Why market returns can run ahead of CPF OA rate

Fear of investment loss keeps most CPF members from investing. But failure to invest lets inflation eat into savings, resulting in a smaller retirement nest egg

THE CPF monthly salary ceiling will rise progressively starting September and reach S$8,000 in 2026 from S$6,000 currently. Already one of the largest contributions of any national system globally, these increases mean that for every Singaporean, the CPF becomes even more important as a form of savings. It is a key vehicle in building a future nest egg and preparing for retirement adequacy.

This major Budget 2023 announcement was followed by several other changes since then – all aimed at addressing the needs of Singapore’s ageing population, the growing risk of old-age poverty, and securing retirement adequacy.

The latest announcement was a change to the Special and MediSave Accounts (SMA) rate to 4.01 per cent from 4 per cent. The SMA interest rate is pegged to the 12-month average yield of the 10-year Singapore Government Securities. That rate crossed the 4 per cent floor threshold, and so an adjustment kicked in.

People were surprised at the first increase in 15 years, and at the minuscule size of the rise. One blogger calculated that if you have S$100,000 in your SA, the increase in interest rate will be $5 for the year – just enough for a plate of chicken rice.

CPF-OA rates lag inflation

The OA rate also has a formula based on the three-month average of major local banks’ interest rates of 0.66 per cent. Despite the rise in interest rates, our banks are not really paying us a lot to keep our money there. As a result, the CPF floor interest rate for the OA at 2.5 per cent remains. The last time market rates exceeded the floor rate was in 1998.

Many have recently taken to investing in T-bills, especially for the OA funds. T-bills, however, are not a long-term solution, especially if interest rates start coming down. T-bill rates have already fallen back down to 3 per cent. Considering the opportunity cost of interest lost as we transfer funds in and out of the CPF account and the investing cost, the actual gain is small.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The OA interest rate has also consistently lagged inflation rates. The Singapore CPI has risen faster than 2.5 per cent in the past five years. Inflation is effectively eroding the purchasing power of CPF members, who have an increasing amount accumulating in the OA. If we are to build a meaningful nest egg that will support the future income and sustain our quality of life, we cannot afford to fall below inflation or even just keep up with inflation. We must do better.

Investing in financial markets empowers individuals to beat inflation rates. The power of compounding market returns through low-cost passive index investing has been proven over cycles and over decades.

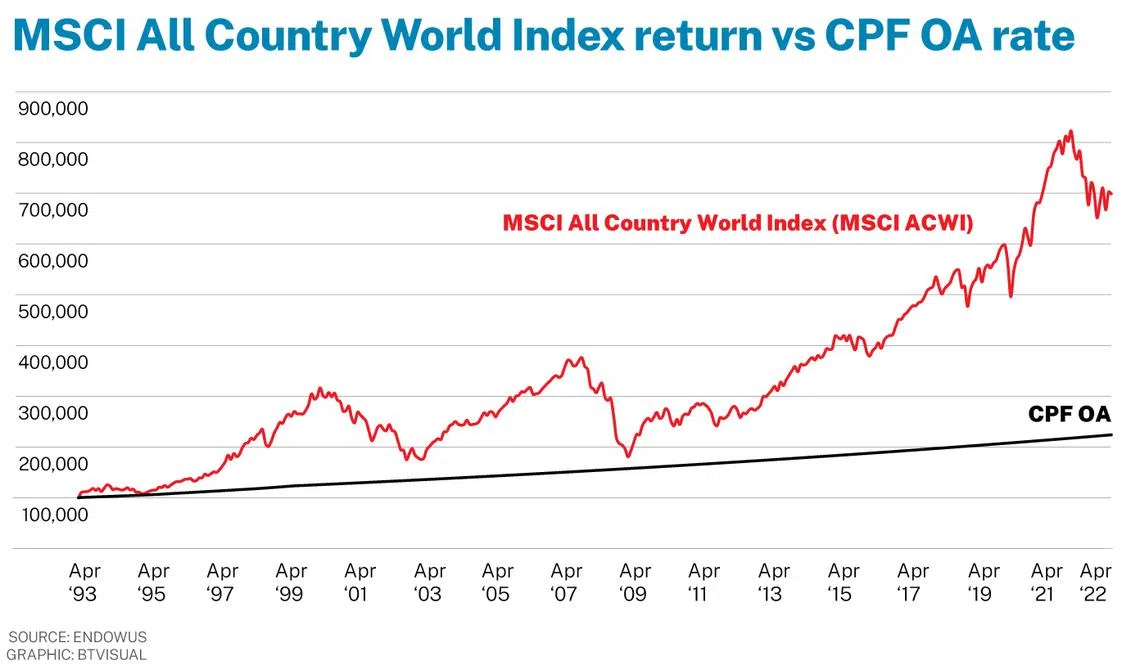

Based on the most recent end-May 2023 data, global stocks as represented by the MSCI All Country World Index (ACWI) have consistently beaten both Singapore inflation rates and the CPF-OA interest rate of 2.5 per cent, except the one and two-year period to May 2023 that included the market correction in 2022.

Even this year, the market so far has surprised with a healthy 9 per cent return, or 16 per cent on an annualised basis. From the lows of October 2022, markets have rebounded by double digits.

Overcoming fear to invest CPF savings

Many people say it is risky to invest your OA savings. Investing does incur the risk of losing money. We also know that without risk, there is no return.

One can argue that the only zero-risk option is the CPF, where the OA has no risk of losing money and pays a decent 2.5 per cent. But is market risk the only risk? The CPF’s purpose is to help secure our future. Thus the most important risk is failure to secure that future. If we do not invest, inflation eats into our savings and that translates to certainty of failure.

How do you improve your chance of success in investing so much so that it overcomes the fear of losing money? The answer is to invest over a longer time, especially amid high inflation.

Extending your investment horizon reduces your risk, as defined by the volatility of returns, significantly. The historical data for periods longer than 15 years shows a success rate – of not losing money – of 100 per cent.

It is impossible to forecast when markets will rise or fall. This year is a prime example. We have had sticky inflation, rising Fed rates, slowing growth, banks going bankrupt, US debt ceiling concerns, and growing geopolitical risk.

Yet markets are up year-to-date. This tells us that the market is not the economy. The market has bigger, profitable companies and sieves out bad performers and rewards companies that are successfully growing. It continues to increase the weight of the winners over time.

To build wealth over the longer term, we advocate investing on a regular basis into a core, diversified portfolio with an evidence-based approach, and without taking unnecessary concentration risk. The CPF-OA is a perfect pool of money to invest in this way.

Contribution and CPF rates may change further over time. But there is only one time-tested, proven way to invest in financial markets to achieve better success.

The writer is chairman and chief investment officer at Endowus, an independent wealth platform advising over S$5 billion in individual and family client assets across public and private markets.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services