Only 14% of sustainability-linked bonds aligned with key climate goal: report

SLBs have faced considerable criticism since their 2021 boom, and much of this is valid

JUST 14 per cent of sustainability-linked bonds (SLBs) are in line with the Paris Agreement’s goal of limiting the rise in global temperatures to below 2 deg C, said a report released on Wednesday (Mar 27) by the non-profit Climate Bonds Initiative.

“The current SLB market contains a high share of low-quality deals that lack ambition, credibility, and adequate disclosure,” said the report, which was sponsored by the Singapore Exchange.

As at November 2023, a total of US$279 billion had been raised across 768 SLBs globally. Of these, only 105 bonds, representing US$47.2 billion, are “aligned” under a classification system known as the SLB Database (SLBDB).

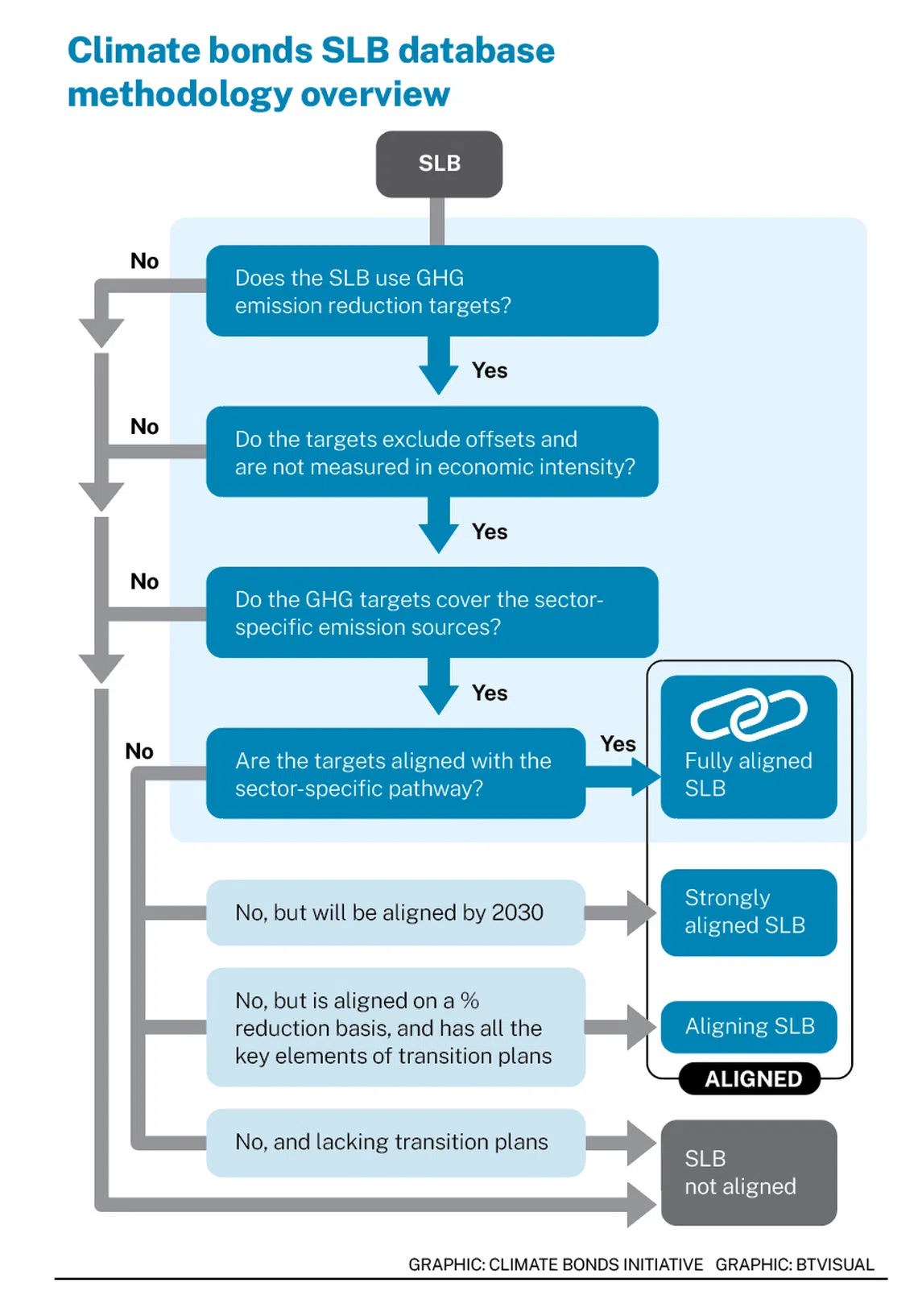

The system, created by the Climate Bonds Initiative, is based on alignment with the Paris Agreement’s 2 deg C goal. Under the SLBDB, bonds are deemed to be “fully aligned”, “strongly aligned”, “aligning” or “not aligned” – depending on factors such as their use of greenhouse gas emissions targets and being in line with sector-specific decarbonisation pathways.

Of the 663 SLBs deemed “not aligned”, 320 lacked greenhouse gas targets; another 200 had only partially covered the scope of greenhouse gas emissions in their targets.

In particular, many SLBs’ targets do not include Scope 3 emissions – the indirect emissions arising from supply chains. This is even though such emissions are highly material in many sectors.

A NEWSLETTER FOR YOU

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

The report recommends SLB targets be linked to relevant reporting standards and regulations, without using opaque ratings and scores. At least one target should be related to climate mitigation, with Scope 3 emissions included if material.

“Regulators could enforce rules around key performance indicator selection, possibly on a comply-or-explain basis at first. Materiality assessment guidance for each sector should be provided given region-specific contexts, with rules linked to this,” the report said, adding that monitoring mechanisms should be implemented.

Need for more guidance

The report also flagged other areas where regulators and standard-setters could develop guidelines and rules for the structuring of SLBs.

