J-Trust stands firm behind LCD purchase (Amended)

Japanese financial giant sees LCD as its primary platform for property and property-related business across Asia

JAPAN'S J-Trust Group's acquisition of Singapore listed hospitality group LCD Global Investment has caused consternation among some of the latter's minority shareholders. The crux of the unhappiness surrounds the fact that the Tokyo-listed financial giant bought 29.5 per cent of LCD - just shy of the general offer mark - leaving minorities no exit route, should they choose to bail out.

With the founding Lum family now out of the picture, many are also unsure of the fate and direction of the Singapore-listed company under its new controlling shareholders.

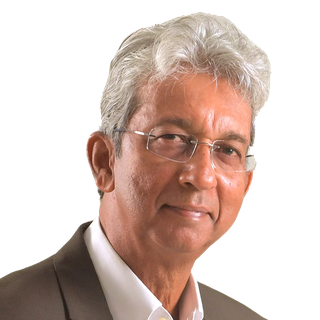

But J-Trust's president and CEO, Nobuyoshi Fujisawa, who is now also executive director of LCD, insists that such fears are misplaced. "LCD will simply grow and flourish, supported by the resources and networks of J-Trust," he told BT in an exclusive interview.

Indeed, armed with some US$1.4 billion in cash (following a US$1 billion fund raising last year), J-Trust has a considerable presence in the non-bank financial space in North-east Asia.

Starting out in 1977 as Ikko Shoji, a modest-sized Osaka-based financial player dealing in factoring and small business loans, it listed on Osaka's second board in 1998. By 2005, it was taken over by Zenkoku Hoshou Co. Three years, later, in March 2008, Mr Fujisawa bought out Zenkoku Hoshou's controlling stake in the company, and renamed it J-Trust Co.

Over the next few years, Mr Fujisawa - who owns 32 per cent of the company - expanded its portfolio, acquiring various financial and property players throughout Japan.

In 2011, it relocated its headquarters in Tokyo, culminating in its Tokyo listing last year, where it now has a market capital of US$1.5 billion.

Over the past three years, the company has expanded its pan-Asian footprint, buying businesses in South Korea and Indonesia, and most recently, Singapore. It bought a 20 per cent stake in Indonesia's Mayapada Bank in December last year, acquired KJI Consumer Finance LLC and HICAPITAL Co in South Korea in March this year, and is in the process of buying Indonesia's currently-defunct Mutiara Bank from the Deposit Insurance Corp of Indonesia with the intention of reviving it.

Financial services business such as credit cards, consumer finance and credit account for 41 per cent of the group's 62 billion yen (S$724 million) revenue, while amusement business accounts for 27 per cent, followed by international financial business, including investments, consumer finance and banking businesses in South Korea and more recently in Indonesia.

But property is one business where it has huge ambitions, according to Mr Fujisawa. "We were keen to grow J-Trust's property footprint not just in Japan but also across Asia, particularly South-east Asia," he said

It was with this in mind that Singapore-based J-Trust Asia was set up as its South-east Asian headquarters last year. J-Trust Asia is headed by Shigeyoshi Asano, who is also an executive director of LCD now.

According to Mr Fujisawa, LCD appeared on J-Trust's radar screen as a strong property player with a regional presence.

"It had a good management team, strong balance sheet and great assets, with brand presence in Singapore, Thailand, China and London," he said. "Most importantly, they had expertise we didn't have in the property and hospitality segment in these markets." He sees LCD as J-Trust's primary platform for its property and property-related business across Asia, particularly South-east Asia with its 600-million population. The plans include powering LCD as it builds and acquires new assets in hospitality and property investments across South-east Asia and China.

"We will finance LCD's expansion via our Nihon Hoshou credit guarantee and loans business," he added.

"While individual markets may vary, economic growth is very much intact, supported by population and wealth growth. For example, even as the Singapore property market softens, there are opportunities in other neighbouring markets. But even here in Singapore, we are looking at entering the hotel, residential property and office property market, as long as the price is reasonable and the longer term returns are acceptable."

One market which J-Trust is keenly watching is Japan, where there are moves afoot to relax rules in the gambling-gaming sector.

"There is strong synergy between gaming and hospitality," he said. "We bought a 10 per cent stake in a Jeju Island (South Korea) gaming business recently. If Japan's gaming laws are changed, we want to be ready to participate."

And LCD would be the J-Trusts vehicle to participate in this segment, he added.

An earlier version of this article incorrectly stated that the company bought a 10 per cent stake in Indonesia's Mayapada Bank. It is in fact 20 per cent. Also this article incorrectly stated that the company is in the process of buying Indonesia's currently-defunct Mutiara Bank from the Tahir family. It is in fact from the Deposit Insurance Corp of Indonesia. The article above has been revised to reflect this.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Huawei’s new phone sports latest version of made-in-China chip

Meta’s earnings flop sparks US$400 billion sell-off in tech stocks

Singapore shares open lower on Friday; STI down 0.1%

OUE wins tender to lease, develop new ‘zero-energy’ hotel at Changi Airport’s T2

Roku’s warning on ad-supported streaming competition clouds upbeat earnings

Stocks to watch: CLI, Great Eastern, MIT, Sheng Siong, iFast, OUE, Far East Orchard