Will the US market and dollar continue to underperform in 2026?

Whichever way they go, it still makes sense to diversify one’s portfolio, and to invest globally to dilute the currency effect

ANOTHER year has gone by with major stock markets at or near historic highs. Global equity markets, including the US, wrapped up 2025 with a strong finish. Expectations among Wall Street market strategists remain almost unanimously bullish for 2026.

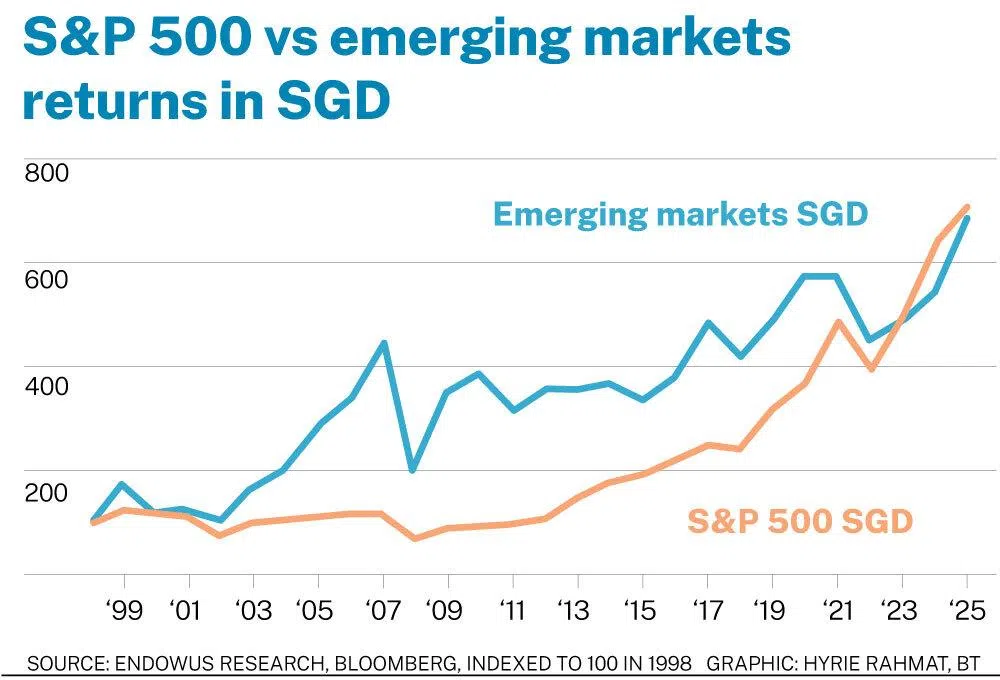

The popular S&P 500 index delivered a solid return of 17.9 per cent for the year in US dollar terms. This comes on the back of three consecutive years of positive returns. The index has risen in six out of the past seven years – each time by double digits.

Investors should be happy with such a return, but human psychology does not work that way because we compare. Unfortunately, the S&P 500 did not just underperform the tech-heavy Nasdaq index for the third consecutive year, it also underperformed global markets ex-US by a historic margin.

The Emerging Market (EM) index returned 33.6 per cent, and developed equity markets ex-US (MSCI World ex-USA) returned 31.9 per cent. The best-performing market globally last year was South Korea; the Kospi index delivered a stellar 75 per cent.

