China’s mammoth effort to get foreigners to spend, spend, spend

ON a visit to Beijing last June, Cecilia Skingsley joined her colleagues for dinner at a restaurant in the financial district on the west side of the city near the headquarters of the central bank.

But when the bill arrived, Skingsley, head of the innovation hub at the Basel-based Bank for International Settlements, was stumped. The restaurant wouldn’t accept cash and didn’t have a point-of-sale (POS) machine that could process overseas bank cards.

The only method of payment the restaurant would accept was via QR codes using the ubiquitous Alipay or WeChat apps which Skingsley, like most foreign visitors, did not have on her phone. A Chinese colleague came to her rescue and settled the bill by scanning the QR code.

Skingsley’s experience highlights the obstacles facing foreign visitors in China when it comes to paying for goods and services.

Whether taking a taxi, shopping, visiting tourist attractions or even buying a cup of coffee, in some cases, the only way to pay is via QR code scanning. Foreign bank cards and cash are of little use, leaving visitors with the problem of “have money, can’t spend.”

The problem has become more prominent since the pandemic, which accelerated the divergence in payment methods between China – which went down the path of QR codes – and the rest of the world, which, by and large, adopted near-field communication (NFC) technology, which allows contactless payment, or tap to pay.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Regulators have been pushing banks and nonbank payment platforms, such as Alipay, owned by Ant Group, and WeChat Pay, operated by Tencent Holdings’ Tenpay Payment Technology, to improve services for international visitors and make it easier for them to spend money.

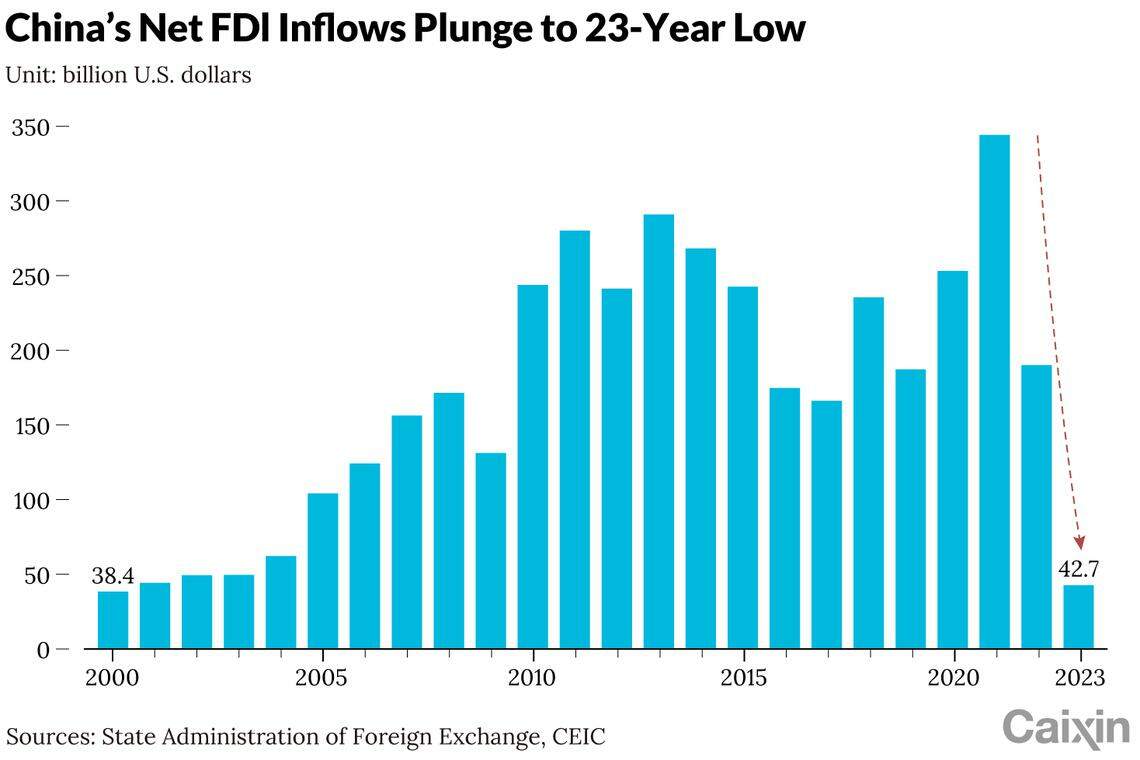

The campaign is part of a broader strategy to boost China’s attraction as a destination for overseas visitors and reverse a slump in foreign investment.

QR vs NFC

During the pandemic, global payment service companies like MasterCard accelerated the migration to NFC technology. MasterCard users can now tap to pay in most of its more than 200 foreign markets, and more than 60 per cent of its transactions worldwide are now completed this way, a source with the New York-based company told Caixin.

China’s digital payments system adopted a technology that allows the use of barcode or QR code scanning to make transactions via mobile phones.

