Oil treads US$60 line to lift O&M stocks

Oil and gas stocks on SGX extend rally to almost 2-year high as inventories fall; analysts see oil price pullback on overbuying, shale threat

Singapore

AS INVENTORIES fall and expectations build on a sustained output cut, Brent crude oil prices stayed above the psychologically important US$60 a barrel mark for a third day in a row.

Singapore Exchange (SGX) oil and gas stocks, as represented by the FTSE ST Oil and Gas Index, traded near a 23-month high, propelled by optimism that the worst is over.

Torbjorn Kjus, oil market analyst at Norway's DNB Bank ASA, told The Business Times that in the short term, the benchmark Brent market is vulnerable to profit taking.

A catalyst could be oil cartel Opec (Organization of the Petroleum Exporting Countries) not extending a deal on output cuts, he said.

Recent comments by major producers Saudi Arabia and Russia have led the market to expect output cuts ending March 2018 to be extended till the end of the year. The decision might be made at a meeting in Vienna at the end of the month.

"The market is currently technically overbought," Mr Kjus cautioned, adding that financial players are also holding record net long positions.

Norbert Rucker, head of macro and commodity research at private bank Julius Baer, is staying cautious and expects oil prices to fall back to US$45 to US$55 a barrel.

North America inventories can build up again as the market enters a seasonal soft patch, with refineries slowing crude oil purchases for maintenance reasons. The inventory situation in Europe and Asia is also not as positive for prices, he said.

Another reason to be cautious is US shale producers, which can flood the market should prices become too attractive. "The theory of the shale cap on oil prices is being tested again. We still believe that it holds true, but if not, we would need to revise our oil view," Mr Rucker said.

Since crashing in mid-2014 from prices of above US$100 a barrel, Brent crude has mostly traded in the US$40s and US$50s.

But evidence is mounting that the supply-demand balance is flipping in favour of higher prices.

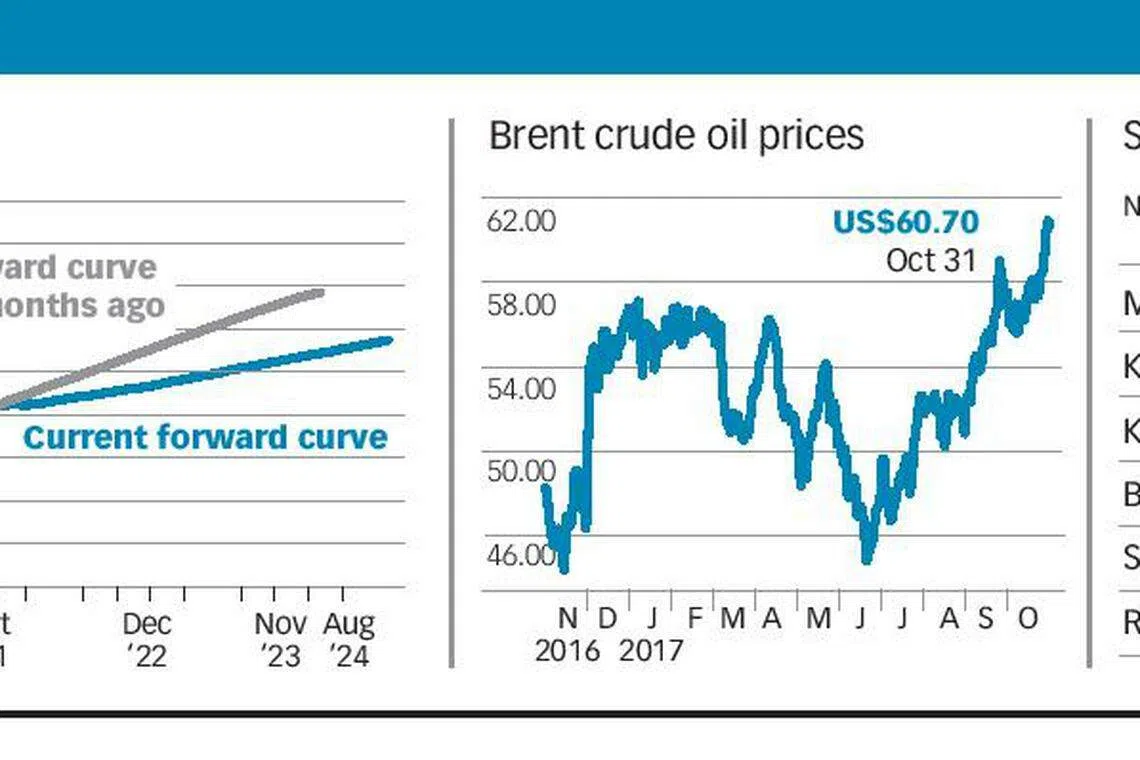

Commodities contracts should in theory trade at higher prices the further the expiration dates into the future, due to holding costs like warehousing fees and interest forgone.

This has been the situation since the oil price crash.

The relationship has flipped in the past two months, with oil for delivery in the near term more expensive than deliveries further down the road.

Known in industry jargon as backwardation, this market structure implies it is no longer as profitable to store oil for the future due to high current demand. Backwardated forward curves have historically coincided with strong crude prices.

An October blog post by fixed income manager Pimco said: "The shape of the oil curve has historically been one of the best predictors of future returns ... Subsequent four- and 12-week returns for long oil futures positions in backwardated oil markets have averaged 1.3 per cent and 2.9 per cent, respectively."

Meanwhile, continued global economic growth has led to strong oil demand growth this year. A range of official statistics are now showing lower crude oil inventories, supported by anecdotal evidence in floating storage and in storage facilities like in South Africa's Saldanha Bay.

Continued demand for commodities is likely to be supported by strong economic and manufacturing data around the world, said Kelvin Tay, regional chief investment officer at UBS Wealth Management.

In Singapore, the past month saw companies with rigbuilding businesses like Keppel Corp and SembMarine rally along with Brent oil prices.

"Tactically, I think the (offshore and marine) sector should do well in the next three to four weeks as the market becomes more confident that the offshore drilling sector outlook is stabilising," said Kum Soek Ching, head of Southeast Asia research at Credit Suisse Private Banking.

There could be interest to rotate into offshore and marine stocks after the sector's performance lagged properties and tech in the third quarter, she said. But oil price movements will be a key driver, along with contract wins.

"At 1 to 1.5 times book, valuations have not recovered by much, so the market is also not pricing in any significant improvement in return on equity," she said.

READ MORE: Sembmarine back in the black with Q3 net profit of S$2.72 m

Copyright SPH Media. All rights reserved.