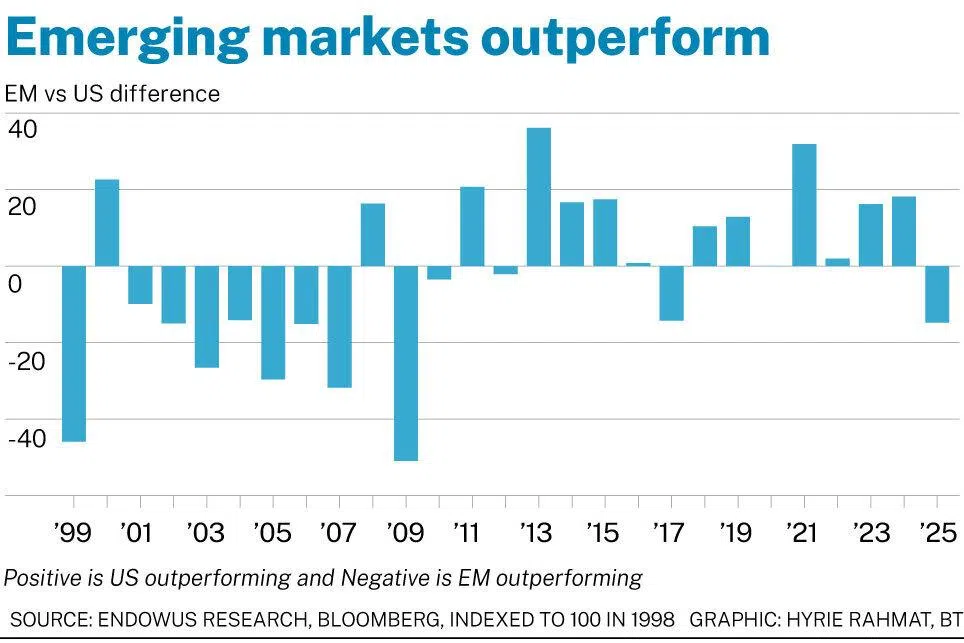

What is remarkable is that 2025 was the first time in eight years – and only the second time in 15 years – that EMs outperformed the US market. However, this was not always the case. After the tech bubble burst in 2000, EMs outperformed US markets for seven consecutive years between 2001 and 2007.

Double whammy: currency matters

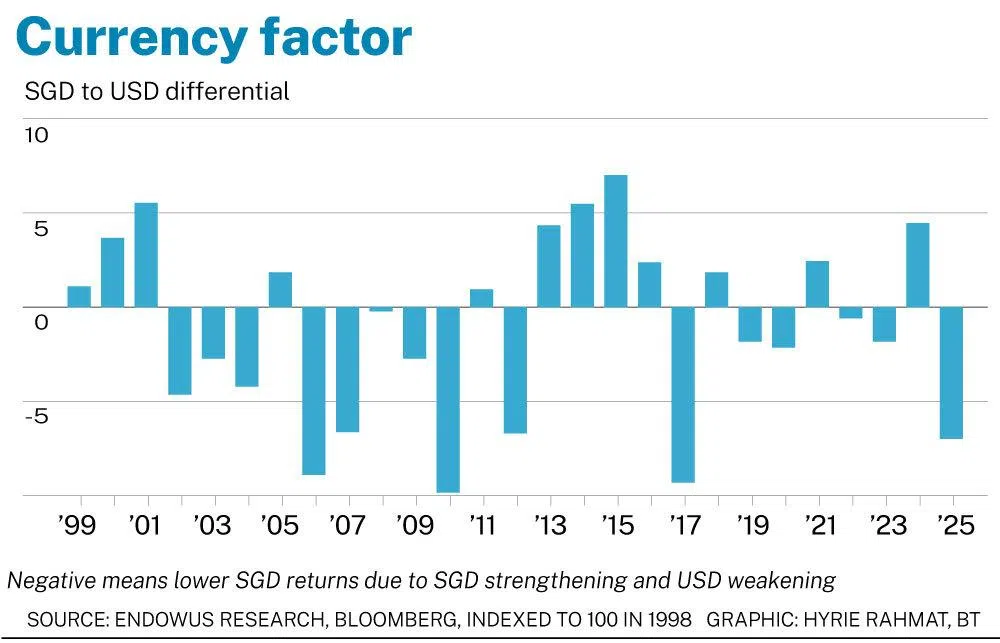

The currency impact added insult to injury for the Singapore-based investor. As the US dollar weakened against the Singdollar, returns from the S&P 500 in Singdollars were significantly lower, at 10.9 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The Singapore dollar has had 15 years of appreciation and 12 years of depreciation. In the years when it strengthened, the average appreciation was 4.6 per cent compared to the average depreciation of 3.8 per cent. Over the long term, the Singapore dollar appreciated against the US dollar, and was a drag on returns by an average 0.8 per cent per year.

