HDB resale prices accelerate, rising 1.8% in Q1 on stronger demand

The Q1 rise is fastest quarterly increase since Q3 2022

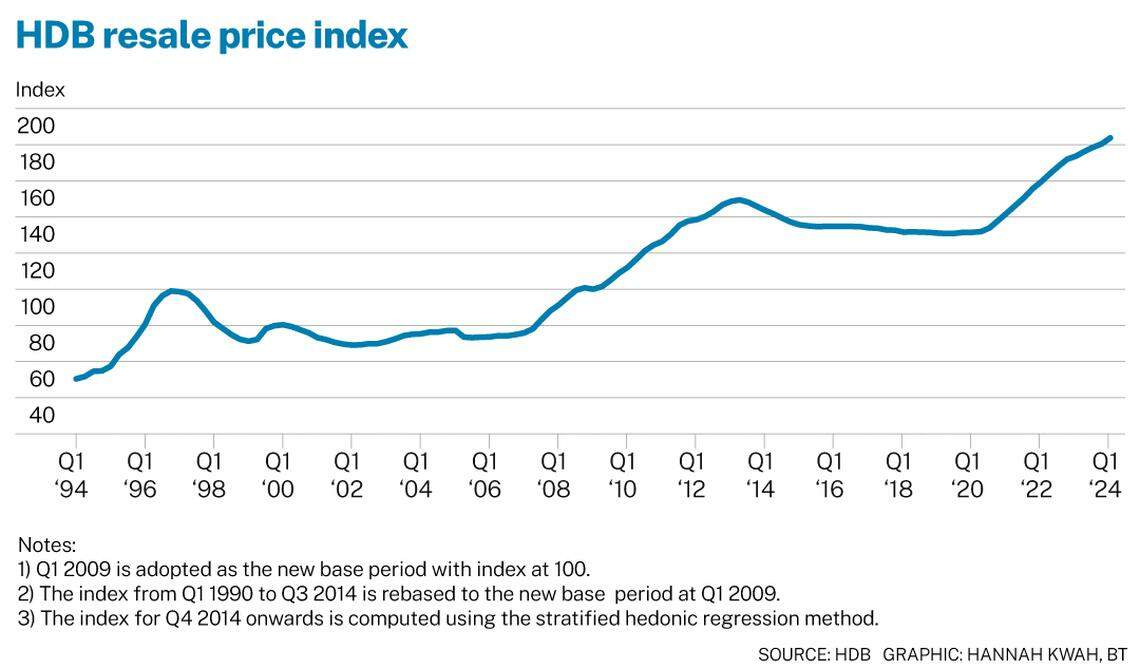

HOUSING and Development Board (HDB) resale prices rose 1.8 per cent in the first quarter of 2024, faster than the 1.1 per cent seen in the quarter before.

Demand strengthened in Q1, with resale transactions rising 8 per cent to 7,068 units for the quarter and up 1.3 per cent on the year, according to data released by HDB on Friday (Apr 26).

This is the fastest quarterly increase since Q3 2022 and the highest Q1 sales growth recorded since data was available in Q2 2007, noted Christine Sun, chief researcher and strategist of OrangeTee Group.

Wong Siew Ying, head of research and content, PropNex Realty, said that the rise in HDB resale prices has outpaced the price growth of private properties. “The growth in the HDB resale price index has outpaced that of the URA private property index since the start of the Covid pandemic in early 2020,” he said.

Between Q1 2020 and Q1 2024, overall HDB resale prices rose 40 per cent cumulatively, compared with a 34 per cent increase in private home prices.

More first-time buyers are opting to buy flats from the secondary market instead of waiting for the new Build-To-Order (BTO) sales launches, since HDB reduced the number of sales launches per year, said OrangeTee’s Sun.

A NEWSLETTER FOR YOU

Property Insights

Get an exclusive analysis of real estate and property news in Singapore and beyond.

Larger flats are increasingly in demand, and more private property owners are “downgrading” to public housing, analysts suggested.

Sales of five-room and larger flats in Q1 rose 14.4 per cent quarter on quarter, observed Lee Sze Teck, senior director of data analytics at Huttons Asia.

Lee also said demand from private property owners entering the HDB resale market in Q1 – these buyers would have just come out of the 15-month wait-out period introduced in September 2022 as part of market cooling measures.

Resale flat supply grew in Q1. More flats reached their five-year minimum occupation period (MOP) in 2022, 2023 and 2024 and would have become available for resale, said Lee.

The number of “million-dollar flats” continued to climb. Some 185 resale flats changed hands for at least S$1 million in Q1, 38.1 per cent more than in Q4 of 2023.

More HDB towns experienced price gains in Q1, Lee said, with 20 out of 26 HDB towns showing prices rising between 0.1 and 7.9 per cent in the quarter. Resale flats in Serangoon, Bishan and Kallang/Whampoa posted the biggest gains, while average prices for flats in the Central Area and Marine Parade fell for the third straight quarter, said Lee.

ERA Realty’s key executive officer, Eugene Lim, expects mature estates to chalk up steeper price growth this year. “In particular, those located in proximity to amenities and transport nodes which are not affected by the stringent resale conditions for the upcoming Prime and Plus flats are highly sought after by buyers,” said Lim.

Market watchers expect resale prices to rise in the range of 3 to 6 per cent in 2024. Prices rose 4.9 per cent in 2023, decelerating from the 10.4 per cent increase in 2022 and the 12.7 per cent growth in 2021.

Q1 data also showed the HDB rental market slowing. The number of approved applications to rent out HDB flats fell to 9,398 cases, down 4 per cent on the quarter and down 2.7 per cent on the year. As at the end of Q1, some 58,355 HDB flats were rented out, an increase of 0.3 per cent over the previous quarter.

“Rental demand for HDB flats has contracted for two consecutive quarters and the pace of decline is gathering pace,” said Nicholas Mak, chief research officer, Mogul.sg. The 4 per cent drop in rental transactions in Q1 followed a 0.7 per cent dip in Q4 of 2023, he noted.

OrangeTee’s Sun said the rental supply of HDB flats has also been dwindling, as the number of flats that reached MOP dropped last year and is projected to decline further this year. The increase in the Additional Buyer’s Stamp Duty may also have led to more owners deciding to sell their HDB flats, rather than buy a second property while holding on to their HDB flats for rental income.

In the near future, “demand may shrink as some tenants may shift to the private market since private rents have been moderating over the past six months”, said Sun.

The latest market data shows private home rents falling further in Q1, by 1.9 per cent, following a 2.1 per cent drop in Q4 2023. Sun reckons HDB rents could dip by up to 3 per cent this year.

HDB will launch about 19,600 BTO flats in 2024. In June 2024, about 6,800 BTO flats will be offered in Jurong East, Kallang/Whampoa, Queenstown, Tampines, Woodlands and Yishun.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Airbnb promises to combat sex work in rentals during Paris Olympics

Hong Kong property deals hit three-year high in April

More homes planned in Media Circle to support housing demand

Qatari Sheikh sells London mansion to fellow royal for £39 million

Toronto home sales fall for third month in April; prices rise

Far East Shopping Centre owners in private talks after close of S$928 million en bloc tender