VC deals in Asean at record US$20b high in 2021; uncertainty over exits in 2022

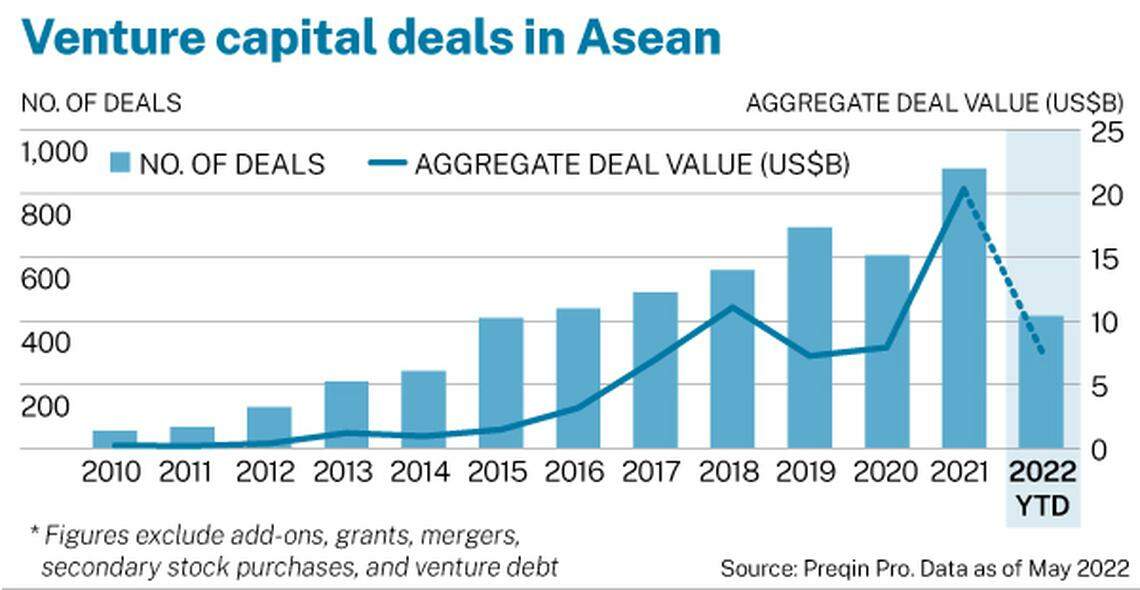

VENTURE capital (VC) investments in South-east Asia recorded another bumper year in 2021, soaring 1.6 times to hit a record US$20.4 billion.

That’s twice as much as the rest of Asia, which recorded a 0.8 time growth in aggregate deal value last year, data analytics company Preqin has said.

VC dealmaking continued to grow in the first half of 2022, with the region recording US$7.7 billion in deal value as at May, from 416 deals. But Preqin warned of global headwinds that could make investors more cautious.

South-east Asian tech has been on the rise over the past few years, driven by regional giants such as Grab. Following a rebound from pandemic lows, the region’s aggregate deal value in 2021 was 35 per cent higher than the 2019 and 2020 levels combined, and 85 per cent higher than the last peak of US$11 billion in 2018.

With the downward pressure on valuations for listed companies translating to lower valuations for later-stage deals, investors are increasingly turning to early-stage deals to tap emerging startups in sectors experiencing rapid growth, Preqin noted.

While late-stage investments continue to drive overall deal value, aggregate deal value has grown very little in the past few years. In contrast, the average deal value for seed-stage deals in 2021 was US$1.8 million, compared with the past five-year average of US$0.78 million.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Macro-economic pressures have prompted investors to be more selective in backing companies, with more favouring startups with strong balance sheets and low cash-burn rates.

“Excess liquidity globally has led to inflated valuations. This has left investors and businesses particularly vulnerable, given considerations including geopolitical tensions, rising oil prices, inflation and interest rates,” the Preqin Territory Guide: ASEAN 2022 report noted.

“With the volatility in public markets causing a reset of valuations in private markets, private equity and venture capital investors will not be able to rely on multiple expansion as a value driver.”

Exits remain an area of uncertainty in 2022. While the startup ecosystem recently witnessed the exits of some of its first-generation unicorns such as Bukalapak, Grab and PropertyGuru, the region has some way to go to provide investors with the liquidity they seek, said Preqin.

At US$6 billion, the aggregate exit value in 2021 was higher than in the past 5 years. But the exit path for late-stage companies, especially those eyeing public listings, remains cloudy amid a global economy mired by supply shortages, soaring inflation and high interest rates.

Special-purpose acquisition companies (SPACs) were once regarded as a quick route to the public market, but the channel has since frozen up, following increased scrutiny by regulators.

Preqin said: “It’s clear that deals done amid the frenzy 12 months ago will no longer work for future SPACs as they work toward enhanced disclosures and improved due diligence on the portfolio companies. They will need to demonstrate their ability to create real value in order to sustain investor interest.”

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Startups

Grab-led GXBank teams up with Zurich to offer affordable insurance

GoTo eyes private placement of 120.1 billion shares

SoftBank leads US$1 billion funding for UK self-driving startup Wayve

Singapore battles to revive struggling stock market

NSG BioLabs bags US$14.5 million funding; inks tie-ups with Merck, EnterpriseSG

Singapore’s Anywheel gets green light to expand fleet to 35,000