It is then important to understand that when one invests in the S&P 500, the currency exposure would typically will take 1 per cent off the headline USD returns. This trend predates Trump, the tariffs and the popular dollar debasement theories. If you are bearish on the USD, then you’d need to be wary of investing heavily or making concentrated bets on just a single market like the US.

One way to negate this long-term impact of a stronger Singapore dollar is to invest globally, so that the currency effect is somewhat diluted by the diversified currency exposure.

Back to basics: what drives stock market returns?

Equity markets are fundamentally driven by three factors: earnings growth, multiple expansion and currency movements. Adding the payouts received through dividends gives you the total return for the market or index.

A company is highly affected by top-down macro factors such as economic growth or consumer demand for its products and services. Prices of goods and their input costs are influenced by and also drive inflation, which is closely tied with interest-rate policies.

Micro factors such as the company’s management and strategy, its investments and cost management also affect earnings. The combination of all these factors and many others drive profit growth.

Thus, when looking at earnings, it is more about where we are in the cycle. Over time, earnings almost invariably rise as the economy, trade and monetary base expand over the long term.

It is also a nominal number; inflation will raise it more and is thus a positive factor underpinning markets.

What happens in 2026?

The S&P 500’s performance in 2025 was largely grounded in earnings, which are estimated to have risen by 13.6 per cent. As we look towards 2026, the gears are shifting.

Earnings growth is likely to decelerate even if economic growth remains strong, as most expect. But economic growth could turn negative if a US recession takes hold. With dividends unlikely to change much and currency moves remaining highly uncertain, the only remaining lever for the US market is multiple expansion – that is, investors paying more for every dollar of profit.

The challenge is that US valuations are already high. At end-2025, the S&P 500 was trading at more than 22 times forward earnings – a clear premium to history. The US Cape (Cyclically Adjusted Price-to-Earnings) ratio remains near the 99th percentile of its long-term averages.

While valuations are notoriously poor as an aid to timing the market in the short term, they are incredibly helpful in setting long-term expectations. A higher starting valuation almost mathematically guarantees a lower return profile over the next decade, and vice versa.

Of course, if you draw out a positive scenario, it is feasible that US economic growth could remain robust, allowing companies to generate good earnings growth. Multiples, with falling interest rates, could expand further and companies may pay out higher dividends, resulting in another positive year.

But the bigger question is whether we could see a repeat of last year, when the US did exactly that – and yet left a lot of investors unhappy because of better performances elsewhere and the impact of a weaker currency that dragged on returns.

Whether markets rise or fall this year, being diversified is even more vital for your portfolio. The starting point for valuations remains significantly lower in most global markets outside the US despite last year’s outperformance. By diversifying, you aren’t just hedging your risk; you are positioning yourself where the mathematical probability of future returns is more in your favour.

This may also be the case for factors such as value versus growth, and asset classes such as fixed income and private markets.

Sometimes, less is more

As we begin a new year, it is easy to do one of two things. On one hand, the path of least resistance is to continue to extrapolate the current trajectory of markets and asset prices as we approach another historic high amid continued optimism in the markets.

On the other hand, we could expect markets to reverse or change course, even though underlying fundamentals may not change in a few days or weeks.

Over the course of more than 30 years of investing, one of the most common mistakes I have seen, and the biggest temptation investors commonly face, is thinking that we have to do something. The itch to take action as the new year begins is not necessarily good when it comes to investing.

Instead, we could focus that impulse and energy into becoming healthier, working on better relationships and pursuing learning so we can improve ourselves. Like new year’s resolutions, trying to do too much may be detrimental to achieving better outcomes.

By prioritising what matters and sometimes doing less and focusing on the important strategic allocations such as diversification, we may welcome and enjoy a year with fewer moves but better outcomes.

The writer is co-founder and group chief investment officer at Endowus, Asia’s leading digital wealth platform with over S$15 billion in client assets in public and private markets and in pensions (CPF and SRS).

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.