Sea rides digital wave to emerge as Singapore's most valuable listed firm

Singapore

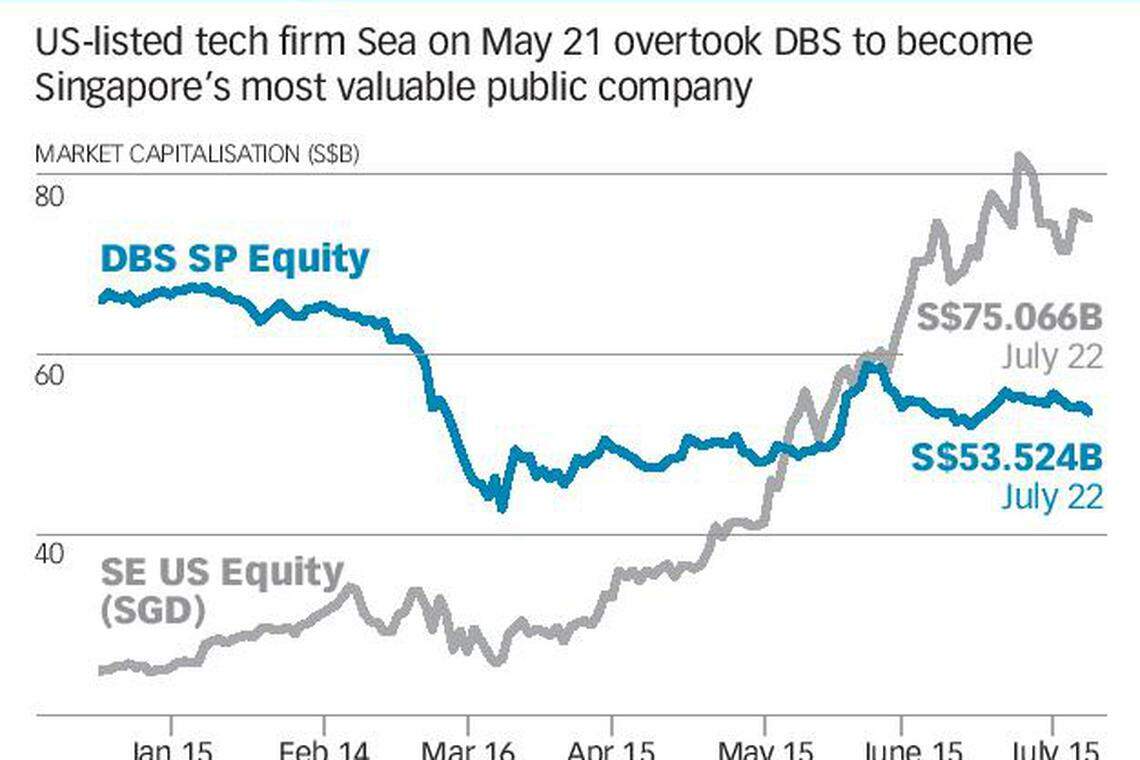

CONSUMER Internet firm Sea Ltd, the parent of e-commerce platform Shopee, has surpassed DBS Group Holdings to become Singapore's most valuable homegrown public company.

Sea, which is listed on the New York Stock Exchange (NYSE), was valued at S$52.2 billion on May 21, overtaking DBS' market capitalisation of S$49.4 billion. As at July 22, its lead has widened - the group was valued at S$75.1 billion, compared with DBS' S$53.5 billion.

The boom in Sea's share price comes amid a rally in technology stocks in the US despite the global economic downturn. Investor appetite has surged for companies with operations in enterprise software, cloud computing, e-commerce, digital entertainment and gaming.

The tech-rich Nasdaq Composite has risen 19.3 per cent year-to-date, outperforming the Dow Jones Industrial Average's -5.37 per cent and the S&P 500's 1.4 per cent. This comes amid a rapid shift to digitalisation for companies and changing consumer habits as the pandemic forces masses of people to go online.

Shares in Sea had been steadily climbing even before the pandemic. The company's share price rose 255.3 per cent in 2019 to close out the year as a top-performing foreign stock on a US stock exchange, beating Chinese tech majors Alibaba and JD.com.

A NEWSLETTER FOR YOU

Garage

The hottest news on all things startup and tech to kickstart your week.

Sea operates three main lines of business - a gaming arm called Garena, the e-commerce arm Shopee and a digital financial services business called SeaMoney.

Since its initial public offering (IPO) at US$15 in October 2017, the stock has returned 664.3 per cent, easily beating the NYSE Composite index's return of 9.35 per cent.

