it is now crossing eight billion.

Similarly, global gross domestic product and the quantum of monetary or system liquidity have also continued to expand over time. Since the 1980s, global liquidity has entered an exponential phase of expansion.

In other words, it is inherent in our design and structure that there is an expansive, even inflationary, aspect to our growth. Humans are meant to grow and multiply. Markets reflect this innate design.

When sentiment swings from fear to optimism in a matter of days, it is tempting to react. But reacting is often the enemy of returns.

The sharp rebounds that we have seen – just like the drawdowns before them – underscore how difficult it is to time the markets consistently, which is why staying invested is so important. We are investing in a system that is inherently expansive, despite the bumps along the way.

The case for staying invested

Yes, earnings downgrades may happen. Analysts may project slower growth due to lower trade and reduced industrial activity. But analysts often overreact, boosting earnings too much in good times and slashing them too deeply in tough times. Earnings are a lagging, not leading, indicator.

The effects of shocks take time to play out. Covid-19 took two years to fully affect supply chains. Inflation, which surged in 2022, came well after the initial pandemic shock, and aggressive rate hikes followed. In 2022, as an economic cycle played out, the S&P 500 fell by 25.4 per cent from peak to trough.

What we now see is another external shock in the form of tariff policies; the market reacted and recovered quickly in a similar vein as in 2020 during the pandemic. Markets are efficient at pricing in bad news quickly, and recovery often starts well before the headlines improve. However, the longer-term consequences of current actions have yet to play out.

Diversification is a time-tested way to reduce risk and smooth out returns by gaining exposure to a range of sectors, regions and asset classes – not by chasing the performance of a single asset or trend.

The balanced allocation of 60 per cent equity and 40 per cent bonds has been working well this year to lower portfolio volatility. Gold is another asset that has helped to diversify portfolios.

However, as a Singapore investor, one must be aware that while gold has performed well, returns are slightly diminished when converted into Singapore dollars. Gold can be a good hedge against market volatility, but it is also a US dollar-priced commodity. Hence, there is a currency impact when calculating returns.

With Singapore’s prudent fiscal management, the Singapore dollar is seen as a relatively safe-haven currency and may continue to appreciate against the greenback over the long term. Investors should think in home-currency terms because our future liabilities are in Singapore dollars – and there is no need to take unnecessary currency risk.

Uncertainty is the only constant

Policy uncertainty remains high, and so has market volatility. Measures such as the CBOE Volatility Index and other financial stress indicators remain elevated, but we have already seen how markets rapidly price in negative news and sometimes reverse course before we can react.

What if Trump changes his tune again, perhaps ahead of next year’s midterms? What if growth slows, employment weakens, and the US Federal Reserve begins cutting rates?

We can neither predict these changes nor control the markets. We do not know what Trump might do next or where tariffs are headed. However, as an investor, there are some things we can control – our behaviour, discipline and investment process.

Emotions – especially fear and greed – are powerful. They can drive investors to chase returns, abandon plans, or take unintended risks.

Investing is less about predicting the next move and more about positioning oneself to benefit from the long-term expansive nature of markets by staying focused on one’s goals and being disciplined in one’s process. It is this faith in the power of markets that has driven the greatest success for investors over the long term.

The writer is co-founder and chairman at Endowus, a digital wealth platform with over S$10 billion in client assets across public, private markets and pension (CPF and SRS)

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services