August's NODX surge signals strong Q3 economic growth

Singapore

STRONG trade data in August is likely to point to vigorous third-quarter growth in the economy, but not beyond that, some private-sector economists have predicted.

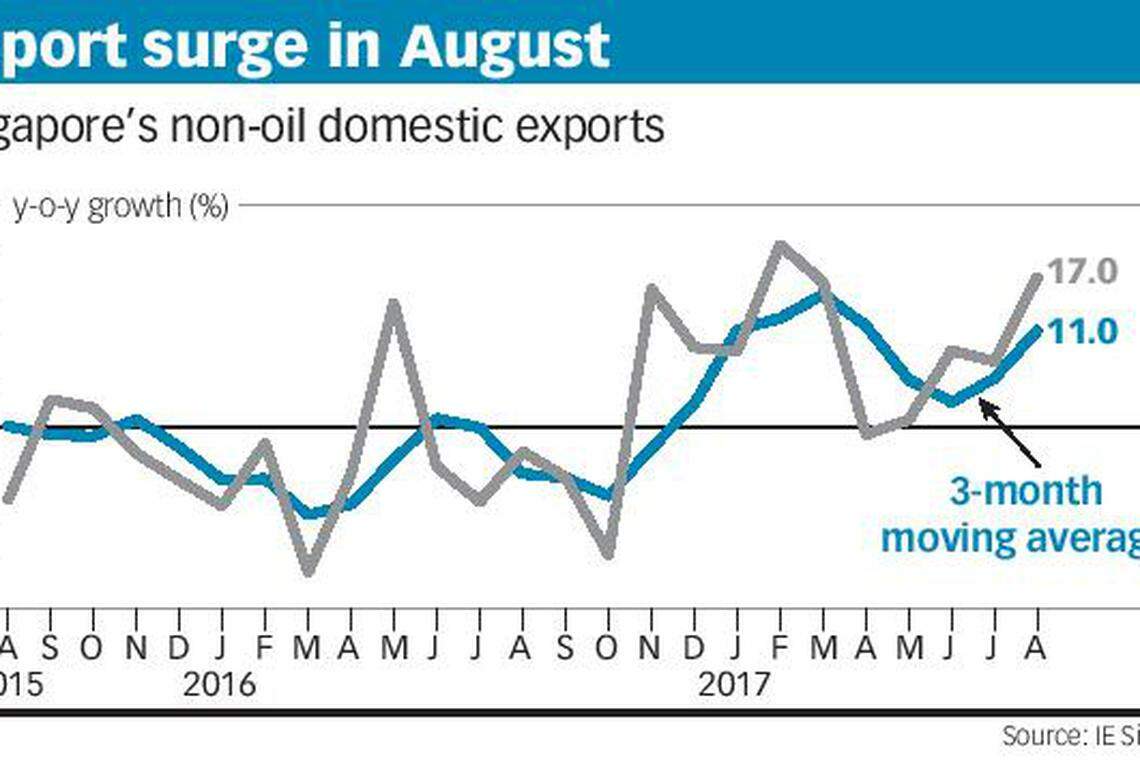

Practically all the trade numbers powered up last month, with little sign of waning. The key non-oil domestic export (NODX) grew 17 per cent year-on-year. This was the strongest expansion in six months, exceeding July's 7.6 per cent (revised from 8.5 per cent) growth and beating the market forecast of 11.8 per cent.

Month on month, the NODX bounced back from a 3.3 per cent fall in the previous month to post a seasonally adjusted 4.5 per cent rise in August, going by the latest trade data released on Monday by the government's trade promotion agency, International Enterprise Singapore.

Stronger shipments of integrated circuits (ICs), disk-media products and parts of ICs drove electronics NODX growth higher to 21.7 per cent, after a 15.3 per cent jump in July.

The electronics NODX has been expanding for 10 consecutive months with little sign of letting up.

Non-electronics exports also put on a better showing. Pharmaceuticals shipments, a volatile segment, moderated from minus 53.6 per cent in July to minus 9.1 per cent in August.

Exports of non-monetary gold recovered from a 18.7 per cent drop to soar 137.7 per cent over the same period.

Citigroup's Kit Wei Zheng said in a brief report that the latest NODX number indicates an uptick in export pace in the third quarter.

Maybank Kim Eng's Chua Hak Bin added that the continued export momentum in July and August "is pointing to strong third-quarter GDP growth".

"With growth broadening to services, we see overall third-quarter GDP growth coming in at around 3.5 to 4.0 per cent," he said.

The economy expanded 2.9 per cent in the second quarter and the government expects it to grow by between 2 and 3 per cent for the full year.

Nomura's economic research team in Singapore counts the semiconductor sector and shipments of chips as the main driver of GDP growth, but they think the tech cycle will soon run out of steam.

OCBC Bank's Selena Ling estimated that the NODX increased 9.9 per cent in the first eight months of the year. IE Singapore expects the NODX to rise 5 to 6 per cent in 2017.

Francis Tan of UOB Bank suggested that NODX growth will ease in the months ahead: "We do not expect the strong double-digit NODX growth since November 2016 can be sustained towards the end of 2017. This is especially since the current electronics cycle may be coming towards an end, with the rolling out of the next wave of smartphones in the months ahead."

A slowdown in the growth of China's economy, Singapore's biggest export market, may also pose some risks to NODX's rise, he said.

Taiwan may be the only one among Singapore's top 10 markets for which NODX shipments fell in August; the biggest contributors to NODX's surge last month were still East Asian markets - in particular China (+43.2 per cent), Hong Kong (+41.9 per cent) and South Korea (+62 per cent).

Shipments to China expanded much more strongly than in July, when NODX exports to the country rose 19.6 per cent. The exports were led by non-monetary gold, petrochemicals and ICs.

The latest trade figures also revealed that oil domestic shipments increased 23.5 per cent in August, up from the 5.7 per cent increase of the previous month. It was the 12th straight month of expansion for oil domestic exports.

Non-oil re-exports, an indicator of regional and global trading sentiments, rose 11.9 per cent - easing from 16.7 per cent growth in July.

Total trade last month jumped 15.6 per cent to S$82.3 billion. It was the 10th straight month of increase.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Vietnam National Assembly head resigns amid graft purge

China central bank flags bond investment risks to some financial institutions: sources

Xi tells Blinken US, China should be 'partners, not rivals'

Indonesia’s push for regional economic integration to continue under Prabowo: Vivian Balakrishnan

Outgoing Singapore, Indonesia leaders to hold their final retreat in Bogor on Apr 29

Beijing city to subsidise domestic AI chips, targets self-reliance by 2027