Government opts for balanced approach to state land sales for H1 2018

It is offering land that could yield about 8,045 private homes including ECs and 63,960 sq m commercial space

Singapore

THE Ministry of National Development's (MND's) decision to maintain state land sales for private residential development for the next half year at around the same levels as the current half's slate is seen as a balanced approach between having, currently, a strong land demand and avoiding a potential oversupply in future.

JLL national director Ong Teck Hui said: "Even if there had been more sites on the first-half 2018 programme, the current optimistic bidding for residential land may not be moderated as demand for sites is still keen, with developers trying to secure land to capitalise on the market recovery."

Land prices would remain high; the only thing that would happen is that because Government Land Sale (GLS) sites are easier to deal with than collective sales, an increase in state land sales would have swung over some of the demand from collective sales to state land sites, Mr Ong reasoned.

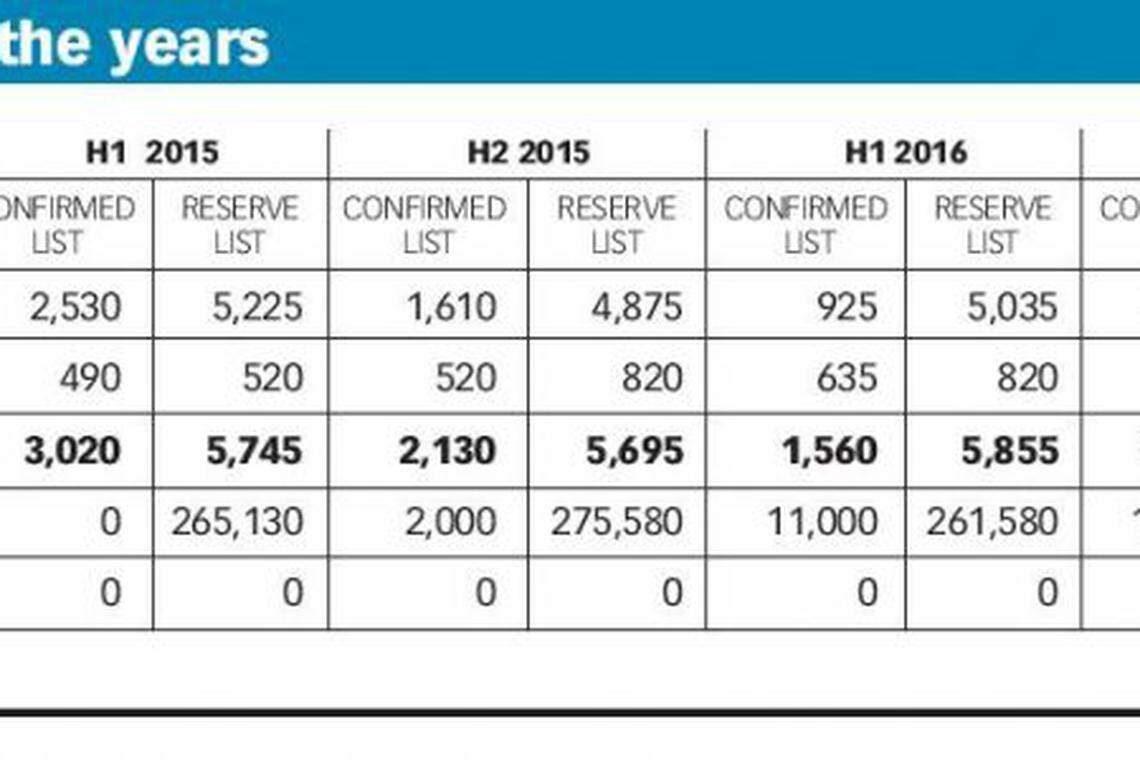

For the first half of 2018, MND is offering land that can potentially yield about 8,045 private homes, including executive condominiums (ECs), and 63,960 square metres gross floor area (GFA) of commercial space via the confirmed and reserve lists.

This is compared with the land supply for 8,125 private residential units (including EC units) and 83,590 sq m GFA of commercial space via the two lists, in the current H2 2017 slate.

The H1 2018 confirmed list has six private residential sites (including an EC plot) that can yield 2,775 private homes (including 450 EC units) and 4,450 sq m GFA of commercial space. In comparison, in the H2 2017 programme, MND is releasing land for 2,840 private homes (including ECs) and 26,800 sq m GFA of commercial space. Confirmed list sites are launched according to schedule, regardless of demand.

On the reserve list, the government will offer eight private residential sites (including two EC sites) and a commercial site. These sites can yield 5,270 private homes (including 1,255 EC units) and 59,510 sq m GFA of commercial space. This is similar to the H2 2017 reserve list supply of 5,285 private residential units and 56,790 sq m GFA of commercial space.

Explaining the factors that it took into account the crafting of the next half's programme, MND acknowledged the strong demand for land from developers and a pick-up in private residential sales volumes.

That said, it reiterated that there is a large potential supply of around 20,000 units from awarded en bloc sales and GLS sites that have not yet been granted planning approval, on top of the around 18,000 unsold units that already have planning approval." Both numbers include ECs.

Moreover, there are more than 30,000 existing private homes that remain vacant, the Ministry noted.

Taken together, the total supply pipeline, including the units from the H1 2018 GLS Programme, will be adequate to meet the purchase demand for new private housing from homebuyers over the next one to two years, MND said.

Ageeing, Edmund Tie & Company's head of research, Lee Nai Jia, said that there is sufficient supply in the next two to three years. "However, in the immediate term, buyers may have fewer options. From anecdotal evidence, there are fewer owners in older condo developments listing their units for sale as they are preparing for an en bloc sale. Separately, there are fewer new completed but unsold units in the market due to the improving take-up rate."

While most industry observers expect land bids to remain at elevated levels as the bullish bidding pattern continues in both the GLS and private-sector collective sales fronts, CBRE Research's head of Singapore and South-East Asia Desmond Sim offers another perspective. "As we see more and more collective sales being successfully closed, it is a clear indicator that, increasingly, developers' hunger is being satiated . . ., so there is no need to flood the market with GLS sites."

He also argues that due to complexities involved with collective sales - such as traffic feasibility studies and the possibility of legal wrangles among owners - the supply pipeline of the new units from the redevelopment of en bloc sale sites may stretch over a longer period than envisaged. This may ease some of the oversupply fears.

Savills Singapore research head Alan Cheong expects the sites in the H1 2018 GLS slate to be hotly contested. "The sites on offer are generally considered smallish by today's standards, given developers' enlarged balance sheets from the return of capital and profits from projects developed on sites bought in the 2011-2013 state land tenders."

This will ratchet up bids for both GLS and en bloc sites, he added.

Wong Xian Yang, head of research and consultancy at OrangeTee & Tie, noted that developers will have to weigh their risk-reward ratio which is worsening as land prices surge and the launch pipeline expands.

On a more optimistic note, DBS senior vice-president for group equity research Derek Tan said: "We remain bullish in the Singapore property market and also expect demand to remain strong in the coming year. As confidence in the property market is still on the rise, we continue to expect strong participation in land tenders, especially for choice sites.

"Despite the various warnings, we believe it is unlikely for the government to intervene - unless prices rise too much, too quickly."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

London's Canary Wharf sees £1.2b slashed from property values

Commercial real estate debt is back with 170% jump in sales

Chinese city of Chengdu relaxes home-buying rule to revive sales

Vanke slams Moody’s downgrade, citing shareholder support

Private home prices ease to 1.4% rise in Q1; rents fall a further 1.9%

Singapore office rents in central region fall 1.7 per cent in Q1 after rising for 9 quarters