Temasek's SGX-listed trusts averaged 42.2% return in 3 years; DBS is portfolio's top performer

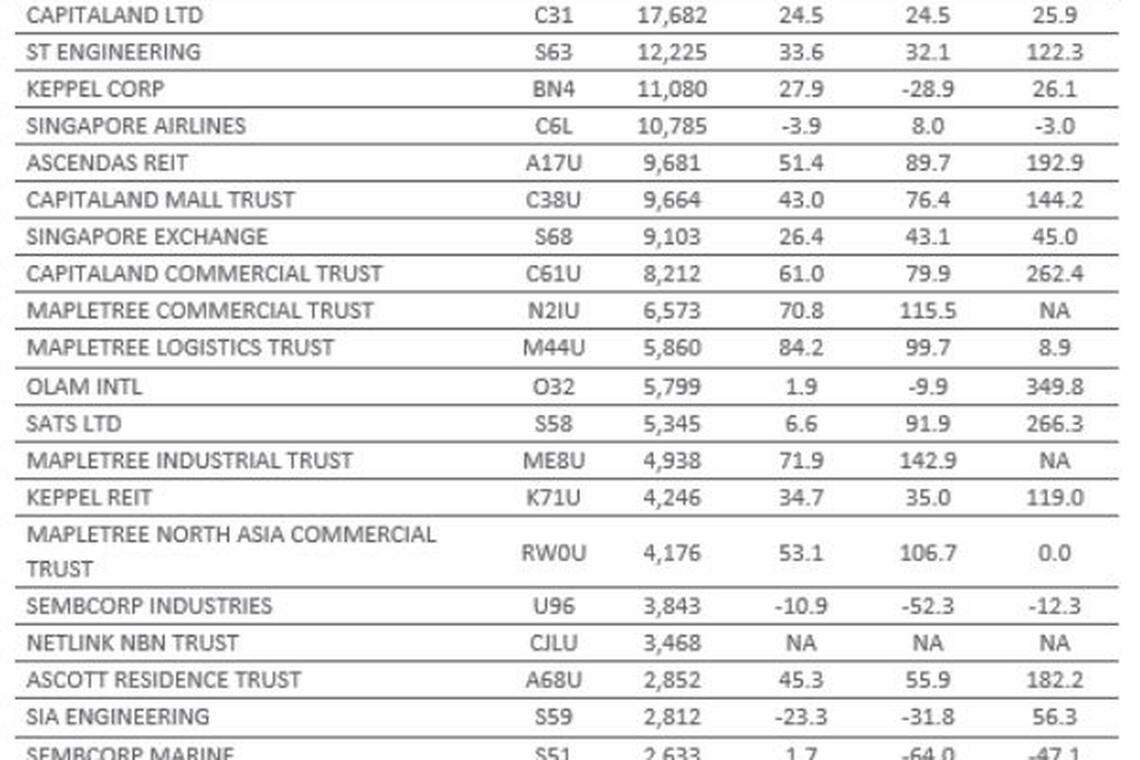

AMONG Temasek Holdings' Singapore-listed investments, the 10 trusts in the portfolio averaged a three-year total return of 42.2 per cent as at Sept 20.

This brought the five-year and 10-year total returns to 67.4 per cent and 82.7 per cent respectively for the 10 trusts, the Singapore Exchange (SGX) said on Tuesday evening in a report on Temasek's investments.

Meanwhile, the 15 SGX-listed companies in the portfolio averaged a three-year total return of 6.1 per cent, as well as five-year and 10-year returns of 0.2 per cent and 82.6 per cent respectively.

The state-owned investment firm's portfolio includes at least 25 listings in Singapore, comprising the 15 companies and 10 trusts with a combined market capitalisation of over S$260 billion, SGX said.

Among companies, the best performers in the last three years based on total return were DBS (88.5 per cent), ST Engineering (33.6 per cent) and Keppel Corporation (27.9 per cent) as at Sept 20. On average, the trio had three-year, five-year and 10-year total returns of 50 per cent, 24.4 per cent, and 109.9 per cent respectively. All three stocks are constituents of the benchmark Straits Times Index (STI).

As for trusts, the top SGX-listed performers in Temasek's portfolio over the same period were Mapletree Logistics Trust (MLT) (84.2 per cent), Mapletree Industrial Trust (MIT) (71.9 per cent) and Mapletree Commercial Trust (MCT) (70.8 per cent). They averaged a three-year total return of 75.6 per cent, bringing their five-year total returns to 119.4 per cent.

MCT was added to the STI on Monday, with an approximate 1.5 per cent index weighting. MLT has been on the Reserve List - which comprises the five largest non-constituents of the STI, by market cap - while MIT replaced MCT on the Reserve List on Monday.

Temasek's Singapore exposure - which stands at 26 per cent - has grown by S$41 billion over the last decade, as at its March 31 financial year-end.

The portfolio also has a 40 per cent exposure to Asia ex-Singapore, and 34 per cent exposure to the rest of the world.

Having anticipated an increasingly challenging environment since last July, the firm moderated its investment pace, investing some S$24 billion and divesting S$28 billion during the year ended March 31.

The entire portfolio had a net value of S$313 billion as at March 31, up S$183 billion over the last decade. The portfolio value is based on share prices for listed investments, and book values for unlisted investments. The 10-year total shareholder return (TSR) stood at 9 per cent as at March 31, while the 20-year TSR was at 7 per cent.

Aside from the 25 main portfolio stocks listed in Singapore, Temasek also holds small stakes in other SGX-listed companies such as UOB, OCBC Bank and City Developments Limited, the bourse operator noted on Tuesday.

Similarly, Temasek's portfolio companies CapitaLand and Keppel Corp also have major investments in other listed entities, while companies such as Singapore Post have named Temasek as a deemed substantial shareholder through Temasek's interests in Singtel and DBS.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Porsche posts Q1 profit drop on ramp-up costs

IBM plots US$730 million expansion of Canadian semiconductor site

Seatrium unit to fully redeem S$500 million worth of floating-rate bonds early

Yeo Guat Kwang, John Chen retiring from corporate boards

US: Wall St opens higher

Air China orders homegrown C919s in challenge to jet duopoly