Q3 office rents back in growth mode, reversing long downtrend

This comes as the nett amount of occupied office space islandwide increased by 10,000 sq m in the quarter

Singapore

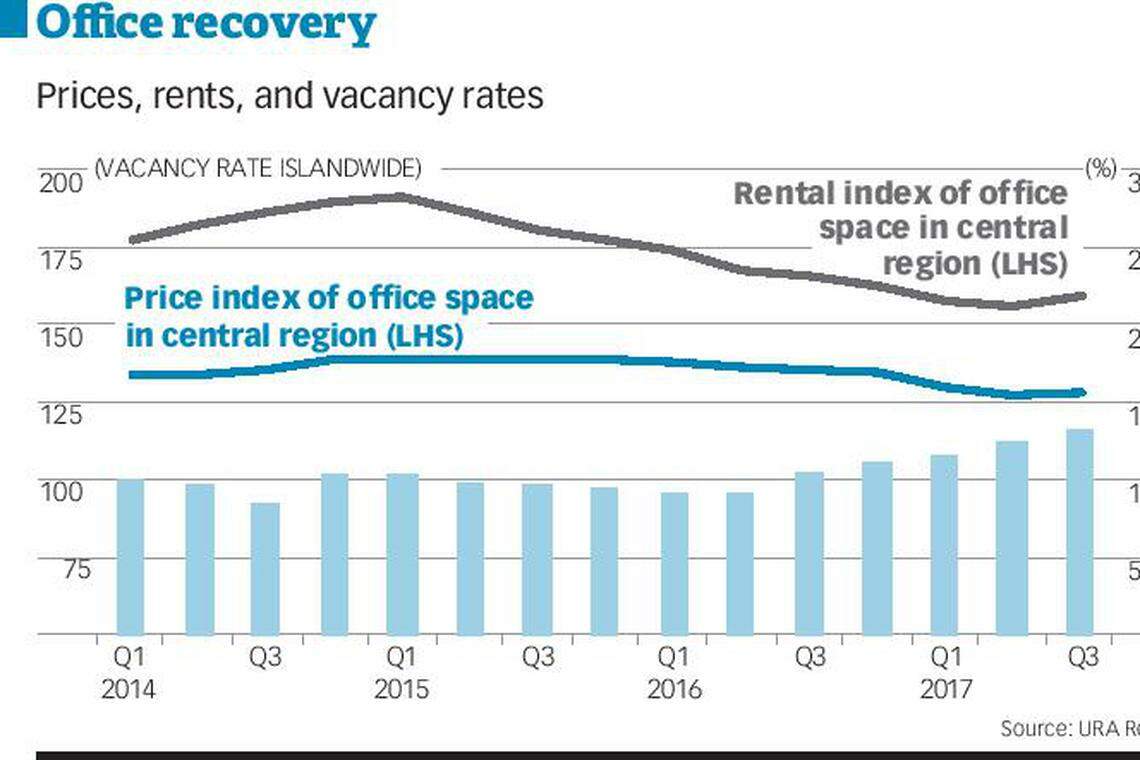

FIGURES released by the Urban Redevelopment Authority (URA) on Friday suggest that the office market has turned a corner, with rentals rising 2.4 per cent in the third quarter, reversing the downward trend for the past nine consecutive quarters.

This came as the nett amount of occupied office space islandwide increased by 10,000 sq m in the quarter, compared with an increase of just 1,000 sq m in the previous quarter. Net demand and absorption in the downtown core micro-market was even stronger at 13,000 sqm.

Consultants attribute the rental price recovery to improved business sentiment and tenants' gravitation towards new developments in the CBD. JLL head of research and consultancy in Singapore Tay Huey Ying noted that the net absorption of 51,000 sq m recorded for the Downtown core sub-sector in the first nine months of 2017 has exceeded the area's full-year net absorption for each of the last three years.

CBRE Research head of Singapore and South-east Asia Desmond Sim said: "This is an indication that prior fears of a supply overhang have diminished as leasing commitments to new developments continue to gather steam.

"The office market is showing signs that it has turned the corner. This improved confidence was evidenced by higher rental expectations from landlords, particularly for higher quality buildings."

Cushman & Wakefield's (C&W) Grade-A CBD basket of properties shows office rents rising by 3.4 per cent quarter-on-quarter to S$8.90 per square foot per month in Q3.

Its research director Christine Li said: "While demand has been soft primarily among banks and financial services companies, the slack has been picked up by other sectors such as shipping, energy, legal and technology."

On top of these, competition in the co-working segment also intensified in the quarter: American co-working giant WeWork took up 60,000 sq ft and 28,000 sq ft in 71 Robinson Road and Beach Centre respectively, while another operator, The Great Room, expanded its footprint by leasing 36,000 sq ft in Centennial Tower.

Other notable leasing transactions include container shipping line Ocean Network Express leasing 50,000 sq ft and Macquarie taking up 40,000 sq ft in the newly completed Marina One. Meanwhile, engineering firm Arup signed a lease for 40,000 sq ft at Frasers Tower.

Still, the office vacancy rate hit a 12-year high of 13.3 per cent, up from 12.4 per cent in the previous quarter.

But this was the result of a "tsunami" of office space supply (which increased 91,000 sq m in Q3, compared with a nett increase of 76,000 sq m in Q2) as well as landlords' bargaining power and ability to hold.

Alan Cheong, senior director of research and consultancy at Savills, said: "This unusual state of affairs (of both rentals and vacancy rates increasing) can be explained by the fact that when buildings are newly completed today, they may not be fully or close to fully taken up.

"However, as landlords these days have stronger holding power than prior to the global financial crisis, they are holding out for higher rents for the remaining unlet space.

"Also, once a new building is 60 per cent committed, the landlord often will have stronger bargaining power to ask for higher rents for the other 40 per cent."

In all, about 5.4 million sq ft of office space has come onstream islandwide in 2016 and 2017, Ms Li from C&W said. Tenants, more optimistic about the economy, are capitalising on the low-rent environment to negotiate for early renewals and relocations. Year-to-date, rentals are still down 2.1 per cent. Consultants expect a further increase in Q4 to result in an overall flat trend for the full year 2017, following which rents could rise a further 3-5 per cent in 2018.

URA data also showed prices of office space increasing 0.4 per cent in Q3, compared with the 1.4 per cent decline in the previous quarter. This is as liquidity continues to compete for a limited pool of tradable office assets in Singapore, said Ms Li.

Recent deals such as CapitaLand Commercial Trust's acquisition of Asia Square Tower 2 and GuocoLand and Guoco Group's clinching of a Beach Road office site also supported the price recovery.

En bloc fervour spreading to mixed-use and commercial sites has further stirred buying sentiment.

READ MORE: Analysts cautiously hopeful retail slump over after Q3 data

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

Hong Kong home prices rise for first time in 11 months after curbs scrapped

HDB resale prices accelerate, rising 1.8% in Q1 on stronger demand

Singapore’s private home prices up 1.4% in Q1, rents drop by 1.9%: URA

OUE wins tender to lease, develop new ‘zero-energy’ hotel at Changi Airport’s T2

Singapore office rents in central region fall 1.7 per cent in Q1 over Q4: URA

Homebuyers shun new real estate in Vancouver, hurting builders