There is a lack of transparency around SLB disclosures, for instance, such as what their targets are or what frameworks they rely upon. The report recommends that SLBs should be aligned with Sustainability-Linked Bond Principles, a set of guidelines by the International Capital Market Association.

Callable SLB structures, meanwhile, may face an issue when call dates precede target or trigger dates. This would give issuers the option to call the bond if they know the targets will not be met, thus avoiding or reducing their financial penalties.

To mitigate this, the report suggests call dates come after at least the first target and trigger date. In cases where the call date precedes the target date, the call price should reflect an assumption that the target has not been met.

Regulators should “monitor misuse of callable structures, especially in periods of falling interest rates which increase the incentive to exercise call options”, the report said.

“Monitor the proportion of call options among SLBs, and especially the extent to which they are exercised. Legal clauses should also be monitored to ensure they are not used in bad faith,” it added.

Assurance is yet another area for improvement. While the majority of SLB issuers obtain assurance, its level and scope can still be improved, said the report. The best practice is for issuers to assure target performance annually before and after the target date, as well as the entirety of their sustainability reporting.

The report acknowledged that SLBs have faced considerable criticism since their 2021 boom, and that much of this is valid. The problems lie in inadequate structural and calibration features, however, as well as companies’ weak underlying plans for transition – and not with the sustainability-linked concept.

Greater standardisation of SLB structures “would facilitate the introduction of supportive policies and the acceptance of such instruments for regulatory classifications, widening the pool of investors”.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

ESG

Why decarbonisation is so hard

Basel Committee adds climate risks to banking supervision standards

Temasek-BlackRock joint venture closes inaugural decarbonisation-focused fund at US$1.4 billion

As COP29 planning begins, reforms needed to fulfil Paris ambition

How should investors assess climate transition risk in their portfolios?

Climate court ruling could set precedents in Europe and beyond