The unfamiliarity of this system to overseas visitors left many struggling to pay for goods and services. The problems were compounded by the onerous sign-up process for foreigners to set up a WeChat Pay or Alipay account in China, which includes a requirement for real-name authentication.

The situation started to improve in 2019 when Alipay and WeChat Pay, which together account for more than 90 per cent of China’s nonbank mobile payments market, allowed overseas users to link certain international cards to their apps, but the service only allowed them to transact with a limited number of merchants.

In recent years, the two platforms have made upgrades that allow users to link overseas cards issued by global payment companies such as Visa, MasterCard and JCB to their apps, giving them access to tens of millions of local merchants.

International users now can spend up to 3,500 yuan (S$664) via Alipay without going through the full identity verification process, sources close to the platform told Caixin.

Foreign users of WeChat Pay can now link their overseas bank cards for payments under a specified amount without providing full identity information, while the identity verification process has been simplified.

WeChat Pay has also waived transaction fees for users with foreign bank cards on payments of 200 yuan or less to meet their needs for low-value, high-frequency purchases, although transactions over that amount are subject to a 3 per cent fee, according to a Tencent statement in July. Alipay has a similar policy.

Under central bank guidance, the two digital payment behemoths have raised the cap on a single mobile payment for foreign users to US$5,000 from US$1,000 and the limit on their annual mobile payments to US$50,000 from US$10,000, according to their statements in March.

But the government wants banks and payment platforms to do more to help overseas visitors.

The State Council, China’s Cabinet, released a directive on Mar 7, urging them to streamline registration processes for their payment apps, and make sure there is a choice of payment methods in areas that draw large foreign footfall.

Disappearing POS machines

International visitor arrivals collapsed during the pandemic and have failed to recover to pre-pandemic levels since China reopened its borders. That has fuelled a slump in the use and installation of ATMs and POS machines, a standard payment method in Western countries.

“After three years of the pandemic, QR code payments have become mainstream in China, resulting in a significant reduction in the number of ATMs for cash withdrawals,” an employee in the credit card department of a Chinese joint-stock bank told Caixin. “Many places no longer have POS machines.”

The central bank has been pushing to make payment methods more convenient for foreigners, including increasing the acceptance of foreign bank cards, improving mobile solutions, and upgrading ATMs to facilitate cash withdrawals, Zhang Qingsong, a deputy governor at the People’s Bank of China, said at a briefing in December.

But the roll-out of POS machines that accept overseas cards has been slow due to concerns among foreign card payment networks and local merchants about the cost.

Multiple sources with global card networks told Caixin that signing up new merchants to accept foreign card payments requires investment for Visa and MasterCard and if they don’t process many transactions, it’s not cost-effective.

These card networks need to weigh the financial implications carefully.

That means taking a strategic approach to expansion that prioritises certain areas over others, rather than rolling out a widespread installation as domestic rival UnionPay has done, the sources said, referring to the state-owned financial services group that provides bank card services including POS systems and an interbank network that links all the ATMs across the country.

“It’s improbable that we would concentrate our efforts on promoting POS machines at merchants where only a handful of transactions with foreign cards occur annually,” one of the sources said.

Too expensive

Local merchants are also wary of adopting these devices due to the higher fees involved. Retailers with domestic payment systems are typically charged 0.6 per cent of the value of transactions, with reduced rates applicable to certain transactions, according to a report from Ping An Securities last May. In comparison, fees for transactions using foreign cards typically range from 2 per cent to 3 per cent of the transaction value, which disincentivises local merchants from using systems that process payments made via foreign bank cards.

The installation of new POS terminals exclusively for foreign card transactions would not be a long-term solution, an employee at Visa told Caixin.

One viable alternative would be to enable China’s current array of POS systems to accept both local and international bank cards, he said, adding that Visa is looking into the possibility of leveraging the capability of China’s existing POS infrastructure.

In terms of solutions for those who still want to pay by cash, banks have been asked to build more foreign currency exchange facilities, especially at major ports, airports and hotels, according to the State Council’s directive. Authorities should continue the ongoing rectification campaign against merchants who refuse to accept cash payments, it said.

The central bank has been exploring the use of its digital yuan to make it easier for overseas visitors to pay for goods and services. The digital currency received a major push during last year’s Asian Games in Hangzhou, thanks to a new feature that allows foreigners in the country who download the digital yuan app to top up using their overseas bank cards. One type of digital yuan account is permitted a daily payment maximum of 5,000 yuan without requiring full identity verification. CAIXIN GLOBAL

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Global

China’s BYD shows effects of price war with weaker first-quarter earnings

Red Cross finances ‘stabilised’, new chief says

China’s Xi to visit France, Serbia and Hungary, aims to boost EU ties

Japan’s yen jumps against the dollar on suspected intervention

India tech tycoon’s family office bets on AI to prop US$10 billion fund

Japan’s proposed export curbs will impact normal trade, China says