At US$114.65 as of the close of the market on July 23, the shares were trading at 19 times Sea's 12-month trailing revenue; the company has been loss-making since its IPO.

Despite this, analysts remain bullish about the group's prospects. According to data from Bloomberg, 13 out of 15 analysts have a "Buy" call on the stock. The consensus target price was US$115.97.

Analysts point to the stability and strong momentum of Garena, which is Ebitda (earnings before interest, taxes, depreciation, and amortisation)-positive, the rapid growth and market share of Shopee, and the prospects of digital finance for the fledgling SeaMoney.

The company also has a strong cash position of US$2.6 billion as at end-March, and firm support from major shareholder Tencent, which owns about 30 per cent of the company.

Sea managed to narrow its net loss to US$280.8 million for the first quarter ended March, from US$689.6 million a year ago, after its revenue more than doubled.

Revenue from its digital entertainment arm rose 113.2 per cent to US$369.7 million as the number of active users and paying users increased.

In particular, Sea's self-developed title Free Fire hit a new record of over 80 million peak daily active users. It was also the highest grossing mobile game in Latin America and South-east Asia, according to data analytics firm App Annie.

That said, Sea is exposed to revenue concentration risk, as the top five games account for about 80 per cent of digital entertainment revenue, said JP Morgan analyst Ranjan Sharma in a June 24 report.

Meanwhile, revenue from e-commerce and other services rose 104 per cent to US$266.5 million and gross orders on Shopee was up 111.2 per cent to 429.8 million.

Citi, which was among those with a "Buy" call, noted how lockdowns in many parts of South-east Asia have sped up online shopping adoption and accelerated orders and gross merchandise value (GMV) growth at Shopee.

"This, we believe, is due to the relatively low e-commerce penetration among the young and large Internet-using population (over 360 million) in the region," wrote analyst Alicia Yap in a report on July 7.

Research from e-commerce aggregator iPrice, leveraging user data from SimilarWeb and App Annie, found that Shopee was among the top two most used e-commerce apps in South-east Asia in 2019, based on monthly active users. Shopee was also the most visited e-commerce website, chalking up 2.1 billion visits against Lazada's 1.8 billion.

Sales and marketing expenses have continued to be a significant expense for the loss-making firm - it spent US$308.3 million, or 73.2 per cent more, on this in Q1 - though market watchers have mostly stomached it in view of the need for user acquisition and retention.

While e-commerce and digital entertainment are Sea's strong points, some analysts are more cautious about the firm's financial services arm. DBS Group Research bucked the trend when it downgraded Sea from "Fully valued" to "Sell" on July 2, with an unchanged target price of US$72.50.

"We like Sea's gaming and e-commerce businesses although we are less optimistic on the prospects of the hyper-competitive e-wallet business," wrote analyst Sachin Mittal.

DBS values Shopee at US$32.70 based on enterprise value to FY21 forecast adjusted revenue of 4.5 times, Garena at US$33.90 per share based on enterprise value to 12-month forward adjusted earnings before interest and taxes of 12 times, and SeaMoney at US$2.60 per share based on enterprise value to FY21 forecast adjusted revenue of 15 times.

It expects SeaMoney to burn cash for a long time as e-wallet market leaders in Indonesia, such as GoPay and Ovo, are far ahead. DBS also flagged revised Indonesian tax regulation for cross-border transactions that might pose some downside risk to Shopee's performance.

JP Morgan gave a more sanguine view of the digital financial services arm. While it acknowledged the heavy losses likely to be incurred by the business, it anticipates strong growth in ShopeePay as Sea pushes for higher adoption across the region through methods such as shipping and cashback promotions, and partnerships with offline merchants.

In Q1, ShopeePay's total payment volume (TPV) reached 17 per cent of Shopee's GMV. JP Morgan estimates that ShopeePay's TPV will make up 33 per cent of Shopee's GMV by 2022.

Mr Sharma wrote in a report on June 24 that SeaMoney is valued at US$4 per share on a price to TPV multiple basis when benchmarked against major global payment companies. "Until SeaMoney shows a path to profitability, it is likely to trade at a valuation discount, in our view."

Garage is BT's startup vertical. Read more news, analysis and opinions at bt.sg/garage

READ MORE:

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Startups

Semiconductor unicorn Silicon Box vows to avoid geopolitical mire

A cheat sheet of startup and tech M&As in South-east Asia

Zilingo ex-CEO’s criminal complaint is retaliation against whistleblowers: source

Gojek and ComfortDelGro Taxi to send untaken rides to each other’s platforms

SG fintech firm Bambu shuts down after missing profit targets, says founder

Telemedicine platforms evolve beyond virtual consultations